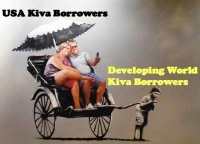

When we reported on Kiva.org’s decision to open up its micro-lending platform to U.S. entrepreneurs, Kiva CEO Premal Shah told us he was concerned about backlash in the community. Shah acknowledged that the decision to open lending to U.S. recipients may draw criticism because it goes against the idea on which Kiva was founded—lending to help development in third world countries where credit options are limited.

It looks like Shah’s prediction was correct. There is now a lending team on Kiva’s community platform titled “Unhappy Kiva Lenders.” The members, which total 375 lenders from around the world, are angry that Kiva is extending loans to U.S. entrepreneurs. The team’s page states that “including borrowers from the USA has undermined the very core of what made [Kiva] so unique and special; small, impactful contributions to entrepreneurs in impoverished situations in developing countries.”

The tirade on the page is harsh, calling the decision “shameful and disgraceful” and a deviation from Kiva’s core mission. The group cites an example of a recent Kiva loan request from a U.S. entrepreneur who had a college degree and a career in architecture who wanted to start a business in website design. The loan he requested was for $7000 to start the business, an amount the lenders suggest could help 7 to 10 different borrowers in other parts of the world.

Kiva’s stated mission is “to connect people through lending for the sake of alleviating poverty.” The anti-U.S. lenders claim that lending to U.S. entrepreneurs doesn’t alleviate poverty because Americans aren’t living in true poverty, compared to people in underdeveloped countries.

**US borrowers do not have to pay to send their kids to elementary school. **They don’t have to build their own house. **They don’t have to walk miles to get the bare minimum of medical care….if needed they can access FREE, generally high quality medical care. **They have a system of laws and courts in place that work. **They enjoy police and fire protection. **They generally have access to inexpensive and dependable public transportation. **They take for granted electricity, clean water, inspected food and indoor toilets. **

Some of that may be true. On the other hand, Shah makes a compelling case for the need for a micro-lending platform in the U.S. He says more than 10 million U.S. business owners face difficulty obtaining capital—even before the credit crisis and economic slowdown which made lending tight. And there’s no doubt that with the credit crunch creating a drought of lending, small businesses in the U.S. are finding it tough to find funds, especially if their financial history isn’t stellar. Finally, there is nothing wrong with giving U.S. lenders the opportunity to boost entrepreneurship at home, especially at a time where jobs created by small businesses can help lift the economy out of a recession.

It seems to me like the angry protests are misdirected. Kiva’s lending program has long been hailed as one of the more innovative platforms on the web and its ambitions have always been towards helping foster entrepreneurship (as well as alleviating poverty) in various areas of the world. Kiva’s decision to offer microlending to U.S. entrepreneurs reflects a genuine need for additional lending in the U.S. economy. And who knows? Kiva’s policy may attract a new crop of lenders who want to help at home first, and once they get hooked, spread capital overseas as well. The more capital that goes into the Kiva system, the more chance borrowers everywhere will have to eventually tap into it because many Kiva lenders simply recycle their loans as they are paid back.

We’ve contacted Kiva.org for a formal response.