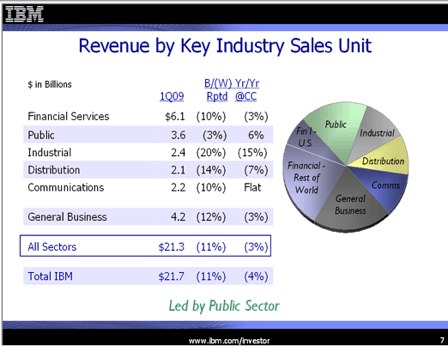

IBM reported its first quarter 2009 earnings this afternoon, posting diluted earnings of $1.70 per share compared with diluted earnings of $1.64 per share in the first quarter of 2008, an increase of 4 percent. First-quarter net profit fell one percent to $2.30 billion from $2.32 billion in the first quarter of 2008. Total revenue for the first quarter decreased by 11 percent, to $21.7 billion from the first quarter of 2008. Analysts expected first quarter earnings of $1.66 a share on revenue of $22.5 billion.

IBM said that it expects to report 2009 earnings of at least $9.20 a share.

IBM CFO Mark Loughridge said that sales of the companies software and services helped IBM weather the economic environment. Hardware was hit harder, according to the company.

Revenue, which IBM says was impacted by currency performance and the declining economy, from all parts of the business decreased on the whole. Total Global Services revenues decreased 10 percent, Global Technology Services segment revenues decreased 10 percent, and Global Business Services segment revenues decreased 10 percent. Short-term business client contract signings decreased by 14 percent to $5.5 billion but longer-term signings increased 14 percent to $7.0 billion.

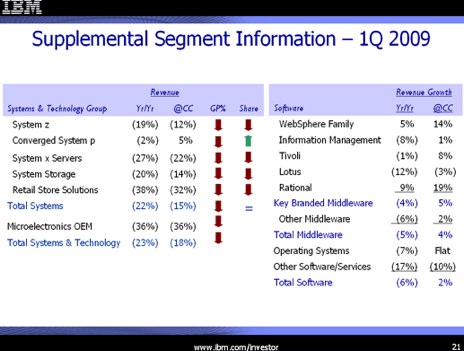

Revenues from the Software segment showed the least drop, decreasing by 6 percent to were $4.5 billion compared with the first quarter of 2008, revenues from IBM’s middleware products (WebSphere, Information Management, Tivoli, Lotus and Rational products), decreased by 5 percent to $3.6 billion, and revenue from operating systems decreased 7 percent to $492 million. Revenue from the Systems and Technology segment fell 23 percent to $3.2 million. Systems revenues decreased 22 percent.

IBM saw fast public sector contract growth, with a 200 percent increase in public sector contracts in the U.S. alone. The company saw a 50 percent increase in public sector contract signings worldwide

When asked about this morning’s news of Oracle’s acquisition of Sun Microsystems, Loughridge remained evasive and said the company is optimistic about their acquisition strategy in the coming year. IBM withdrew is $7 billion offer to buy Sun a few weeks ago, but it appeared that talks may were have been renewed between the two companies. Loughridge also said that the company will continue investment in initiatives like Cloud computing, which seems prime to drive growth.