One of the best decisions we ever made at TechCrunch was when we launched CrunchBase, our open startup directory, at the end of 2007. We aspired to make it the best current source of information about technology startups, people and investors. Data is added by TechCrunch editors, our amazing team of interns, and the community at large (it is a moderated wiki, so anyone can contribute data). Over the last year, the database has grown to include more than 15,000 companies, 26,000 people and 1,700 investors. In short, it’s finally gotten big enough to become interesting. So as 2008 drew to a close, we started running statistics on the structured data to see what we could learn.

Today, we unveil our first premium research product, the TechCrunch 2008 Year In Review, which presents our key findings. The report takes a step back from the news that breaks day-to-day and provides a unique perspective on the major trends of 2008. We cover new products, financings and exits across a variety of technology sectors: search, social networking, cloud computing, mobile communications, advertising and ecommerce, consumer media and entertainment, consumer electronics and clean technology.

Below is a portion of the executive summary and key statistical highlights for all to read. CrunchBase counted 1,422 startups that were founded last year alone, and tracked $13 billion worth of venture investments across all stages of companies. It also tracked 284 acquisitions. The deals for which the price was disclosed totaled $41 billion. If you’re interested in further detail and statistical analysis, you can buy the full Year In Review or use the CrunchBase API to retrieve and parse the data yourself.

The full 143-page report (including 100 pages of tables and charts) is available for $149 as a download. We plan to continue refining our analysis and releasing new reports on a quarterly basis. We’d appreciate your feedback on how we can make our research even more valuable.

Subscribe to our research feed and we’ll notify you by email whenever new reports are released.

Executive Summary

Here are some highlights of the year in tech that you will find throughout the report:

Startup Launch Highlights:

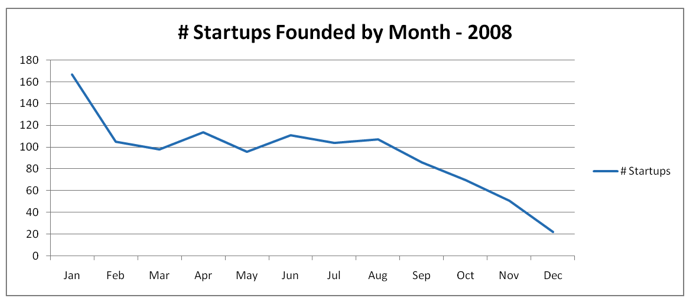

- CrunchBase recorded 1,422 new companies formed in 2008.

- More than 1,000 companies were founded through August. The number of new start-ups then declined precipitously each month from September through year-end.

- 1,276 new start-ups have not raised or disclosed financing rounds in 2008.

- 146 new start-ups received $146M in aggregate angel, seed, and series A financing.

- The average number of months between founding and financing was 3.8 months.

Venture Highlights:

- CrunchBase recorded over 1,100 financing transactions representing $13 billion in venture financing, approximately 50% of total capital raised in 2008. (CrunchBase data is still accumulating in clean tech, healthcare, and international categories.)

- Transaction volume followed a rough bell curve– approximately 20% of deals were angel and seed round, 60% were Series A and B and 20% were Series C or later-stage rounds.

- Average round sizes: $0.6M for seed rounds, $1.2M for angel rounds, $6.3M for series A, $11.1M for series B and $20.4 for series C rounds. Later-stage financing averages were $26.4M for series D and $36.5M for series E rounds.

- The top 10% of deal flow captured 50% of capital raised (133 deals raised over $25M, totaling $6.9B.)

- The most heavily invested sectors were clean tech, social networking, ecommerce and mobile, which each received $1B or more in venture.

