Betting on sports is one of the most popular forms of gambling in the world. And for good reason. Unlike more traditional gambling, people often have feelings about the teams and stars they’re betting on. Both the money-making and the fan aspect are also what help drive fantasy sports. And StarStreet thinks they can tap into what people like about both with a different approach.

Betting on sports is one of the most popular forms of gambling in the world. And for good reason. Unlike more traditional gambling, people often have feelings about the teams and stars they’re betting on. Both the money-making and the fan aspect are also what help drive fantasy sports. And StarStreet thinks they can tap into what people like about both with a different approach.

But don’t call it “betting”, founder Jeremy Levine is quick to note. These are “investments”, not “bets”.

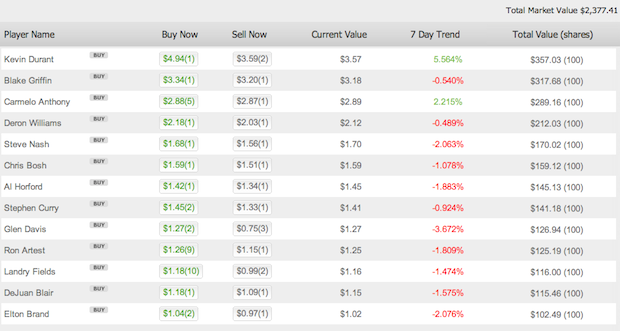

One of last year’s TechStars graduates, we first noted StarStreet last June. What they’ve built is a stock market system for sports that uses real money. The first market was for the NFL, but it temporarily closes down when that season is over. So now they offer a NBA market. And beginning today they’re offering a MLB Market and a NCAA March Madness Market.

Oh, and StarStreet is getting some money of their own to help pay for the new features.

SV Angel and Jarr Capital have led a seed round of funding for the company, with angels Don McLagan, Andrew Blachman, Ben Littauer participating. It’s probably an easy investment — not bet — for these guys to make since StarStreet has a clear road to start making money. They take a 4 percent cut on the sale side of every trade (but there are no fees to buy, and no fees for depositing and withdrawing money from the system).

Others have tried this sports stock market idea before and it hasn’t worked. Notably, OneSeason lasted for, well, one season. But StarStreet believes their model will actually work because it’s a zero-sum market. With StarStreet, the total value of each sports’ market is constrained from the time of players’ “IPOs” until their “retirements” at the end of the season. (And IPO’s occur as a blind yankee auction, so everyone has a shot at getting a piece.)

In terms of legality, again, StarStreet is about investing and not gambling. “It is a game of skill (not chance) that does not depend on a single end outcome or result (like a bet does),” Levine says, noting that they’ve had plenty of lawyers vet the idea.

In fact, the non-gambling issue is why StarStreet’s NCAA market will only be for play money, and not real money. First of all, they can’t use the names of amateur athletes because unlike professional athletes, their names are not in the public domain. So that means you have to invest in teams, but because of the way the tournament works, some teams get eliminated before others and the money invested in them returns to the pool — that gets a little too close to gambling, Levine says.

Levine won’t say how much money they’re bringing in from the NBA market yet (the initial NFL market was done without their fee to test things out). He will say that engagement numbers are high though. “About 25 percent of the traders are active every single day, over 50 percent almost every single week since we launched real money,” Levine says.