In August, we wrote about PayNearMe, an alternative payments product from the company formerly known as Kwedit. For background, Kwedit launched another payment product earlier this year, to much controversy. But this one could be a winner; PayNearMe has already signed up a number of high-profile merchants and is launching today to the public.

In August, we wrote about PayNearMe, an alternative payments product from the company formerly known as Kwedit. For background, Kwedit launched another payment product earlier this year, to much controversy. But this one could be a winner; PayNearMe has already signed up a number of high-profile merchants and is launching today to the public.

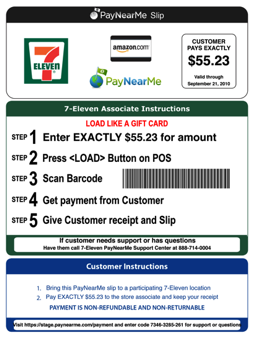

PayNearMe allows people who don’t have or don’t want to use credit or debit cards to purchase products with cash at more than 6,000 7-Eleven stores in the continental U.S. On participating e-commerce or merchant sites, consumers can use the PayNearMe option to pay for e-commerce purchases, telephone orders, loan repayments, money transfers and more. You simply place your order with PayNearMe and print out the given receipt. You then take that receipt into a 7-Eleven and they scan it and you pay in cash. Once you pay, your order with the retailer or merchant will be fulfilled.

The company began testing this form of payment for Facebook credits in August, but is now launching integrations with Amazon.com, Progreso Financiero, MOL AccessPortal (MOL), m-Via, Lexicon Marketing, LLC, Adknowledge’s Super Rewards, Money to Go and SteelSeries. For example, you can use PayNearMe on Amazon.com to buy Gift Cards online.

For 7-Eleven, PayNearMe is integrated with the convenience store’s point of sale and will notify payees in real-time when their consumer has paid. Merchants can also instruct PayNearMe to print custom messages on consumers’ register receipts, which can be used to print gift codes, tickets, proof of insurance, loan statements, legal disclosures, and more.

The ability of PayNearMe’s portal to print customized messages could make it ideal to sell transportation tickets, insurance products or even initiate money transfers. The platform is hoping to more than just a way to purchase items online, PayNearMe wants to be the go-to way for users to pay with cash but still order items online.

PayNearMe’s founder and CEO Danny Shader says the option is ideal for the 25 percent of American households that do not own a credit or debit card and this find it more difficult to conduct transactions online.

While the idea of making a trip to a 7-Eleven to pay for an item you ordered online may seem strange to some, Shader believes that this option will be able to gain traction as a viable payments platform for users who only have access to cash. And PayNearMe has been able to score a number of high-profile deals with merchants like Amazon (Shader says more are on the way); so it should be interesting to see if the alternative payments option gains a loyal userbase.