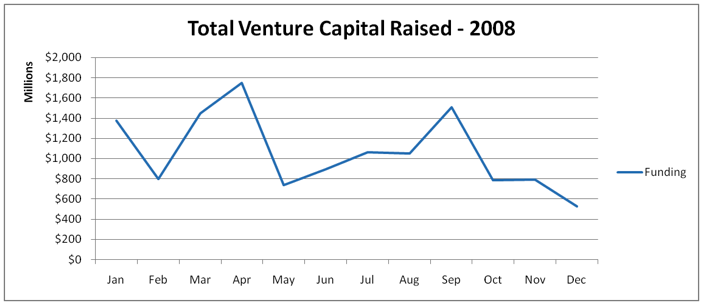

- Venture activity declined as the year progressed and US markets fell. Deal flow through September averaged over $1B and 100 financings per month. By December, activity was nearly half, or $600M raised from 50 deals.

- The healthy quarters of 2008 showed some aggressive raises. CrunchBase counted 9 companies that raised $100 million or more in 2008: Iridium ($500M), Xiaonei ($430M), Nanosolar ($300M), HomeAway ($250M), SulfurCell ($134M), GridPoint ($120M), Palm ($100M), Rearden Commerce ($100M) and Spinvox ($100M.)

- CrunchBase found an additional 15 companies that raised $50-100 million: Active Network ($80M), Adconion Media Group ($80m), Coremetrics ($60M), Facebook ($75M), Federated Media ($50M), Fisker ($65M), Glam Media ($65M), i/o Data Centers ($56M), LinkedIn ($75M), Plastic Logic ($50M), Realtime Worlds ($50M), Silk Road ($54M), Slide ($50M), SpotRunner ($51M) and Trion ($70M.)

M&A Highlights:

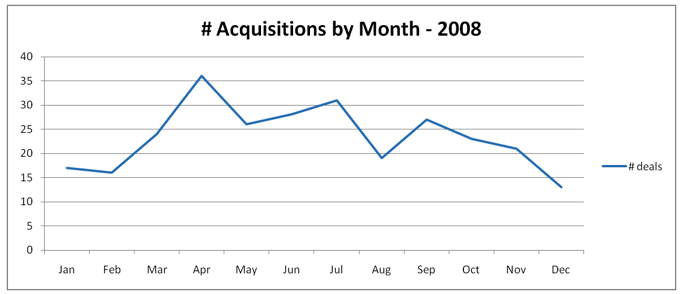

- CrunchBase counted 284 exits in 2008, exceeding $41B (nearly 200 transactions had undisclosed purchase prices.)

- CrunchBase recorded 7 transactions of $1B or more: HP’s acquisition of EDS ($13.9B), Google’s acq. of DoubleClick ($3.1B), Brocade’s acq. of Foundry Networks ($3.0B), buyout firm Hellman & Friedman’s acq. of Getty Images ($2.4B), CBS’s acq. of public company CNET ($1.8B), Microsoft’s acq. of public company Fast Search & Transfer ($1.2B) and Sun Microsystems’ acq. of MySQL ($1.0B.)

CrunchBase counted 42 deals priced at $100M-$1B, and another 39 transactions were announced between $10-100M. - The 4 largest corporate buyers with multiple acquisitions aggregating $1B or more in 2008 were: Google ($3.6B), Microsoft ($2.6B), eBay ($1.5B), and AOL $1.0B. (Note: large corporate buyers frequently do not announce all deals and do not disclose all purchase prices.)

- If you’re a seller, Google and Microsoft were the largest, most consistent buyers between 2007-2008. Yahoo! had been a major buyer in 2007 ($1.5B) but dropped its spending to $200M in 2008. AOL was a strong buyer in both 2007 and 2008, but TechCrunch expects that trend to decline in 2009 given the company’s recent write down of assets, and lackluster results from its $850 million Bebo acquisition. Amazon increased deal flow between 2007 and 2008, and they are likely to remain acquisitive as strong trends in cloud computing continue.

See the table of contents, table of tables and content preview here.

TechCrunch 2008 Year In Review

$149

TechCrunch 2008 Year In Review and Quarterly Reports Q1-Q3 2009

$295