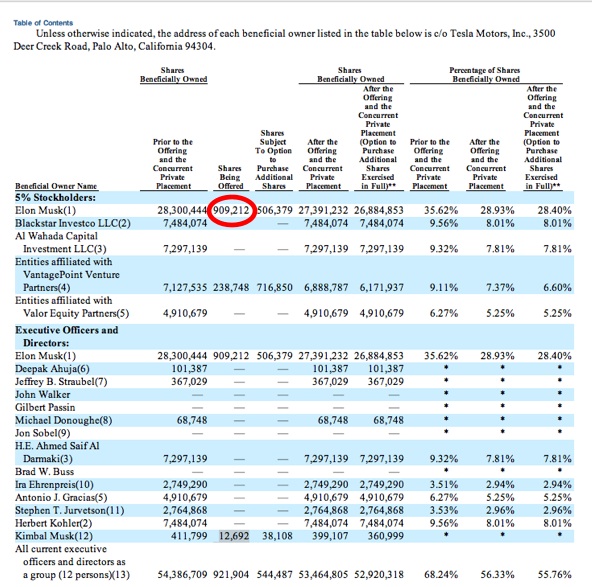

One day before its scheduled IPO, Tesla Motors is increasing the allotment of shares that will be sold to the public from 11.1 million to 13.3 million, according to an amendment to its S1 filing. The additional shares are being sold by existing shareholders looking to cash out at the IPO, including Tesla founder and CEO Elon Musk who is selling an additional 909,212 of his personal shares. Other selling stockholders include VantagePoint Venture Partners (238,748 shares), Bay Area Equity Fund (88,586), Westly Capital Partners (72,625), Compass Venture Partners (22,931), as well as friends and family like Elon’s brother (and OneRiot CEO) Kimball Musk (12,692). Tesla itself won’t make any additional money from the bump in shares, but more shares will be available to the public.

If Tesla shares open at the high end of its expected range of $14 to $16, the Silicon Valley electric car company will debut with a $1.5 billion market cap (based on 93.5 million total shares outstanding after the IPO and a concurrent $50 million private placement with Toyota). After the offering, Tesla’s largest shareholder will still be founder Elon Musk, who will own 28.4 percent of the company (worth $426 million at that valuation, versus a potential windfall of $14.5 million for the shares he is selling). The second largest shareholder will be Daimler (through an investment arm called Blackstar Investco) with 8 percent of the shares, and the third largest will be the government of Abu Dhabi (through Al Wahada Capital Investment) with 7.8 percent of the shares. The two biggest VC shareholders will be Vantage Capital Partners with 6.6 percent and Valor Equity Partners with 5.25 percent.

It takes a ton of money to crack into the car business. Even before the IPO proceeds, Tesla has already raised $783 million in venture capital and government loans. Tesla is expecting to raise about $210 million in the IPO, bringing the total raised to just over $1 billion.

And so far the company isn’t making any money. Last year, Tesla lost $56 million on revenues of $112 million. In the March quarter of 2010, it lost $29.5 million on revenues of $20.8 million. As of March 31, 2010, the company still had $188 million in cash. But it expects to spend up to $125 million this year, as it gears up to manufacture its Model S sedan (including $42 million to buy a factory in Fremont, California formerly operated by Toyota and GM).

While Tesla is known for its sexy roadster, it the Model S which will make or break the company. It is a more affordable electric sedan which the company hopes will start to make inroads with the general car-buying public.