On Friday, I wrote a post about how Netflix’s recent price change was having a noticeable (negative) effect on the perception of the company and its brand. An interesting conversation evolved in the comment section, with some explaining why they cancelled their Netflix subscriptions and why some even view it as a “PR nightmare”.

During its Q2 earnings call this afternoon, Netflix Founder and CEO Reed Hastings said that the company was not naive in its decision to change its pricing, and indeed expected to be hit with a bit of a backlash. Of course, as Hastings said, “like any customer-driven organization, we feel bad about customers being upset”.

Regardless, it seems that investors are not so optimistic. At the time of this writing, Netflix stock has plummeted more than $28 per share in after hours trading, a 10 percent overall drop. While Netflix posted another strong quarter, with net income up to $68 million, a 55 percent year-over-year increase and $788.6 million in revenue, up 52 percent year-to-year, there were some caveats. As my colleague Erick Schonfeld wrote earlier this afternoon, “Wall Street still isn’t happy with the slowdown in store for the third quarter”. And why is that?

Netflix’s much-talked-about price change goes into effect in the third quarter, and should be fully rolled out, Netflix estimates, by September 15th. As a result, Netflix expects “domestic net additions in Q3 to be lower than the previous year’s Q3, and because of the timing of the price change, revenues will only grow slightly on a sequential basis”. That means: Investors, temper your expectations for the next few months. (Or, as we’ve seen from this afternoon’s activity, “sell it like it’s stolen”.)

Another few possible reasons for Netflix’s less-than-favorable forecast may lie in the fact that content costs are rising, which, coupled with lower revenues per subscription as Netflix transitions to more streaming-only content and the cost of ramping up its international presence (it plans to expand into Latin America later this year), might make some analysts nervous. It also doesn’t help that Netflix is lowering its EPS guidance for the next quarter’s to between $0.72 to $1.07, down from $1.26 for this quarter.

On the earnings call today, Reed Hastings said that the “DVD will have a longer and bigger life than people think”. On the other hand, according to its letter to stockholders, “With the rapid adoption of streaming, DVD shipments for Netflix have likely peaked”. In creating a separate management team and, really, business for DVDs, the company hopes that the life of those circular discs will continue, but really this seems to mark the beginning of the end.

Because Netflix’s streaming business is finally established, the company is in a position to encourage its customers to switch to streaming, and the price change was as good as any other catalyst to accomplish this.

And, in encouraging the transition, Netflix can take savings earned from not having to pay the same level of shipping costs for DVDs, and funnel it into its streaming. Of course, Netflix has had some problems with outages and all parties are aware that it just doesn’t have the same breadth of its streaming library in comparison to its DVDs. So, the need to begin allocating more funding to its infrastructure and developing its streaming content is paramount at this point. Expect major updates to Netflix’s streaming content over the next year, or watch as customers jump ship.

And, speaking of that, Netflix also remained tight-lipped about a potential Dreamworks deal that is reportedly on the table. While Hastings would not say if an agreement has been reached, he didn’t exactly deny that conversations were ongoing.

As a result of all of these changes and its ongoing discussions with potential streaming content partners, it’s of no surprise that the company said that it is not “planning to bid on Hulu”. Ad-supported free content that focuses on the current TV season just isn’t part of the Netflix landscape at this point, though there’s no doubt that the company will be keeping its eye on Amazon Prime and Hulu Plus, especially as a potential future buyer of Hulu decides what to do with its subscription service. Apple, Google, and Microsoft have all begun kicking the tires on Hulu, but its still uncertain where the company will end up.

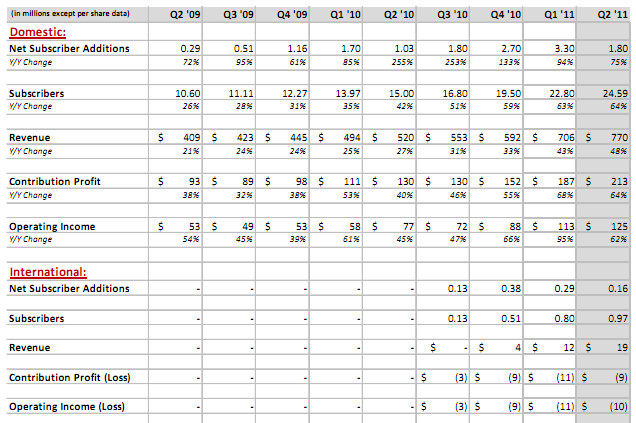

That being said, Netflix added 1.8 million subscribers in the U.S. during the second quarter, a 75 percent hike when compared to the second quarter of last year, bringing its total subscribers to 24.6 million, up 64 percent from Q2 2010. What’s more, 75 percent of those new subscribers signed up for Netflix’s streaming-only option.

Clearly, Hastings and company are confident that its streaming business is in good enough standing that this is the best time to begin accelerating the transition from DVD to streaming. Hastings said that he expects Netflix to have 22 million streaming subscribers by the end of Q3, and 25 million total U.S. subscribers, meaning the company only expects to add another 400K or so subscribers over the next quarter. In the big picture, this may just be a blip on the radar, it all just depends on how unhappy customers really are, and the perceived viability of the competition.

For more on Netflix’s financials, click here, and for a quick overview, check out the chart below: