Editor’s Note: This is a guest post by Mark Suster, a 2x entrepreneur who has gone to the Dark Side of VC. He started his first company in 1999 and was headquartered in London, leaving in 2005 and selling to a publicly traded French services company. He founded his second company in Palo Alto in 2005 and sold this company to Salesforce.com, becoming VP of Product Management. He joined GRP Partners in 2007 as a General Partner focusing on early-stage technology companies. Read more about Suster at Bothsidesofthetable and on Twitter at @msuster.

One of the most common questions that entrepreneurs who meet me for the first time like to ask is, “Do you miss being an entrepreneur? Aren’t you ever tempted to go back and do it again?”

The obvious answer is yes. When it’s in your blood, it’s in your blood. I guess it’s kind of like crack (not that I know from experience). It’s addicting. I know this sounds superficial. If you’ve taken the roller coaster ride that is a startup – you know what I’m talking about.

But I’m very happy now. I’m enjoying being a VC. I thought I’d talk a bit about the differences I’ve experienced between being an entrepreneur & a VC – you know, from “both sides of the table.”

On Being an Entrepreneur

I was asked by somebody recently in a private message on Quora about whether the individual should leave his comfortable job to become an entrepreneur. You would think the obvious thing I would tell somebody is, “yes, of course it’s a great idea.” You’d be surprised. I often advise against it. I really have to know somebody’s personal story and circumstances to know whether it is suitable for that person.

In this particular case I wasn’t convinced it was a good idea from the limited information I had. The following is a short excerpt of what I said,

“… being an entrepreneur is very unsexy. Long hours. Time away from family. Low salary. High risk. High stress. It only looks sexy when you read TechCrunch. There is no shame in being an exec at a company or whatever.”

And I mean this. I’m sure everybody has their own definition of the attributes of an entrepreneur. Some of the ones I would identify are:

- Not very status-oriented

- Doesn’t follow rules very well and questions authority

- Can handle high degrees of ambiguity or uncertainty

- Can handle rejection, being told “no” often and yet still have the confidence in your idea

- Very decisive. A bias toward making decisions – even when only right 70% of the time – moving forward & correcting what doesn’t work

- A high level of confidence in your own ideas and ability to execute

- Not highly susceptible to stress

- Have a high risk tolerance

- Not scared or ashamed of failure

- Can handle long hours, travel, lack of sleep and the trade-offs of having less time for hobbies & other stuff

The truth is that in my experience very, very few people really enjoy the “pure” startup environment: months with no salary, months with no live product and lots of trial, error & rejection. Even many successful entrepreneurs tell me that they’d prefer to do a buy-out the next time rather than go back to square one in a startup. NOT easy.

There are a larger number of people who enjoy coming on when an idea has become validated and thus “de-risked” but I still think this is a small number of people. And also there are a large number of people who would like to do startups in theory, but have high cost bases (family, real estate, school loans, whatever) that makes it very difficult to take the kinds of risks required.

And what gets lost in reading about the glamor of Facebook, Twitter, Zynga, Groupon and the like is that most startups fail. And for ones that do get sold often most of the employees don’t really make huge upside gains. You don’t read about these garden variety outcomes online – only the high profile exits or busts. Mostly you read about fundings, product releases, big valuations, and M&A. So readers of tech journals gain a bias of the chances of success.

I’m not trying to be negative. But I start most conversations with “wantrepreneurs” by saying,

“make sure it’s in your personality type, make sure you have the risk appetite, make sure you can afford to take the risks given your life situations and make sure you know that there is a high possibility your startup won’t be hugely financially rewarding. If you still want to go for it knowing all this and all that you’ll endure – awesome! It’s the best experience I’ve had in life. But not for the faint-hearted.”

You’re in for the Ride

There’s nothing quite like shipping V1.0 of your product. You’ve come full cycle from vision, to hiring some people, raising some cash, arguing about direction, setting a release date, missing a release date, feeling like you’ve effed everything up, regrouping, rethinking, getting back on track and then setting your baby loose into the wild. And then. Whew. Sit back and watch usage. Get your press coverage. Either you arc up emotionally or you arc down. There’s not a lot of flat line.

Snap. Great story on TechCrunch! Inbound calls from partners, people who want to join, “atta boys” from friends. You knew it all along. Your vision was right. VCs are calling wanting meetings. La vita e bella. Uh, oh. Fawk. Facebook DID NOT just announce that! Scoble is saying your best days are behind you? No, I think we can still be huge. We’re just going to have to change our focus a bit. Weekends. Evenings. Regroup. Team losing a bit of confidence in you. VCs pushing out your meetings a few weeks. WTF? Just a month ago they were all emailing you!

