It’s been a rough quiet period for Groupon CEO Andrew Mason, but as his IPO nears in the next couple weeks the company is making a final push to sell their shares to the public with an IPO roadshow (which you can watch online). Mason & Co. do a good job of putting forward the best possible story to potential investors: Groupon is addressing trillion-dollar markets, it is the largest local commerce platform with scale effects, it is building on its daily deal dominance to move into adjacent products and markets (events, goods, travel), and it is building a local commerce Triforce centered around daily deals, instant mobile offers, and loyalty rewards.

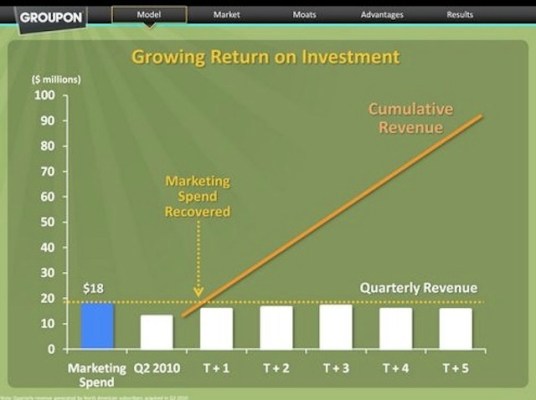

But out of all the roadshow slides, Mason wants investors to focus on the one above because it answers his critics that Groupon is spending its way into oblivion. It shows the return on Groupon’s marketing investments.

One of the biggest red flags in Groupon’s SEC filings has been the enormous amount it spends on marketing ($466.5 million the first nine months of this year to “on subscribers acquisition,” according to the latest S-1 filing). In the third quarter, Groupon was able to get its costs under control to the point where it wet from a $101 million operating loss in the second quarter to almost breakeven (with a $239,000 operating loss in the third quarter).

The slide shows that in the first quarter of 2010, Groupon spent $18 million in marketing, which resulted in the company adding 3.7 million new customers. Groupon then tracked the spending of that cohort of customers over time. “We pay a fixed amount up front, and we recover our marketing costs in two quarters,” explains Mason. Those customers ended up making enough repeat Groupon purchases that they contributed $100 million to Groupon’s revenues and $43 million to its “contribution profits.”

The question I would pose if I was an investor in the roadshow is whether or not that analysis holds true for later cohorts of customers as well. If it does, then Groupon’s unconventionally high marketing budget will result in equally high returns. I wouldn’t be surprised if the returns diminished with later cohorts, but it was also a market share land grab strategy which Groupon is toning down now that it has 142 million “subscribers,” only 16 million of which are repeat customers. Groupon is already focussed on getting more of those one-time buyers to come back.