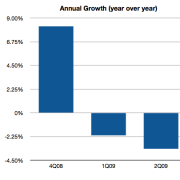

Most of the public Internet companies have reported their second quarter earnings by now. In a research note sent out to clients today, J.P. Morgan provides a few takeaways from the quarter. We already know that the recession continues in overall online advertising (see our chart at right), but even normally-strong search revenue was down. And display advertising shows “no signs of recovery.” Travel, finance, and entertainment remain especially weak advertising sectors.

But even in a down market there can be winners. Both Google and Amazon gained share in search and e-commerce revenues, respectively. Google now commands 72.3 percent of all search revenues, according to J.P. Morgan. Online travel sites are also benefiting from the weak economy, with hotels giving them more inventory.

Here are some key takeaways from the note:

- Search revenue was down Y/Y for the first time. We estimate that domestic search rev was down ~2% Y/Y during 2Q as we believe Google’s and Microsoft’s gross search revenues were roughly flat, while we estimate Yahoo!’s gross search revenue was down ~10%.

- Google continues to gain search dollar market share. Despite the launch of Bing, search dollar market share shifts in favor of Google have continued. We estimate that the 2Q’09 gross dollar market share of Google, Yahoo!, and Microsoft came in at 72.3%, 20.9%, and 6.8% vs. 2Q’08 levels of 70.6%, 22.7%, and 6.6%.

- Display advertising is showing no signs of recovery. Yahoo’s display revenue was down 14% Y/Y in the quarter on top of 1Q’s 13% decline. The declines at Microsoft and AOL were significant

- Online travel agents are likely benefiting from increased inventory. Industry sources point to hotel suppliers both domestic and abroad giving more inventory to online travel agents in an effort to increase volume. This quarter, Expedia showed a 26% Y/Y lift in room nights sold, a significant increase from 1Q’s 13% growth.

- Amazon still gaining market share. 2Q saw Amazon (North America rev. +13% Y/Y) continue to take share from eBay (US non-vehicles GMV -8%), though the ~2,150 bps difference in growth rates was down from ~3,240 bps in 1Q.