Yahoo gave up on the search business when it struck its partnership with Microsoft, and now it’s focussed on its strength, which is online display advertising. Yesterday, Yahoo reported a 17 percent increase in display revenues on Yahoo-owned sites. CEO Carol Bartz told analysts on the conference call: “We are running really fast. We are not going to give up this leadership in display very easily.”

But that leadership is already being threatened. Google, which has always trounced Yahoo in search, may soon surpass it in display revenues as well. Last week, Google broke out its display ad revenues for the first time. If you annualize all of the third-quarter display advertising revenue from DoubleClick, AdSense, and YouTube, it comes to a $2.5 billion revenue run-rate.

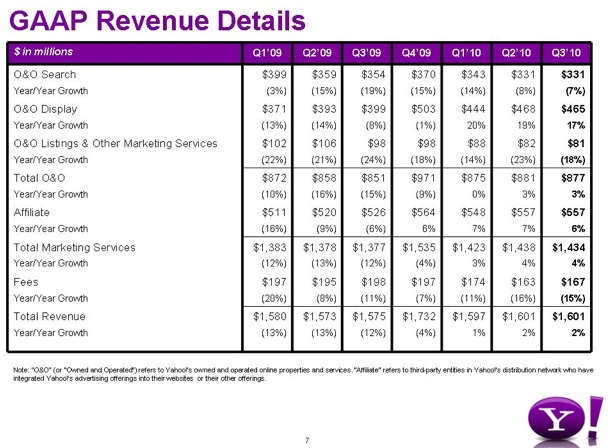

How does that compare to Yahoo? Display advertising on Yahoo-owned sites last quarter produced $465 million in revenues. If you annualize that, you get about $1.9 billion. But Yahoo also reported $557 million in affiliate revenues on third-party sites (the equivalent to Google’s AdSense and DoubleClick ad networks). Here is where it gets tricky because Yahoo does not disclose how much of those affiliate revenues come from display versus search ads. If you assume that Yahoo’s affiliate advertising breaks down roughly the same way as its and owned-and-operated advertising, then that would mean about half is display. So that is another $1.1 billion. Add that to the $1.9 billion, and you get $3 billion in annualized display revenue for Yahoo.

But that is being generous because most of Yahoo’s affiliate revenue is actually search. Depending on what that percentage is, Google’s display revenues are already either just as large or bigger than Yahoo’s. Not bad for a one-trick pony. For instance, if Yahoo’s affiliate revenues are 70 percent search, that would bring its total annualized display revenue to $2.6 billion. If they are 80 percent search, display goes down to $2.3 billion.

Whatever the number, the gap isn’t too large. (Note that for both Google and Yahoo these numbers are gross revenue before third-party publishers take their cut). And I haven’t even mentioned the other elephant in the room: Facebook. If Facebook’s total revenues are going to hit $2 billion in 2010,a huge portion of that is display. And Facebook revenues are growing much faster than Yahoo’s.

If Yahoo hasn’t already lost its leadership in display advertising, it is in danger of losing it very soon.

Update 10/21: Today, Yahoo spokesperson Mojgan Khalili responded to this post with three main points: Yahoo didn’t give up on search (we’ll just agree to disagree there), it makes more money from display than Google, and it is growing faster in display than the overall market. She writes:

A significantly larger percentage of Google’s display revenue is distributed to third party publishers than the percentage of Yahoo!’s display revenue that’s shared with other publishers. Google is an ad server and a distribution channel via AdSense and DoubleClick. Yahoo! is a direct channel for online advertising and we keep the majority of the display revenue we report. For example, we generated $1.9 billion in display revenue on our owned and operated sites in the last 12 months (ending September.) That’s Yahoo!’s revenue, not revenue we share with other publishers. We earn a modest amount of display affiliate revenue on top of that.

Despite growing off a much larger base than Google or Facebook, we meaningfully outgrew the market for online display advertising in the first half. We grew 19-20% when the market overall was estimated by IAB and others to be growing roughly 12%. Data isn’t yet available for Q3, but our growth rate of 17% was likely still well ahead of the market.

While Yahoo itself may be keeping more of those display ad dollars for itself, Google still is catching up fast in the total amount of display ad dollars going through its system.