In January, private company stock marketplace SecondMarket published data on private company stock sales that they helped complete in 2009. And February’s report showed the transactions that took place in January, which showed a strong demand for consumer products and services startups. The majority of transactions in January were sales of Facebook stock. SecondMarket just released its February report, which you can download here.

In January, private company stock marketplace SecondMarket published data on private company stock sales that they helped complete in 2009. And February’s report showed the transactions that took place in January, which showed a strong demand for consumer products and services startups. The majority of transactions in January were sales of Facebook stock. SecondMarket just released its February report, which you can download here.

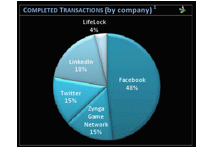

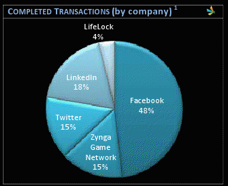

Transactions more tripled in February, from $13 million in sales to $43.8 million in sales last month. A full 48% of the transactions were sales of Facebook stock, compared to 38% in January. And last month, we reported that sales are being completed for as high as $40 per share (or a $17.6 billion valuation). But we learned this week that Facebook CEO Mark Zuckerberg is in no rush to take the company public. LinkedIn took 18% of the transactions, and sales of both Twitter and Zynga stock were each 15% of the total. LifeLock rounded the group out with 4% of the total.

The transactions concentrated mainly in consumer products and services (85%) and media and entertainment (15%). Similar to January’s trends, Facebook, LinkedIn and Twitter attracted the most transactions on SecondMarket.

On the buying side, Facebook led the way with one-third of all buyside demand followed by Twitter (7%) and LinkedIn (5%). Interest in Zynga (3%) also rose in February. On the seller side, ex-employees of start-ups stepped up their selling activity in February, comprising over 80% of sales, the highest percentage in the past nine months.

Noticeably missing from the report was Tesla, which filed for a $100 million IPO in late January.