AOL reported another lousy quarter this morning. Even ignoring the $1.4 billion goodwill charge, revenues were down 26 percent and cash from continuing operations was down 44 percent (as was free cash flow).

What we are seeing is a very messy transition as AOL shifts multiple lanes from an online subscription business to an advertising one, and at the same time to a new online content production model. AOL CEO Tim Armstrong is making this transition in the glare of being a once-again publicly traded company—and public investors are not a patient bunch.

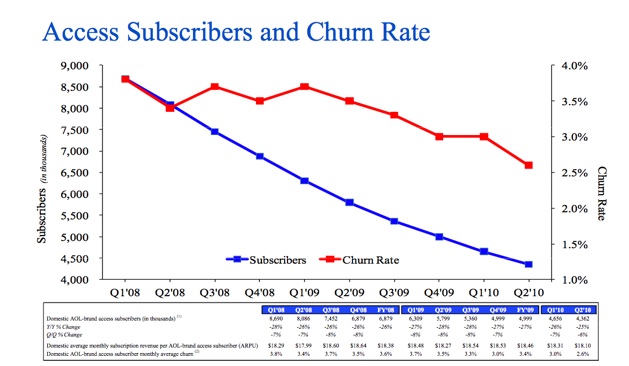

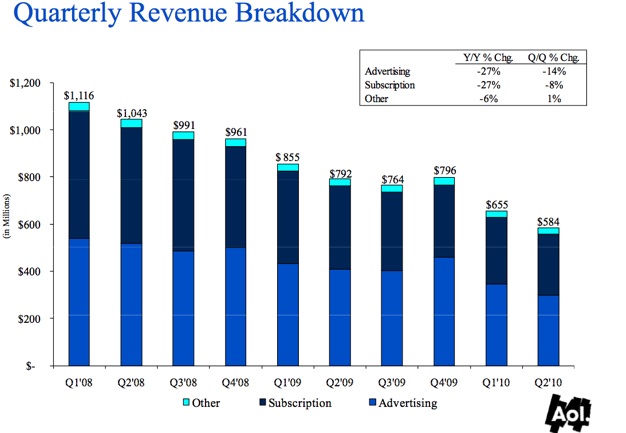

Let’s break down the numbers. In the second quarter, AOL reported total revenues of $584 million, down from $792 million a year ago. We all know that AOL’s Internet access subscription business (including dial-up and bring-your-own broadband customers) is going away. And revenues for that portion of AOL’s business declined by $96 million. AOL is down to 4.4 million subscribers, and is losing 2.6 percent a month.

But AOL’s advertising business, which is supposed to be its engine going forward, did even worse. Its revenues declined by $110 million.

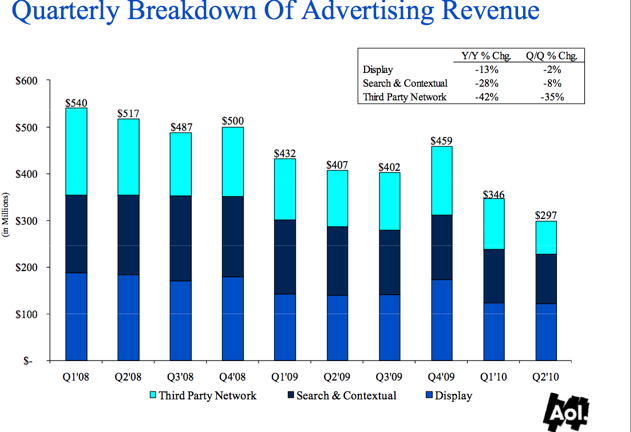

If you drill down into just the advertising portion of revenues, every single segment is down: its third party ad network (down 42 percent), search and contextual ads (down 28 percent), and even display ads (down 13 percent). AOL is de-emphasizing its third-party ad network, so that too was expected. And as it closes down properties in Europe and growth stalls, that means fewer searches (and search ads) on its owned-and-operated sites. But what is going on with display advertising? That is where AOL is supposed to shine. And the rest of the industry is showing a recovery. Yahoo, for instance, saw a 19 percent jump in display advertising revenues during the quarter.

AOL’s display advertising took a hit from AOL’s retreat from Germany and France, but the bigger problem seems to be the salesforce reorg that is still reverberating throughout the company. AOL’s strategy depends on its own salesforce selling premium ads on its own sites. But the salesforce is still reeling from the reorganization set in motion at the beginning of the year. AOL is also trying to be less spammy about the types of ads it shows, which accounted for about $8 million of the decline in domestic display ad revenues.

You might think that all AOL has to do is keep its advertising business going and growing as its access business goes away. But what is happening here is a much messier transition, as the kind of advertising revenues AOL generates is starting to come from different sources. Instead of an ad network and massive traffic driven by AOL.com, it is trying to build up a whole collection of new sites and content to help push its audience share back up.

And that is actually a huge challenge because so much of its pageviews (and thus display and search ad revenues) were previously tied to its captive, but dwindling, subscription customers who used AOL as their homepage and guide to the Internet. Nobody is doing that anymore (except for those 4.4 million people, half of whom probably just haven’t yet gotten around to canceling their subscriptions).

Instead, now AOL is pursuing a nichebuster content strategy, where it supplements its AOL.com traffic with search-friendly niche content sites. One area it wants to own is local news, with its patchwork of Patch sites, which now cover 83 towns from 44 last quarter. AOL will also start pushing a lot more video onto its homepage, powered by its StudioNow acquisition. If these strategies start to work and AOL can get its overall audience share up again on its owned-and-operated sites, that should help with both display and search advertising (it is still negotiating a new search deal with Google, which powers its search—and Armstrong is still keeping the Bing option in his back pocket).

Big transitions like these are always messy and they always take longer than expected. The unanswered question is whether AOL will look better than it did before when it comes out the other end.

Photo credit: Flickr/Kelly Hau