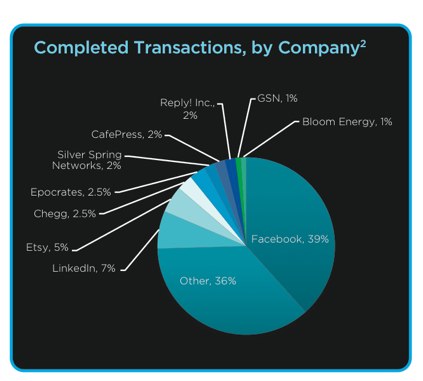

With shares of Facebook recently hitting a $70 billion valuation in a private auction on SecondMarket, you’d think those are the only shares that trade on the private stock market Facebook did make up the biggest portion of trades (39%) in the fourth quarter of 2010, but the market for private shares is broad and demand is strong for all sort of shares from LinkedIn (7%) and Etsy (5%) to Chegg (2.5%)and Bloom Energy (2.5%). Last quarter, SecondMarket handled $158 million worth of private stock trades, a little more than double the $75 million worth in the third quarter. For the entire year, SecondMarket handled $400 million worth of private trades.

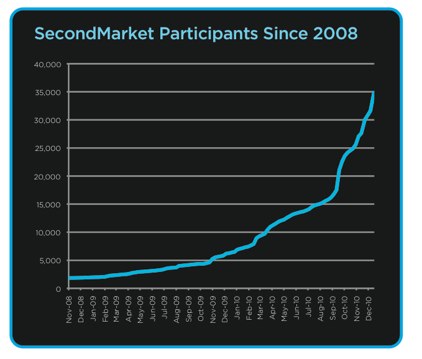

The number of venture funds, hedge funds, and wealthy individuals trading on SecondMarket also continues to rise, reaching about 35,000 cumulative participants since 2008. The growth in transactions, particularly in relation to Facebook, is drawing SEC scrutiny, but SecondMarket will continue to expand as long as tech companies won’t—or can’t—go public. You can read the full Q4 report here.

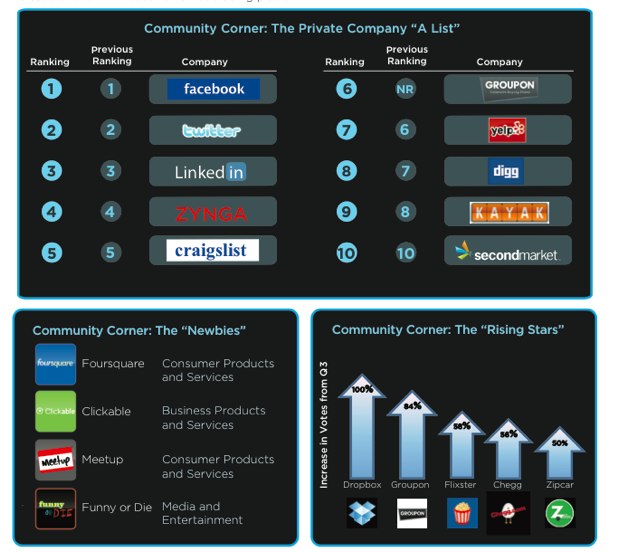

In terms of demand for shares, Facebook, Twitter, LinkedIn, Zynga, Craigslist, and Groupon top the rankings. Rising stars include Dropbox, Chegg, and Flixter, as well as Clickable and Foursquare. There is more demand than there are shares,