Well, you still have 6 months runway. What if we pivot slightly? Not a total change – just a different way of making money. What if we dropped the code that would compete with Facebook and instead go after this other area? Relaunch. Oh, man. Our user numbers are up. Awesome! Loving this new direction. It’s all good.

But … only 2 month’s cash left. Let’s just not pay ourselves for a couple of months. The junior devs need it. They’re month-to-month. I think we can be like the Maccabes and stretch this cash. Do we tell our team? Can they handle knowing we only have 3, maybe 4 months cash? Or if we say that will they all be putting out the word to their friends to look for their next gig?

Great new product release. Another good article. VC meetings going well. Holy sh*t!!! We just landed the biz dev partner we’ve been working on for 9 months. They love us! Awesome! $2 million in VC. Life couldn’t be better. All your buddies want to join. No. Google DID NOT just acquire our main biz dev partner. What? Google doesn’t know if they’re going to honor our contract? We now have to re-convince everybody? But we had a term sheet !!!

You can’t believe it. Eight beers that night. Maybe even tequila. And the next morning – water off a duck’s back. We’ll find a way. Startups weren’t mean to be easy. Back to work.

Anyone who has worked in a startup will know that this narrative is not exaggerated. If anything it’s the tame version. Every one of these events (with names changed) has happened to companies I’ve worked at or closely with. Most of them in the past 12 months. I’ve personally experienced much worse. Imagine how Flurry felt when Steve Jobs called them out by name. They seems to have bounced back nicely.

I remember being a few months before my wedding wondering whether I would walk down the aisle unemployed. It was 2002 – the “dog days” of the Internet and we were running out of cash. I remember an employee asking me whether I’d fill out their paperwork to get a home loan when we only had 3 months of cash in the bank. What do you tell somebody in that situation? I remember having a merger called off at the last minute and having a planning meeting at a pub to figure out how to run a bankruptcy process (luckily, we never had to do it).

And I had all the VCs play head games with me. One investor played chicken with me by threatening not to approve my next-round financing unless I gave him more equity. He wasn’t willing to put in more money but he had “blocking rights.” I had 10 days of cash. He was going on vacation for 2 weeks and told me, “Too bad, I’ll deal with this when I get back.” I literally told him to fawk off and sue me. That is a true story for which I have witnesses. I hung up. He called back and said, “OK, do the deal.”

Really? I had to go there? I learned this lesson long ago – many investors wait until you’re staring at a cliff before committing whether to re-invest in you. It is risk minimization + maximum leverage. I swore never to do that as a VC. Many VCs don’t realize just how destructive this is to team spirit and confidence. Penny wise, pound foolish.

But there is nothing that would ever replace the rush of being on the top of the startup emotional curve. Winning my first million-dollar contract. Getting on the front cover of the most prominent VC magazine in Europe (was called Tornado Insider). Acquiring a competitor with complimentary assets whom we long wanted to beat. Walking into an office at the London Underground and seeing every workstation open and using our product.

I was watching “Meet the Press” this morning and they put a big screen behind the guests with TweetDeck open and showing the constant stream of information about Egypt. That must have been a proud moment in the Betaworks offices.

And on the bottom of the emotional startup curve there is nothing crappier than having to lay off 60 employees in one day. Been there. It tests your soul to have to ask close friends to leave the business. Losing a deal that you had worked on for months after being told you won, having it snatched away from you, will ruin some nights of sleep. There are moments like being on stage when your demo crashes, reading about your competitors raising a ton of cash or having one of your top team members resign that test your will.

My SVP of Sales & Marketing quit 30 minutes before an important board meeting. Dick.

And that’s what it’s like – all superlatives. Your highs are super high. Crack. Your lows are unexplainably low and lonely. It’s the startup roller coaster world. And I miss it.

What do VC’s Experience?

There’s still a cynical entrepreneur in me regarding VC. In my experience many in the industry still think about “my CEOs” or “my companies” as though they are pawns on a chessboard. I’ve heard many a VC comment, “Yeah, I told the company to do A,B,C and they didn’t listen. The management team wasn’t strong enough. That’s why we didn’t succeed.” That’s the rationalization for the failure.

And all too often I hear upon success, “Yeah, I was actively involved on that one. Our advice is what helped them target the right market, hire the right team, build the right products.” And there are some delusional people who really believe it. I remember this attitude really well from working in consulting where people took too much credit for “creating new strategies” and deny any responsibilities for failed initiatives.

