The recent proliferation of early stage financing for photo-sharing startups like Path ($11.2 million), Picplz ($5 million), Instagram ($7.5M) and Color ($41 million) is leading some to speculate that we are in a crazy picture sharing bubble.

The recent proliferation of early stage financing for photo-sharing startups like Path ($11.2 million), Picplz ($5 million), Instagram ($7.5M) and Color ($41 million) is leading some to speculate that we are in a crazy picture sharing bubble.

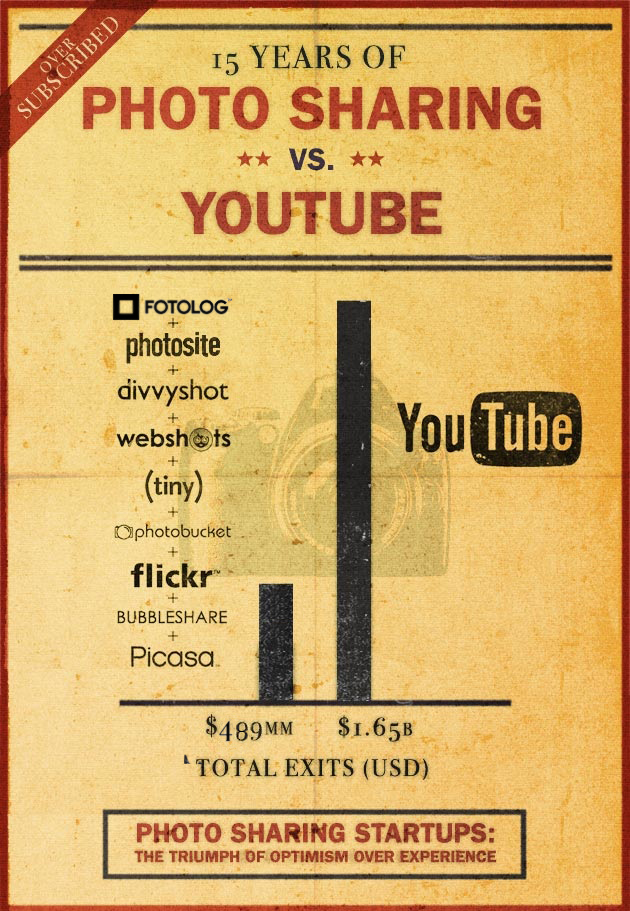

But are photo sharing investments just another sign of irrational exuberance? Curious about how photo sharing exits stacked up, we looked into some of the most notable ones over the past 15 years and put them into the above infographic.

Photo sharing startups that pivoted to something else pre-acquisition like Slide were not included. The total valuation of startup Webshots, which sold itself four times over an eight year period, was averaged out to be around $50 million. Startups whose primary business is photo printing and not sharing, like Snapfish (acquired by HP and now handling printing for 10,000+ retail stores) were also left off of the list.

—————————————-

1999 — Excite acquires Webshots for $82.5 million

2001 — Webshots founders buy it back fro $2.5 million

2004 — CNET buys Webshots for $71 million

2004 — Google acquires Picasa for at least $4.7 million

2005 — United Online acquires PhotoSite for $10 million

2005 — Yahoo acquires Flickr for $30 million

2007 — Fotolog acquired by Hi Media for $90 million

2007 — American Greetings buys Webshots from CNET for $45 million

2007 — News Corp acquires Photobucket for $300 million

2007 — Kaboose acquires BubbleShare for $2 million

2009 — Shutterfly acquires for Tiny Pictures aka Radar for $2m*

2010 — Facebook buys Divvyshot for Undisclosed

—————————————-

Despite the current intense investor interest, the largest exit for a photosharing startup thus far was Newscorp’s acquisition of Photobucket for $300 million in 2007, nowhere near YouTube’s $1.65 billion acquisition by Google in October 2006 (Google itself is valued at $175 billion). Granted video is a more engaging medium than photo, but that still doesn’t explain why, in light of meager exits, the amount of money pouring into the space within the past 15 years has not dropped off?

Perhaps investors are hoping that the new generation of photo sharing apps will monetize better or be less fragmented? Perhaps they’re making a bet that the more ambitious apps (Path, Instagram) will have what it takes to create the next social graph?

The largest difference between the photo sharing space nowadays and the era of the Flickr acquisition is the emphasis on mobile and social. People have linked their Twitter and Facebook accounts to their iPhone through apps like Path and Color, and the value may be in the data and not the photos.

Investors might be also be hoping for a replication of Facebook’s photo sharing victory– A lot of Facebook’s early (and prolonged) success can be attributed to the success of Photos, which launched in 2005 and probably played an important part in helping the company jump from a 10 million valuation in 2005 to 750 million in 2006.

A photo sharing exit is easier said than done. But one must also keep in mind that if we had made this graphic before YouTube was acquired, the right side would be $0.

* As Kevin Marks points out, Shutterfly itself IPO’d in 2006, with an opening market cap of $350 million and a current market cap of $1,610 million. It originally focused on photo prints (which is why it was left out of the graph) but eventually pivoted into an online photo-sharing service.