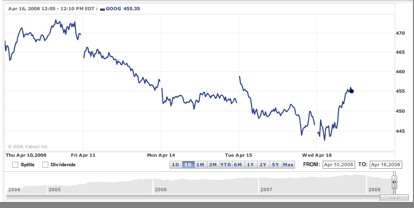

Later today Tomorrow when Google announces its first quarter earnings after the markets close, we are finally going to find out whether all the sturm und drang about Google’s seemingly-flat growth of clicks on search ads is a bad as everyone thinks. Already, Wall Street is bidding the stock up more than 2 percent in midday-trading in the hopes that it was oversold this past week on fears of weakening revenue growth. Those fears are fueled by the latest comScore figures, which estimate that paid clicks in March grew only 2.7 percent, and 1.8 percent for the quarter. The flattening became an issue back when comScore reported its estimate for January growth to be 0.3 percent. Never mind that in the past there has been a very uneven correlation between comScore’s estimates and Google’s actual revenues. Or that changes in the format of the ads meant to reduce accidental clicks (and thus improve the percentage of clicks that lead to actual sales) might account for the part of the decline.

Adding more fuel to the fire is a report put out yesterday by search-ad optimization company SearchIgnite which estimates that Google’s market share of search ad spending actually declined in the quarter to 70.4 percent from 74.5 percent in the fourth quarter of 2007. (And Yahoo’s share supposedly went up from 19.6 percent to 24.2 percent). The problem with this report is that there is no way of telling how representative it is of Google’s total business. It is based on the ad-spending habits of SearchIgnite’s 500 customers, who collectively spent only $300 million during the quarter on search ads across Google, Yahoo, and MSN.

We’ll find out soon enough if these fears are justified or if they are overblown. We’ll also find out if its social networking ad inventory is still dragging down the numbers. The current consensus revenue estimate is $3.61 billion for the quarter and $4.52 earnings per share. Who thinks Google will come out stronger than expected? Or will the shares sink again tomorrow?