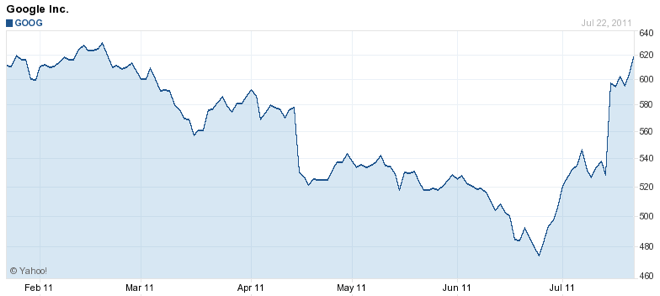

Google’s stock is reaching its highest value over the past six months, trading as high as $619.50 share On Friday, putting search giant just shy of a $200 billion market cap. In fact, Google’s stock closed at $618.23 on Friday, giving the company a $199.23 market cap. The last time Google traded above $600 was in the first week of March. Of course, at that time the company had a different CEO (now chairman Eric Schmidt), and no meaningful social products on the market.

While Google’s stock was skyrocketing earlier this year, in April the company, under the new regime of Larry Page, reported slightly lower than expected earnings, and the company’s stock price fell to $519 per share.

As we know, Page took over, reorganized and shook up operations at the company. He renamed Google’s core business, the search group, the “knowledge group.” And at the time, Page decided employee bonuses would be tied to the success of the company’s soon to be launched social product.

Google’s stock continued to slide downwards into May and June and dropped significantly end of June, when it was revealed that the FTC was preparing a major antitrust investigation into Google’s “core search advertising business.” On June 24, the day the news broke, Google’s stock value fell to a six month low of $474.88.

Of course, days later Google unveiled Google+, the company’s most ambitious social product yet. In the week following the launch of Google+, investors added $20 billion to Google’s market cap. That combined with the general strength of the market and health of Google as a company propelled the stock upwards into July.

Last week, Google blew past analyst expectations, earning a record $9.03 billion in the quarter. And Page revealed that Google+ has upwards of ten million members (in three weeks) sharing and receiving a billion items per day, which were impressive milestones for the fledgling social network. Page was generally optimistic on the call, explaining that the new management structure he implemented is “working together fabulously,” and helping complete Google’s goal of making “sharing on web like sharing in real life.”

And the Street responded. The following day after Google reported earnings, Google’s share price shot up to $597.62 from $528.94 the previous evening.

Since then Google’s stock has been climbing upwards. As Google+ hit 20 million users, analysts are now optimistic for Google’s social plans. As the Wall Street Journal reported last week, Barclays Capital equity researchers are telling investors that “given positive initial traction from users we believe Google is now better positioned to compete and integrate social cues across its products than before, which could drive increased relevancy in search going forward.”

As I mentioned above, there are other factors contributing to Google’s rise in stock value, including the general health of Google as a company as well as the current strength of the markets. But it is interesting to take a look into how the significant growth of Google+ has helped contribute to the dollar value of the company, especially after the stock hit a low point in June. As my colleague Erick Schonfeld wrote previously, bravo, Larry Page.