VTS, a commercial leasing and asset management platform for landlords and brokerages, today announced that it has raised a $55 million Series C funding round led by Insight Venture Partners. Previous investors OpenView and Trinity Ventures also participated. This round brings VTS’ total funding to date to $84 million and makes it one of the most well-funded technology companies in its vertical.

VTS’s services are currently being used to manage about 2.7 billion square feet of real estate and the company says it has about 80 percent of the top 10 global investment managers on its platform. VTS founder and CEO (and former pro surfer) Nick Romito told me that his company is now growing 100 percent year-over-year.

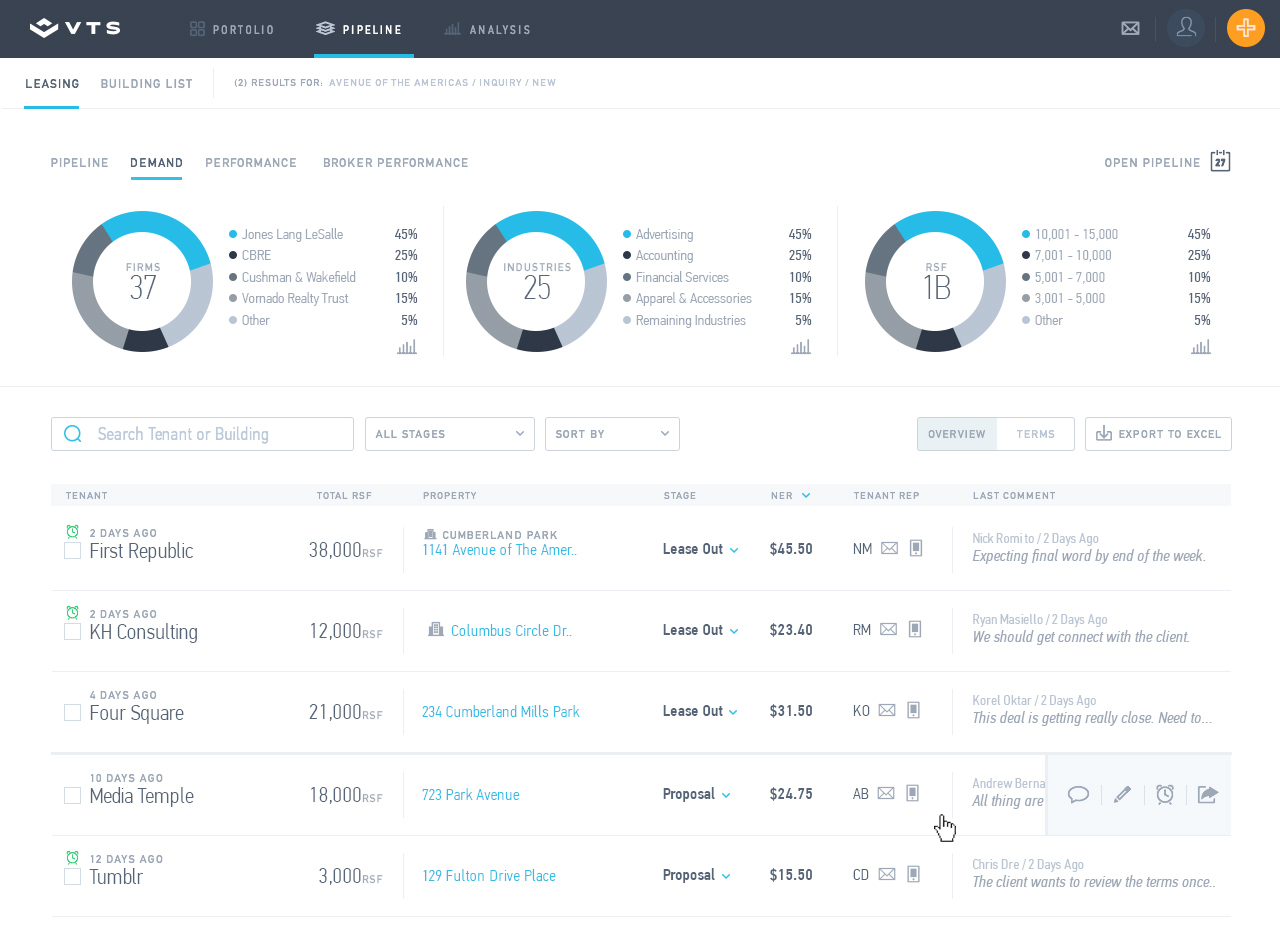

Using VTS, landlords can track leasing trends across their buildings, track negotiations, and monitor their marketing performance, among other things. Similarly, brokers can use the company’s tools to manage their own leasing pipelines, while tenant reps can manage their workflow on the platform, too.

The company says it plans to use the new funding to fuel its global expansion and work on its product. Romito tells me VTS is looking at expanding into the EMEA and APAC markets, starting with Germany and the Netherlands, as well as Sydney, Australia.

As for product innovation, Romito notes that the company wants to become “the one platform that everyone in the commercial real estate industry uses to manage their portfolios, track their deal flow and communicate with their peer set and partners.” Essentially, the company wants to do for commercial real estate what Bloomberg did for financial services.

Commercial real estate — just like its residential counterpart — was long resistant to adapting new technology, but that seems to be changing now, as tools like VTS give landlords and brokers a leg up in a business that increasingly relies on being able to manage and analyze large amounts of data.

“The commercial real estate industry is a massive one; every single country in the world is working with very outdated, manual processes to manage deal their portfolios (leasing, tenant management, future exposure, etc),” Romito told me. “We see our opportunity as capturing more market share among global real estate investors, landlords and brokers, so we can become the single platform upon which the entire industry is managed. A side effect of that is that we generate a ton of data for our clients to harness and use to improve performance. The opportunity is marrying the best software in the industry with some very powerful data.”

Looking ahead, Romito argues that the company’s challenge now is to keep up with its growth as it scales internationally. “Financing can help propel us to be in that right place at the right time, achieving our goal to become the industry standard,” he said.