You must have heard that the Nook and the Kindle, two of the world’s best-selling e-readers, have dropped their prices to below $200 — down to $149 for the Wi-Fi Nook and $189 for the Kindle. It’s bad news for e-readers that recently placed themselves at low price points to compensate for fewer features (like the Kobo I just reviewed), but of course good news for everyone planning on buying an e-reader soon. When I considered secondary features and the possibility of “bulk” e-readers, I concluded that these devices would survive but find themselves marginalized both in price and market share. That seems to be just what’s happening, though of course the tablet market is still emerging, and Google may have a few cards up its sleeve. The brief age of “premium” e-readers is ending.

What can you expect from the e-readers? Well, first of all they can and must cut the hell out of the price, and that’s what we’re seeing now. This functions both as a wedge and a loss leader. I may have a bit too much faith in the idea of devices like this as loss leaders, but if Amazon, Barnes & Noble, and Kobo believe in the services they provide, they’ll enable the customer to take advantage of those services even if it costs the company money at the outset. Not everyone can do this equally: Amazon has money to burn and really wants to dominate. B&N likely has a bit less, considering it has brick and mortars to maintain — a risky business.

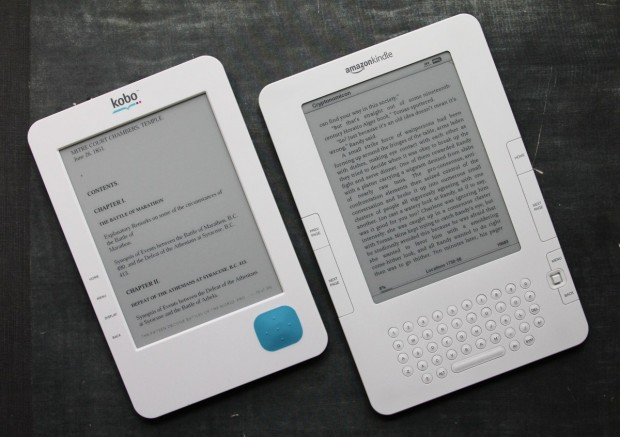

And Kobo, as a newer entry (but still with Borders backing), has even less to spend, not to mention the fact that they have introduced themselves as a less feature-packed device. Just an e-reader, not that there’s anything wrong with that. They’ll have to respond, though; your average consumer, seeing a Kobo and a Nook at the same price, will likely go with the Nook every time, and will be right to do so. They’ve made a good show of putting their e-reader app on as many platforms as possible and their hardware was custom OEM, so maybe they’re going to take the French leave from the hardware game? It’s hard to say.

In addition to being a loss leader, putting your product out there makes a wedge, as well. A customer who has one of your devices and enjoys it is more likely to upgrade when the next one comes out — and if the positioning is right, the price won’t matter nearly as much as the first one. After all, you’re selling a new version of something they already enjoy — you don’t have to sell the entire experience. Your consumer base will have self-selected, or at least that’s a reasonable hope.

The elephant in the room is iPad &co., of course. It’s unquestionably a more versatile device, but it’s unquestionably more expensive as well. This will be the case with all tablets for the time being. It’s the e-reader sellers’ job to make the e-reader a completely separate purchase from a tablet. If there’s feature overlap, play it down. Play up the low cost, the better screen for reading, the battery life, and of course the simplicity. The Kobo was nothing more than a pile of books. That’s what a lot of people want! The hard part is convincing them to pay for it whether they’re buying an iPad or not.

Here’s what I expect: the first mass-market reader (this means no random devices with extremely limited availability) to get below $100 will experience major sales; $100 is a magic number for impulse purchases, and the funny thing is that at that point, features don’t really matter. The main feature is e-book reading. They’ve all got that. Features like annotation and on-device browsing are a bonus people can do without, since it’s easy enough to sync and SD cards will hold hundreds of books. Exclusive book deals and that sort of thing will seem like cheap tricks to consumers, and they can always buy a paperback for almost the same price if they really want it. The premium e-readers will go down in price but unless they’re prepared to lose more money than the next guy (who has a cheaper device to begin with), they’re going to lose their shirts to single-serving devices that don’t try to do more than they need to.

That’s my fantasy, anyway. In reality, we’ve got the education market still waiting to choose sides, and new devices almost certainly on the horizon which may tip the balance of power. There’s one thing you can count on, though: e-reader makers will recognize the drive to beat tablets on features as quixotic, and will focus instead on value and usability. Not a bad choice if you ask me.