Editor’s note: The following guest post was written by Ashkan Karbasfrooshan, founder and CEO of WatchMojo.

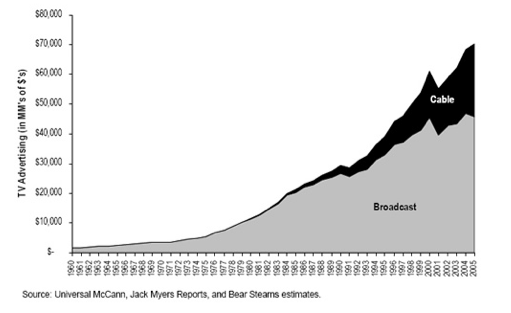

The rise and proliferation of cable grew the total pie for television, leaving networks with bigger businesses even if their share of the pie shrunk.

While the network-to-cable shift was evolutionary, the television-to-web transition is revolutionary. Nonetheless, TV’s Traditional Media Companies (TMCs) are betting that the Web is just another distribution outlet that adds reach and potential revenue to their assets and will grow their business when the dust settles.

Whether or not that strategy pays off remains to be seen. After all, the Web made the music business a more efficient one, but the industry shrank in terms of revenues and profits. In any case, while the TMCs have flirted with made-for-web programming (what I call “Premium content”), they have always gravitated back to made-for-television and theatrical content (what I call “Super premium content”).

For example, Viacom invested in Vice’s VBS.tv back in 2007, but since then they have co-invested in EPIX along with MGM and Lionsgate. Lionsgate itself invested $21.4 million in Break Media for 42% with an option to buy the rest for $58 million. If online video was as amazing as the boosters say, wouldn’t Lionsgate had already exercised its option? Break Media has actually executed quite well and carved a nice niche for itself in the men’s online video category, but for TMCs, the numbers are immaterial.

An Opportunity in Video Content for Startups Who Understand the Fabric of the Web

Indeed, the vast majority of premium content has been created by new media startups. The mistake some of these have made has been to build a Traditonal Media Company on top of the Internet, something that is sheer lunacy and a recipe for shattered egos and wasted millions. Ripe Entertainment burned through $40 million and was backed by both VCs (Rho Ventures and Columbia Capital) and TMCs (Hearst Television and Time Warner). Raising $25-50M to build a content business online is a bad strategy, whereby the better you “execute” the worst off you will be.

In fact, while this revolutionary shift represents an opportunity for some startups, anyone who is surprised by the TMCs’ reluctance to focus on premium content is either being delusional or disingenuous: there is absolutely zero economic incentive or rationale for TMCs to experiment, let alone invest heavily, in premium content. Admittedly, this is an Innovator’s Dilemma at its best, but it’s one thing to question TMCs for hesitating to put their offline programming online to chase pennies, it’s another to actually wonder why they don’t invest in made-for-web programming that has zero existing franchise and traction. Why bother?

Way to Encourage Them, Guys

Of all of the companies that have received funding or invested in premium content, only a few have had exits:

- LX.tv was acquired by NBC Universal and now serves as their content creation arm for taxis and local affiliates in NY and LA;

- Wallstrip was bought by CBS and essentially shut down. Mind you, CBS had no business buying Wallstrip (TheStreet would have been a far better suitor). It shuttered it when the 2008-09 econocalypse hit, ironic, since a cynical take on Wall Street would have been very appropriate at that time;

- Google bought Next New Networks and folded it in its YouTube division to ensure that Googlers didn’t have to deal with humans, and the NNN brass could manage the oddballs who make a living on YouTube and represent the site’s best bet to offer advertisers a modicum of brand-safe content (good luck with that).

Meanwhile,

- HBO unloaded its “new media” HBOLabs/RunawayBox unit to Break,

- Comcast axed NBC Universal Digital Studio recently,

- News Corp. has been dabbling in new media content but it has bigger issues now.

Mind you, slowly but surely, you are seeing some interesting activity:

- Mark Cuban (so HDNet indirectly) invested in Revision3.

Hmm … ok, maybe there will be more activity … but don’t hold your breath. A few years ago, I contacted Bertelsmann to talk about a partnership to help my company, WatchMojo, expand in Europe. We’d begun translating our English videos into Spanish, French and German and Bertelsmann seemed like a great potential partner. They told me plainly that their focus was how to monetize the thousands of hours of media they had in their archive, and not create new content to monetize online.

TV-Envy Killed the Internet Star

The common refrain seems to be “television is a $70 billion market, online video is only a $1.5 billion market, when will online video get its fair share”? Um, how about never? Technically, if you include all revenue, television is actually a $250 billion industry in the US. That is a lot of money and the TMCs know that.

Online video isn’t growing fast enough because:

- There’s not that much good content tempting advertisers, and

- Google’s YouTube has a near monopoly on video distribution when it comes to aggregate scale.

The result is that TMCs lack the economic incentive to invest online since 40% of online advertising’s rapidly growing pie goes to search, and only $1.5 billion will be spent on online video advertising in the U.S.

Balance sheet vs. Income statement

Lost in the “will Hulu sell?” talk is “why would the owners want to sell?”

Hulu raised $100 million at a $1 billion valuation. Even if Hulu’s value has risen since that deal, the increased value on the TMCs’ balance sheets means little. However, if Hulu (in the hands of someone else, be it as an independent post-IPO company, or in the hands of MSFT/YHOO/GOOG) pays the TMCs hundreds of millions of dollars per year in licensing fees, then that kind of annuity on their income statement will be far more valuable. This is why suddenly Netflix has become not just a frenemy but a dear pal to the TMCs, because Netflix can sign big checks each year to the TMCs (lending further credence to the fact that content and distribution are equally important and one without the other is worthless).

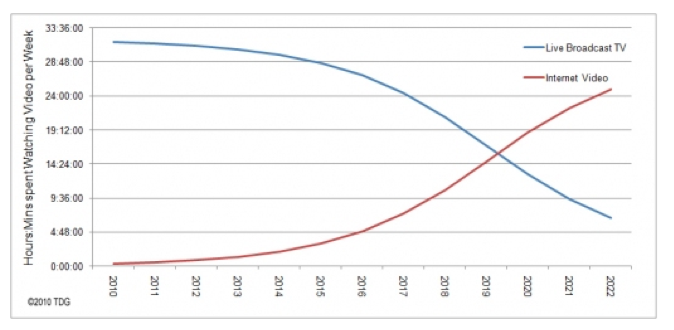

To conclude: Yes, there is an opportunity for new media startups to create lean, efficient, content creating machines online, especially with web video set to overtake live broadcast TV by 2020 in terms of time spent watching.

But, thinking that TMCs should follow suit is lunacy. They are better off thinking up ways to monetize their traditional assets, even if that means repackaging some/all of it for snack-size consumption among online audiences. Over time, the distribution platforms will converge, but control of the content will become a bigger issue than ever. The solution to their problem isn’t “more content.”