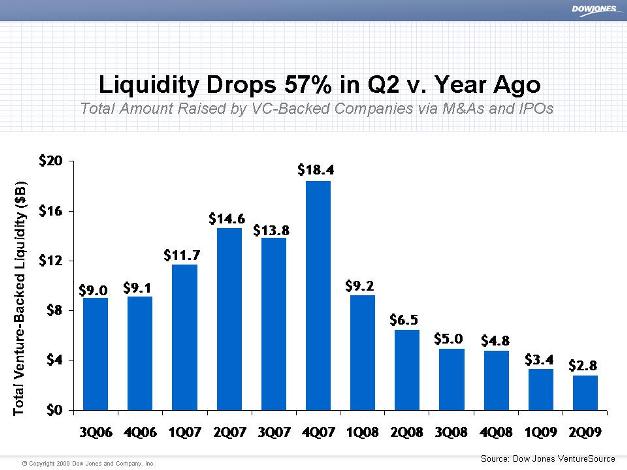

Fifty-seven percent. That’s how much overall venture-backed liquidity decreased in the second quarter of 2009 compared to that of last year: from $6.48 billion to $2.8 billion, if you want the hard numbers. Looking at the chart, I’d say the drop compared to the second quarter of 2007 ($14.6 billion) is even more telling. It’s the bad news from this just-released Dow Jones VentureSource report, with the only positive nugget the fact that three VC-backed companies have been able to complete IPOs (raising a total of $232 million), ending a nine-month drought.

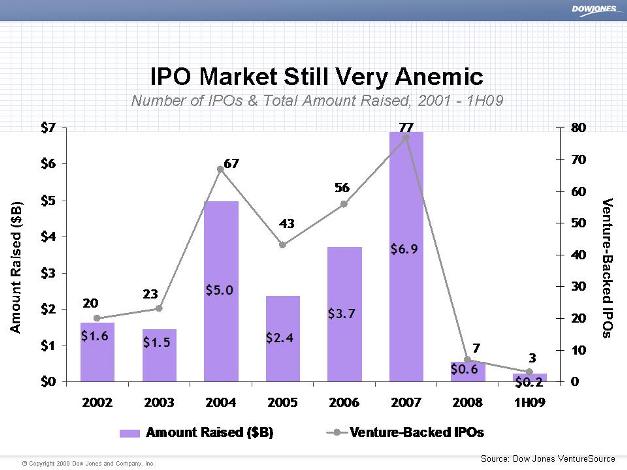

Fifty-seven percent. That’s how much overall venture-backed liquidity decreased in the second quarter of 2009 compared to that of last year: from $6.48 billion to $2.8 billion, if you want the hard numbers. Looking at the chart, I’d say the drop compared to the second quarter of 2007 ($14.6 billion) is even more telling. It’s the bad news from this just-released Dow Jones VentureSource report, with the only positive nugget the fact that three VC-backed companies have been able to complete IPOs (raising a total of $232 million), ending a nine-month drought.

Just half an hour ago, we reported separately that the National Venture Capital Association actually counted five IPOs during the quarter in which a total of $721 million was raised (including DigitalGlobe-$279, SolarWinds-$152 million and OpenTable-$60 million). Also, while the NVCA pegged the number of venture-backed acquisitions at 59 in the second quarter, generating $2.6 billion, the Dow Jones VentureSource report says $2.8 billion was reached through M&As of 67 portfolio companies instead.

Either way, it’s looking very bleak out there, as venture capitalists are not only struggling to take their portfolio companies public but also to sell them. According to the Dow Jones report, M&As were down 60% from the $6.48 billion raised via 89 M&As in the same quarter in 2008. This represents the lowest quarterly M&A deal total since 1999. Furthermore, the median amount paid for a VC-backed company in the second quarter of 2009 was just shy of $22 million, a 46% drop from the nearly $41 million median paid during the same period in 2008.

Jessica Canning, Director of Global Research for Dow Jones VentureSource, commented that the market appears to be correcting the “possibly inflated figures” posted in 2007, but sees the IPO window finally opening up again.

I second Erick’s comment that it’s a bit too early to call it a come-back, but I’m sure a lot of people are happy to finally see at least some IPO activity again, even if it pales in comparison to what we’ve seen from 2004 to 2007.