Mobile payments for micro-transactions on the web are catching wind and there are several players in the space vying for the top spot in the field. Today, Boku, a recently launched mobile payments conglomorate of sorts, is announcing a slew of new customer acquisitions as well as details of its international expansion.

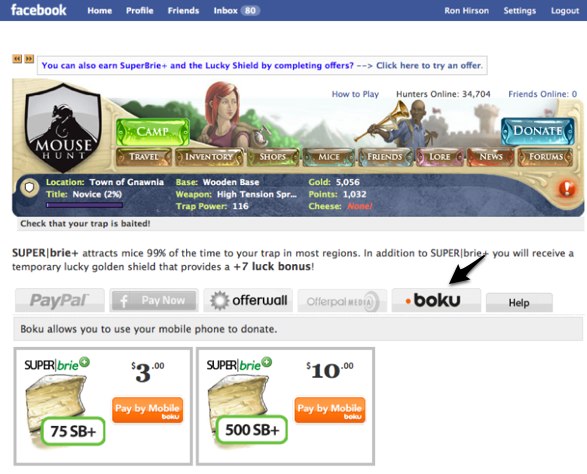

Boku, which acquired competitors Paymo and Mobillcash and raised $13 million in Series A funding back in June, doesn’t require users to have a credit card or bank account to make a micropayment. Users enter their cell phone number on the site, reply to a text message and then all virtual charges are automatically charged to the user’s monthly cell phone bill. As we’ve said in the past, it’s ridiculously easy.

Because of its acquisition of Paymo and Mobillcash, systems that had significant international reach, BOKU gained a strong base of users around the world. Today’s announcement adds availability of the payment service in Finland, Indonesia, Slovenia and Taiwan, bringing the company’s global reach to 56 countries. Boku’s marketing chief Ron Hirson tell us that they are seeing a strong foothold in Southeast Asia and will be expanding to the Phillipines within a few weeks.

Boku has also added a number of online gaming sites, social network applications and the social networks themselves over the past few months, including Playfish, HitGrab and Gambit. Boku says that currently they have over 1000 customers that use its mobile payments platform. So far, Boku has powered 6.5 million online mobile transactions.

But competition is stiff in this field and one competitor in particular, Zong, has also witnessed strong growth over the past few months. Most recently, Zong was chosen to test a pilot program for mobile payments for Facebook’s virtual currency, Credits. While Zong may not have had the organic international base that Boku has (Zong is available in 19 countries), this partnership is sure to help Zong’s global reach thanks to Facebook’s ever growing presence and popularity around the world. Zong also reached a big milestone a few weeks after processing mobile payments for 10 million unique users in 2009.

However, the potential obstacle to Boku, Zong and other mobile payments platforms are the high fees that mobile carriers charge to the payment systems (which are then passed on to the consumer). Boku told us on June that different cell phone carriers charge varying fees that range between 10% to 50% of the purchase price, which is a hefty amount in transaction fees.

But if mobile carriers lower their fees, mobile payments have the potential to be the go-to way to pay for microtransactions. David Marcus, CEO of Zong, says that many U.S. and European carriers that Zong works with are contemplating reducing these fees by building large-scale models to process payments that would in turn lessen the pressure on startups like Zong and Boku as well as the applications and social networks using the systems. Marcus feels confident that if this does happen, the sky is the limit with mobile payments.

Regardless, as shown by growth witnessed by both Boku and Zong, mobile payments are catching on and attracting the attention of some of technology’s giants, like Facebook. And of course the rivalry and ensuing competition between the two companies could continue to spur further innovation and growth. It will certainly be fascinating to see which startup comes out ahead.