Editor’s note: The following guest post is by Nick Ducoff, CEO and co-founder of Infochimps.

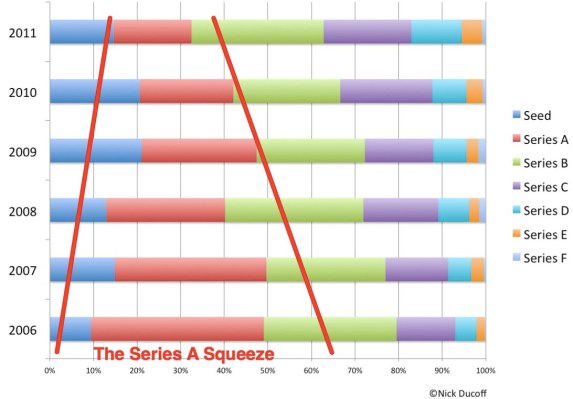

Series A financings are on the decline. They peaked at 283 in 2007 and are on pace to barely crack 100[1] this year (all data is from CrunchBase through the end of June—it is imperfect but the best I’ve got, see chart). They’ve also declined in relative terms, representing nearly 40% of all equity financings in 2006, and less than 20% year to date. I believe there are two main reasons for this: 1) the rise of the Series Seed and 2) the ho-hum exit environment since 2008.

Seed rounds (including angel rounds, but excluding debt) accounted for less than 10% of all equity financings in 2006, but accounted for over 20% when they peaked in absolute and relative terms in 2009, when super angels “shook up” venture capital. Incubators such as Y Combinator, Techstars and 500 Startups (with their demo day yesterday) have been churning out startups, and tools like AngelList have made it easy for angels to get access to early stage deals. Also, VCs have been active in the seed game further expanding the base of early stage investments. There’s been so much deal competition at the early stage, last year there was even talk about collusion!

That’s why a Business Insider article on Monday titled Venture Capital: No Longer a Business of Small Investments in Early Stage Companies inspired me to dig into the data and see for myself what was going on. VCs are less inclined to lead or participate in follow-on rounds unless the company is a clear winner in its class. Furthermore, VCs have had to support their perceived winners longer because exits have been fewer and farther between. Even with the rise of the Series Seed (the nomenclature of which is not used uniformly), Seed and Series A deals collectively accounted for nearly half of all equity financings in 2006, and now account for less than one third.

So where has all the money gone? Companies that make it to Series B tend to live on, and unfortunately for VCs, they’re living longer and longer before an exit. Silicon Valley’s “undertaker” summed it up nicely, “Once it gets to the Series B round, you see people really trying to pull that coach through to the next depot.” That’s why Series C-E, which only accounted for approximately 20% of all equity financings in 2006, are on pace to be double that this year.

The author of The Unthinkable: Who Survives When Disaster Strikes — and Why, Amanda Ripley, says, “[The] brain works by pattern recognition, and when it’s in an extremely frightening situation it sorts through a database for a script.” This is one of those times. The stock market is down 10% from its recent peak, the angels that lead the surge in seed investing have gotten skittish, and VCs are doing exactly what is to be expected, protecting their children most likely to survive.

That being said, institutional investors have long-term time horizons and need to be investing in early stage deals to keep up their deal flow. Even when things were seemingly at their worst in 2008, there was more Seed and Series A investment as a percentage of all equity financings than there has been to date in 2011. The pendulum will swing back. It has to.