Whether it’s a sign of economic recovery or just investment bankers getting ready to take off the month of August, there’s been a lot acquisition activity lately. In the last week alone, IBM purchased SPSS for $1.2 billion, Amazon bought Zappos for $928 million, Sprint paid $483 million for Virgin Mobile, AdKnowledge paid $50 million for Super Rewards, and Yahoo picked up Xoopit for $20 million.

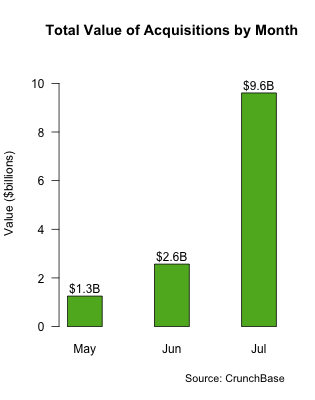

So far in July, the value of the acquisitions we track on CrunchBase totals $9.6 billion, which is nearly three times more M&A activity than the $2.6 billion we tracked in June. M&A exits already started to perk up in the second quarter , according to our latest CrunchBase report. But the increased deal flow on July suggests that corporate buyers are opening up their purse strings even more while acquisition prices are still relatively cheap.

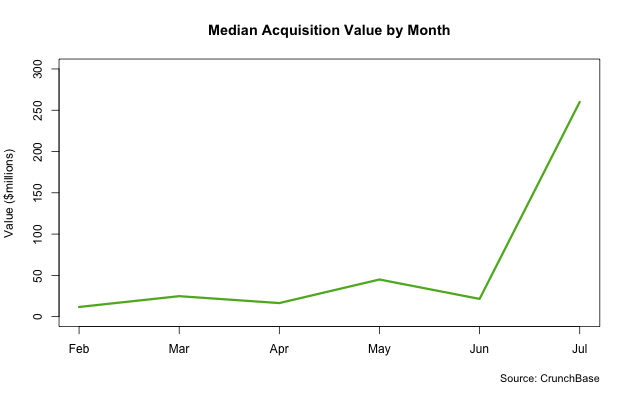

But the bargains might not last. Already, the median acquisition price leaped up to $260 million in July, from $22 million in June. Most of that jump was due to some very big transactions such as the ones listed above, as well as Agilent’s $1.5 billion purchase of Varian and Bristol-Myers’ $2.1 billion acquisition of Medarex. Still, you know what they say about rising tides . . .