As Yahoo prepares for its upcoming shareholder meeting, it is fighting to convince enough investors that it did the right thing by spurning Microsoft’s various offers, especially the last one which had Microsoft just buying Yahoo’s search business, in favor of doing a search advertising deal with Google. Today, Yahoo filed the slide deck that it will present to shareholders at its annual meeting on August 1 (embedded below). There is a lot of he-said, she-said going on here, and the tone of the presentation is extremely defensive.

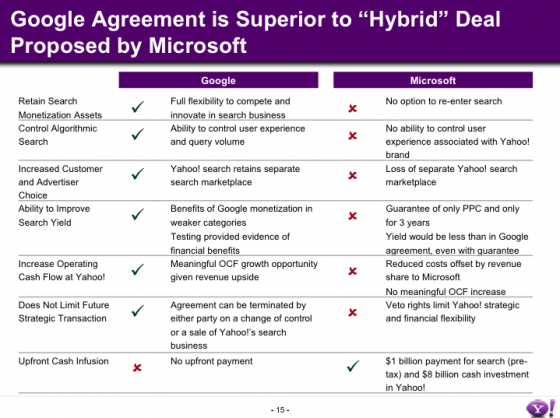

The slides go through familiar territory, marshaling Yahoo’s arguments for why Microsoft’s offer would have been bad for shareholders. But Yahoo does make some new points. Namely:

—Microsoft’s proposed $1 billion for Yahoo’s search business would be taxable, so shareholders would see less.

—Microsoft was only offering a 70% rev-share (TAC) for search ads on Yahoo, which is low for such a big deal.

—Cost savings would be no more than $750 million, not the $800 million to $1.5 billion that Microsoft estimates.

—Conveniently, the $750 million in cost savings that Yahoo estimates is equal to the 30% of revenues it would be sharing with Microsoft under the terms of the deal, thus offsetting any impact on operating income.

—Microsoft was only willing to guarantee its price-per-click rates for three of the 10 years of the proposed deal.

Yahoo’s strongest argument is that separating display and search advertising makes little sense strategically in a world where those two forms of advertising are colliding. (The Microsoft deal would have required that Yahoo give up its search advertising business and prevented it from re-entering that market in the future).

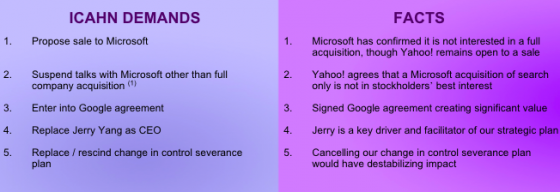

Towards the end of the presentation, Yahoo takes on activist investor Carl Icahn (who wants to replace the board with his own slate of directors) by pointing out that his track record with companies he has become actively involved in trying to change (Blockbuster, Motorola, Time Warner) has not been so great in recent years. It also points up the weakness in Icahn’s five-point plan to fix Yahoo.

Meanwhile, investors are not sure that Yahoo has a plan either. In a note today, Citi analyst Mark Mahaney wonders if maybe an AOL-Yahoo merger isn’t the best remaining option. Excerpt:

—Yahoo!-AOL merger possible – Four motivations: 1) $900 million of annual synergies, 2) Yahoo! gains display scale and keep search options open, 3) Time Warner gains Internet scale via a passive equity stake in larger entity, 4) Yahoo!’s clear interest in remaining independent.

The $900 million in “synergies” he sees are mostly from cost savings. But he also thinks there is value in keeping display and search advertising together. In fact, in another note today he made Google his top Internet pick, in part because of “continued marketing budget shifts to Search.”

Now, if Microsoft were to come back to the table with a serious offer for all of Yahoo, many of these objections would go away.

(Disclosure: As a former employee of Time Warner, I own shares in the company).