Local cost-per-click marketplace Reply.com wants to raise $60 million in an initial public offering. The company filed its offering statement with the SEC this morning.

Reply.com is a cost-per-click ad network which targets ads for local businesses. Its strategy is to gather more information from consumers who click on their ads by inserting a “middle page” between that pops to ask them where they live or what brands they like to improve targeting before showing them an ad.

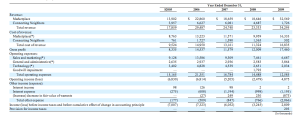

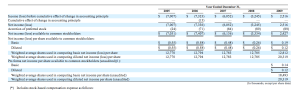

Revenues rose 75 percent in 2009 to $32.6 million. The company operates with a 50 percent gross margin, and turned its first net profit in 2009 of $2.5 million. The business produced $4.7 million in cash flow in 2009, but it ended the year with only $1.3 million in cash. Reply.com acquires click traffic from search engines, display ad networks, and other sources. These traffic acquisition costs account for nearly all of its cost of revenue. In the fourth quarter alone, the generated 4.9 million “enhanced clicks” and 700,000 leads for 5,000 advertisers. The company employs 127 people—103 of them in sales and marketing.

Since 2005, the company has raised $27.5 million from Scale Venture Partners, Outlook Ventures, ATEL Ventures, and Debi Coleman, a former CFO of Apple. CEO Payam Zamani is the largest stockholder. He owns 43 percent of shares outstanding (before the offering). Scale is the second largest shareholder, with 21.5 percent.

Zamani was previously the co-founder of Autoweb, and he’s been bankrolling the Reply.com. Over the past two years, the company has been dipping into his personal lines of credit to improve its liquidity. According to the filing, the “aggregate principal amount that we repaid under these credit lines to Mr. Zamani through December 31, 2009 was $5.9 million.” All of this personal debt to the CEO was repaid as of December 31, 2009, but it does suggest one reason why the company may need more working capital. It also plans to use the proceeds to expand into new advertising categories and geographies (and, presumably, to hire more sales people—local ad plays are very sales intensive).

Click on the tables below to see its consolidated income statement.