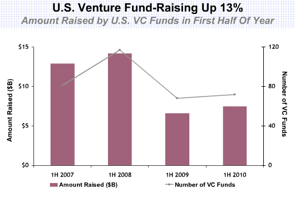

There’s good news for venture fundraising this morning. Following the recessionary drought of fundraising for venture funds in 2009, the amount raised has increased by 13 percent in the first quarter of 2010, with 72 funds raising $7.5 billion according to Dow Jones LP Source. For the same period last year, 68 funds raised $6.6 billion. Of course, this year’s raise is still half of what venture funds raised in 2008: a whopping $14.2 billion.

There’s good news for venture fundraising this morning. Following the recessionary drought of fundraising for venture funds in 2009, the amount raised has increased by 13 percent in the first quarter of 2010, with 72 funds raising $7.5 billion according to Dow Jones LP Source. For the same period last year, 68 funds raised $6.6 billion. Of course, this year’s raise is still half of what venture funds raised in 2008: a whopping $14.2 billion.

Including a U.S. private equity shops, which includes venture funds, 198 funds raised $45.1 billion during the first half, down 26% from the same period in 2009. Buyout funds raised saw the biggest drop in money raised, finding $21 billion across 74 funds, down 35% from $32.4 billion raised by 75 funds a year ago, as limited partners’ interest in mega funds — those targeting $6 billion and up — waned.

But venture funding remained strong, says Dow Jones. Multi-stage funds saw the strongest fundraising for the time periods with Twenty multi-stage funds raising a total of $4 billion, a 15% increase from the $3.4 billion invested in 24 multi-stage funds during the same period last year.

Capital raised by early-stage funds jumped 19% as 49 funds attracted $3 billion in the first half of the year. Later-stage funds, which have generally been known for raising less than multi-stage or eary-stage funds, locked in $500 million for three funds, down 21% from the year-earlier period.

The venture industry’s biggest close came from Sequoia Capital’s Sequoia China Foreign Currency Fund III fund which secured $1 billion its early-stage fund during the first half of the year.