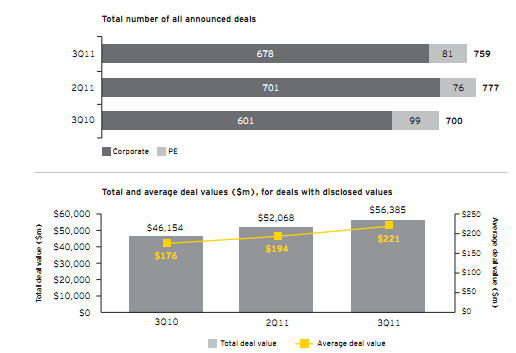

M&A activity in the technology sector continues to grow in terms of value. According to an Ernst & Young report released today, big acquisitions drove the aggregate value of global technology M&A to $56.5 billion in the third quarter of 2011, up 22 percent from a year ago, and up 8 percent from last quarter.

The report says that aggregate deal value (of deals with disclosed value) was the highest total value for any calendar quarter since 2007, before the global downturn. In particular, deals involving smart mobility and business analytics came on strong in the quarter, driving two deals each with values above $10 billion, the first time two deals of that size occurred in the same quarter since the first quarter of 2010.

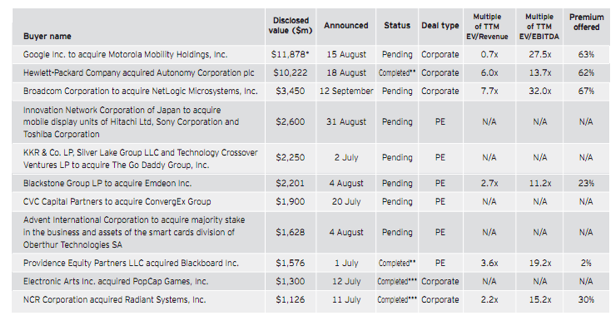

The top deals for the quarter included Google’s $12.5 billion Motorola acquisition, HP’s $10.2 billion acquisition of Autonomy, Broadcom’s $3.5 billon buy of NetLogic, Innovation Network’s $2.6 billion purchase of mobile display units from Sony, Hitachi and Toshiba; the $2.3 billion takeover of GoDaddy, Providence Equity’s $1.6 billion acquisition of BlackBoard, EA’s $1.3 billion purchase of PopCap and NCR’s $1.1 billion buy of Radiant Systems.

One particular focus of technology M&A in 3Q11 was “big data.” There were roughly two dozen deals in this business intelligence/analytics category in the third quarter, including one of the deals above $10 billion.

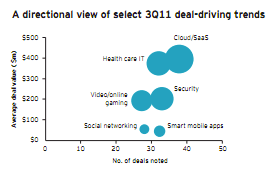

Transactions were also driven by cloud computing, information security, social networking, online and mobile games, health care IT and internet and mobile video. Many deals combined two or more of these trends.

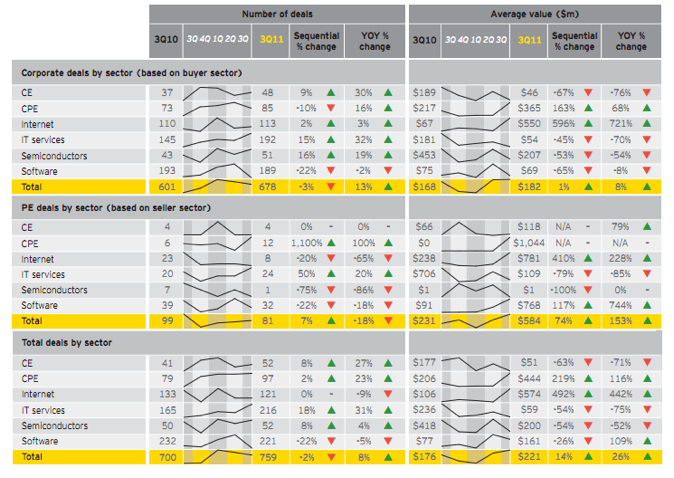

Ernst & Young says that growth in the aggregate value of private equity transactions drove the overall sequential increase in value. PE aggregate value increased 82 percent sequentially to $14.6b in quarter and increased 86 percent year over year. PE firms contributed 6 of the 11 third quarter deals valued above $1 billion.

Big-ticket deals dominated in quarter with the top 11 deals totaling $40.1 billion in value, or 71% of all disclosed in the quarter. This was only the second quarter since 2008 where the top 11 deals all had values of over $1 billion.

Average values per deal also climbed, and were up 14 percent over the previous quarter and 26 percent year over year to $221 million, the highest level in 11 years. The aggregate value of the top 11 deals represented over 70 percent of the total deal volume for the quarter.

In terms of volume, the number of M&A deals dropped 2 percent for the second consecutive quarter, to 759 deals in third quarter. Cross-border deals declined 11 percent each in volume and value in 3Q11, compared with the second quarter 2011.

Outlook clouded by global trends

So will the values continue to grow in technology M&A deals. Ernst & Young cautions that market and economic volatility could cause a dip in value and amount of deals. But the disruptive technologies that continue to be developed (and are in demand) could mitigate this.