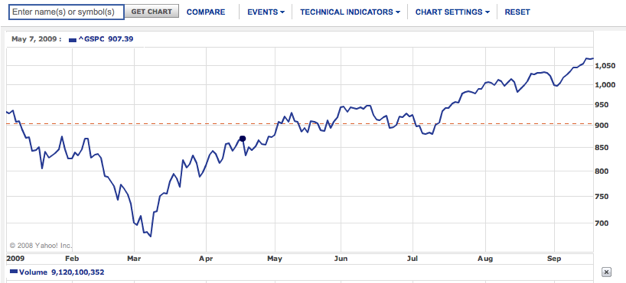

The S&P 500 is up 58 percent from its lowest point last March, the worst of the economic recession seems to be behind us, and even perennial stock market bear Jim Grant is calling for a barn-burner of a recovery, yet predictions of the next stock-market crash are already here. And you can find them on Twitter. Individual traders love to talk stocks on Twitter so much that they have given rise to a whole offshoot service, StockTwits. In fact, some argue that Twitter is becoming a pump-and-dump playground. But it is really no different than the Internet stock boards of old, which mixed honest financial discussion with attempts to manipulate the market with misinformation.

Either way, traders are flocking to Twitter because if there is one area where real-time information is really valuable, it is in trading stocks. The question is, who do you trust and who should you listen to? There are countless stocktwits who are now being joined by more professional prognosticators. One is BAM Investor, which markets its financial model to hedge funds. BAM stands for Behavioral Analysis Of Markets. It uses fractal theory (and the Fibonacci sequence!) to predict emotional mood swings in the market.

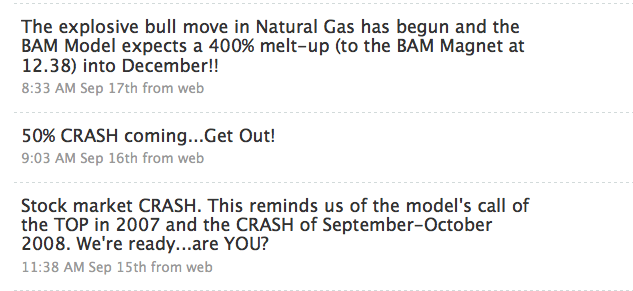

About five days ago it predicted that the current stock market rally would crash by 50 percent. It also thinks that Crude Oil is heading down to $56/barrel. But it is bullish on natural gas, predicting a 400% “melt-up”.

Why should anyone listen to these trading tweets? BAM Investor claims that its financial model predicted the crash of crude oil from $147 to $36, the rise in corn and wheat futures from their 2007 lows, and the 400 percent rally in shares of Ford from February to August, 2009.

But as with any financial advice, investors should beware. BAM Investor is simply using Twitter to market its financial model, which you can subscribe to if you are a serious investor. The true test of a financial model is the consistency of its predictions and its accuracy over time. In other words, can you trust it? Is it right more often than it is wrong? It’s putting its predictions out there for anyone to follow and judge for themselves.

If its predictions start making people money, you can expect its number of followers to grow, but that is also a function of press and marketing. What we really need is a service that keeps track of all of these public financial predictions and rates their accuracy so that the smart money can be separated from the twits.