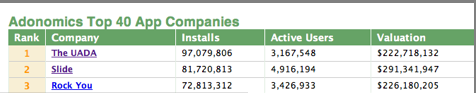

There is something fishy going on at Adonomics, the site that keeps statistics on the most popular Facebook applications. On its home page it lists the “Top 40 App Companies” as measured by how many times each company’s applications have been installed on Facebook. This is a useful list because it provides a snapshot of which Facebook app developers are doing the best by adding up all of their apps and comparing them in one place. For instance, Slide has 82 million installs across eight apps, and RockYou has 73 million installs across ten apps. But at the very top of the list is a mystery company nobody has ever heard of called the UADA with 97 million installs.

There is something fishy going on at Adonomics, the site that keeps statistics on the most popular Facebook applications. On its home page it lists the “Top 40 App Companies” as measured by how many times each company’s applications have been installed on Facebook. This is a useful list because it provides a snapshot of which Facebook app developers are doing the best by adding up all of their apps and comparing them in one place. For instance, Slide has 82 million installs across eight apps, and RockYou has 73 million installs across ten apps. But at the very top of the list is a mystery company nobody has ever heard of called the UADA with 97 million installs.

Forget for a moment that active users would be a better metric by which to rank the list (Slide would top that list with 4.9 million active users, followed by RockYou’s 3.4 million, and then the UADA’s 3.2 million). If you click through to the UADA’s profile page, none of its individual apps are broken out. Instead, there is a link to this placemarker Website indicating that the UADA, whatever it is, will launch on February 29.

The site belongs to Altura Ventures, the Facebook VC firm that is behind Adonomics. Conveniently, Adonomics calculates the UADA’s valuation at $223 million. (Nobody in the Facebook app industry believes Adonomics’ valuations, but that is a different story)

I called Lee Lorenzen, the CEO of Altura Ventures, who was coy about his stealth project. However, he did tell me:

The entity that controls all of those applications is a private company. The cooperative that represents all of those installs and has that valuation, that is essentially what is defined by the UADA. It is not an ad network. I am the interim CEO.

So the UADA, which I am guessing probably stands for something like the United Application Developers Association, is a cooperative of smaller application developers who collectively have about the same market muscle as Slide and RockYou. At least, that is what Lorenzen would like people to believe.

But there is a big difference between a startup that is rolling up Facebook developers (i.e., actually buying them) and a “cooperative” that brings them loosely together. From what I can gather, the UADA is the latter. That means that it is not the biggest Facebook app company. It is a marketing association. And for Altura to use Adonomics to imply that the UADA is more than it actually is seems a bit too self-serving for a site that is trying to positions itself as a neutral provider of market data.

With 16,000 apps on Facebook, it is getting increasingly difficult to get users to try out a new app. They are beginning to suffer from app fatigue. There are obvious benefits for smaller Facebook developers to gang together into larger networks where they can cross-promote each other’s apps. This is already happening in the social gaming category with Zynga and the Social Gaming Network. If the UADA gives smaller Facebook developers a leg up against the Slides and RockYous of the world, it might very well be worth joining. But unless the UADA actually owns all of the apps that it will be representing, it definitely won’t be in the same league as them. And it certainly won’t be worth the same, no matter what valuation methodology you are using. If anyone has any more concrete info on the UADA, please share in comments.