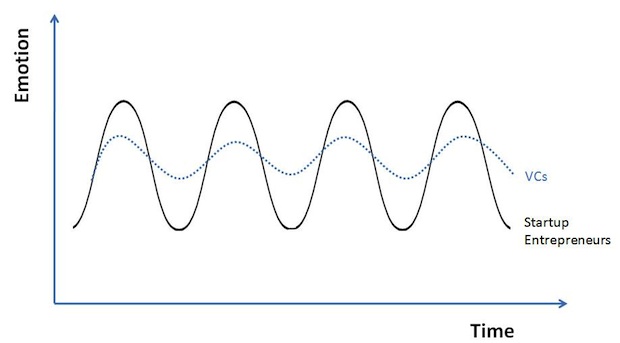

The reality is that the majority of successes & failures are created by and experienced by the entrepreneurs. The VC sense of accomplishment or failure is blunted by being slightly removed and by the portfolio effect. I think it looks something like the graph below.

But there are many great VCs also who see the entrepreneur as their customer as they should do and are realistic about how much of an impact we advisors and financiers really have.

We enjoy our jobs. We love working with entrepreneurs. We’d have to be big babies to complain about what we do. We’re paid well to spend time with smart people who want to change the world. We control our hours, our travel and our investment areas. We get to ride your ride, too. But as above, the highs just aren’t quite as high and we don’t have to sweat the lows as much.

Why Many VCs Secretly Envy Entrepreneurs

When I first considered leaving Salesforce.com to become a VC I obviously called all of my VC friends and asked their opinions. It’s a very tough decision to walk away from a senior role at what I consider one of the most successful tech companies of Internet era. Almost universally they said, “Are you crazy? If you’re going to leave, go do another startup? Don’t go into VC.”

Huh? Here they were in what I thought was one of the most sought after jobs and they almost all told me not to do it. I was baffled. It was 2007. It was well past the Internet boom, well into Web 2.0, before the really profitable years of social networking and when many in the industry were despondent. Really.

What I garnered was that many VCs secretly wanted to be entrepreneurs. They were envious. Let me explain. Let’s say you became a partner in a VC fund in 1995 and started investing heavily in 1997-99. You felt invincible. As John Doerr, the revered partner at Kleiner Perkins said it was, “The largest legal creation of wealth in history.”

You were minted. Golden. Making bank. King makers. Internet pioneers. I remember The New York Times wrote an interesting article about it. They talked about how the dream job for Harvard MBAs used to be investment banking where you wore your Rolex watch, drank $200 bottles of wine at fancy New York restaurants and vacationed in the Hamptons.

Suddenly the VCs and Internet pioneers were buying Patek Phillipe watches, ordering $1,000 bottles of wine, getting all of the best restaurant reservations and flying private jets. At the time all investment bankers secretly wanted to be VCs and many did just that.

But the “gilded age” ended quickly. The days of quick flips, quick IPOs and astronomic returns had come to a close. If you became a principal or a new partner in 2000/01 you had a good salary but as it turns out you were very unlikely to see a large upside “carry” return for quite some time. Nobody really talks about this.

So here’s the deal. There are many VCs who have been made partner since 2000 and haven’t previously had an exit of their own. They’ve probably watched smart teams, younger than them, walk in with a paper napkin, get funding, build a modest company and sell it for $20-30 million in 3-4 years pocketing $8 million for each founder. It looks so easy. It looks so alluring. That’s where the envy comes from.

But they don’t have a great idea. And they have the status of being a VC. And a comfortable salary. And the chance at diversified returns. So it’s hard to put your neck on the line and try. But those returns won’t come for 7-10 years for many of them. Some, not ever.

That’s why when I met Mark Peter Davis and heard he was giving up his VC career to run a startup I was seriously impressed. It takes cojones – hats off to him.

So while you’re struggling to get access to VCs and those that meet you seem unwilling to commit – at least take comfort in knowing that many of them secretly long to sit in your chair, as much as you might find that hard to believe. I promise you. They envy your courage, freedom and upside possibilities. Not all VCs want to be entrepreneurs, of course. But I’ve heard it from many, many a VC that they feel the calling to try. Most won’t.

Me? I’m committed to where I am. I have 3 partners with whom I work really well and whom I respect. We have a broader team that have become our close colleagues & friends. I’m enjoying the diversity of working with 6-7 portfolio teams on a regular basis on strategic issues. I’m enjoying watching them grow from nothing to meaningful businesses. Would I take another hit off the startup pipe? No time soon. But I’d never say “never.” It’s such a rush.

Just please make sure to enjoy the ride (up and down) while you’re there. When you finally get off it’s a long line and you have to be really committed to want to get back on.

Roller Coaster image via Rich Evenhouse on Flickr