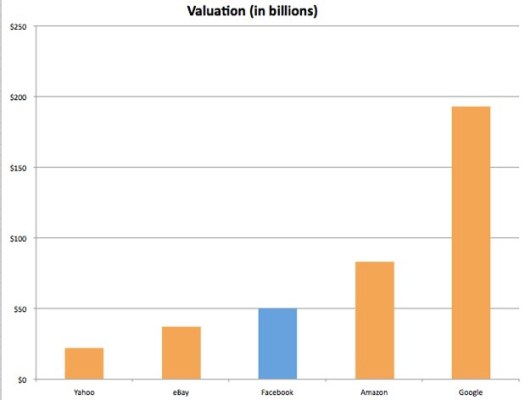

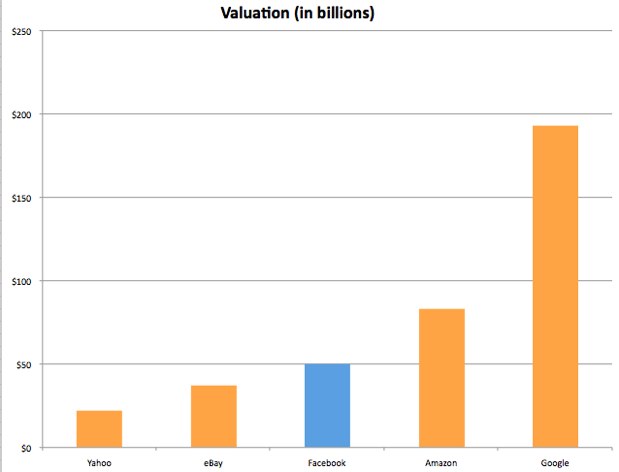

Facebook’s latest round of financing from Goldman Sachs at a $50 billion valuation, which is about the same valuation its shares are trading on SecondMarket, clearly puts it in the pantheon of the most valuable Internet companies. At $50 billion, Facebook is now worth more than Yahoo (which has a $22 billion market cap) and eBay ($37 billion), and almost worth more than both of them combined—and that is before it has even gone public. On the valuation scale of publicly traded Internet companies, however, it is still smaller than Amazon ($83 billion) and Google ($193 billion).

Facebook passed Yahoo in implied valuation last summer. And that feels about right. But is Facebook actually worth $50 billion? Its revenues for 2010 are rumored to be around $2 billion, which gives it a multiple of 25 times revenues. Google, in contrast, is trading at about 9 times estimated 2010 revenues. Of course, Facebook is growing much faster. And what really matters is profits. Facebook is believed to be profitable, but nobody really knows how profitable and there is still a sense that it hasn’t quite perfected its monetization model for social ads.

If anything, Facebook’s desire to push of an IPO as long as possible buys it more time to figure out its business model. Right now, it is just raking in cash based on the fact that 1 in 4 pageviews in the U.S. are on Facebook. It is a volume game, not a quality ad targeting game (yet).

And look at Groupon, which is now valued at about $5 billion with probably half the revenues of Facebook and extremely healthy margins. They are very different businesses with different longterm prospects, but why is one worth ten times more than the other? Something is out of whack. Maybe both are overvalued.

Remember also that private valuations are based on what a handful of wealthy investors are willing to pay—in this case Goldman Sachs, which has other motives as well. By plowing in money now, it moves to the front of the line to manage an eventual IPO. And it has the option to sell a portion of its stake to DST, as well as to sell $1.5 billion worth of shares to Goldman clients through a “special purpose vehicle” designed to skirt the SEC’s 500-shareholder rule, which is when public-level financial disclosure requirements normally kick in.

At $50 billion, though, Facebook is going to have to come out with the biggest IPO in history to justify the current frenzy of private investment. Google’s initial market cap was only half that amount.