We wrote about a distilled version of the Wisdom of the Crowds idea a couple of weeks ago when profiling PicksPal, a fantasy sports betting site. PicksPal’s new product takes the best fantasy sports pickers and (without them knowing) repackages their advice as a paid service to sports gamblers. It’s done remarkably well after the first couple of weeks. The idea is that if you can take the true experts from the crowd and average their opinions, you can get to really stunning results.

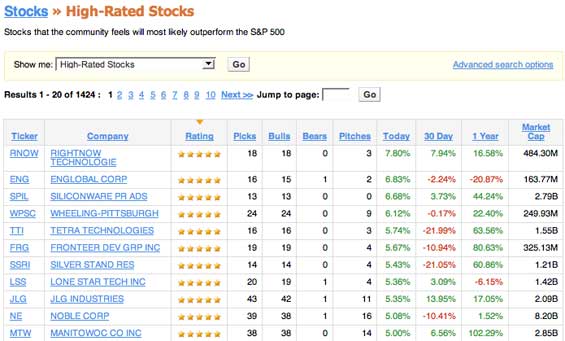

Now we have a second recent experiment in this area, the launch of Motley Fool CAPS. The service joins a host of others (such as SocialPicks) seeking to forecast markets. CAPS lets users place predictions on a publicly listed stock’s performance vs. the S&P 500 over a given time frame. After 7 such predictions a new user is given a CAPS percentile ranking that takes into account their overall return and accuracy (correct predictions / total predictions).

Users join the service for the bragging rights that come with being number one on the leader board and the various award icons adorning their profile. But CAPS is also using that data to create buy/sell recommendations on stocks. Users with a higher rating affect a stock’s recommendation far more that users with low ratings. So its like Wisdom of the Crowds, but with a weighted average towards proven winners.

Markets have traditionally been seen as the most efficient way to value information (even for the ill-fated DARPA terror futures market). But for investors looking for an edge, CAPS may give them the information they need.

A problem, though, is that unllke PicksPal, “experts” on CAPS, which are those users with very high ratings, know that they are affecting stock recommendations. The simple fact that they have this knowledge may affect how they pick stocks, and disrupt the entire system (one of the basic ideas behind the original crowds v. experts analysis in Wisdom of the Crowds). If and when that happens, CAPS may be little more than a way to push stocks that “experts” have a financial interest in, or for other non-efficient reasons.

There are rumors that the new free stock brokerage Zecco is going to offer a similar service. If Zecco customers don’t know that they are part of the user group being used to make predictions, their results may be much better over the long run.