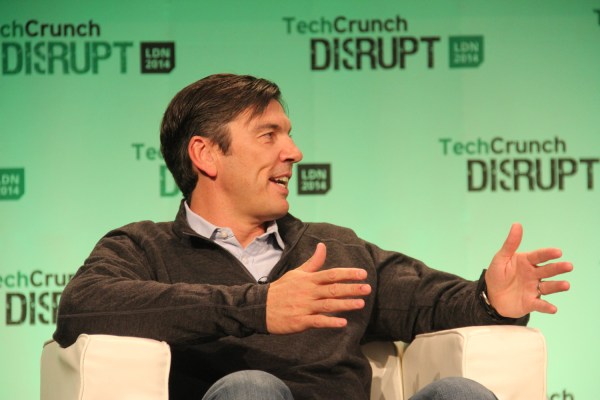

AOL CEO Tim Armstrong was interviewed onstage today at Business Insider’s Ignition conference, and sure, he touched on the ongoing speculation about a merger with Yahoo, as well as the company’s broader strategy. But toward the end of the interview he answered the question that’s on everyone’s mind: What’s the deal with Shingy?

“Shingy” is David Shing, the company’s “digital prophet.” With his silly title, wild hair and penchant for grandiose predictions, he occasionally gets skewered by the media, most recently in a deadpan profile in the New Yorker. (At one point, Shing is described as proudly showing off his drawing of “a bear wearing zebra-print pants and a shirt covered in ones and zeros,” which prompted some at TechCrunch to create their own versions.)

However, Armstrong acknowledged that he himself has taken “lots of spears from the press.” And he said the naysaying journalists “don’t understand the value Shingy brings.”

“David Shing is one the best assets we have as a company,” Armstrong said.

He went on to describe Shing as “really smart, really creative” and “one of the top humans I’ve met.” And he pointed to the fact that Shing “is on airplanes 200, 250 days a year” attending things like executive retreats and helping companies “think differently about the world and where the world’s going.”

And while it’s probably not a surprise to hear Armstrong defending a high-profile employee, Digiday made similar points after the New Yorker story.

(Full disclosure: Since AOL owns TechCrunch, and since I work out of the AOL office in New York, I’ve shared an elevator with Shing and seen him in the office kitchen a couple of times. But that’s the full extent of our interaction.)

Anyway, here’s a question that’s not Shingy-related: Why is AOL investing on both the content side of the business, with publications like the Huffington Post and TechCrunch, and on the ad tech side? Armstrong answered that many of the other ad tech companies are coming to AOL because they’re looking for “non-commoditized content.” He also said the combination is reflected in AOL’s emphasis on “culture and code,” a catchphrase that I’ve seen around the office but never really understood until now.

Oh, and he said that HuffPo is bringing in hundreds of millions dollars in revenue, and is a “good-looking, profitable media company” on its own if you don’t count its current investments in international growth.

“Our company has been built on a brand-centric programmatic stack that has integrated video and mobile,” Armstrong said.

He then referred back to an earlier comment that in a decade or so, there will only be room for 10 or 15 “big chairs” in the industry. In order to have one of those chairs, companies will need both the technical capabilities and the scale.

“AOL has the capability right now, and we’re working really hard to get scale on top of it,” he said.

As for the urging of activist investor Starboard Value that AOL and Yahoo merge, Armstrong continued to dismiss any potential move in this area as “a distraction.”

“For 10 years it’s been a rumor,” he said. “I think I’d keep it in the rumor camp at this point.”