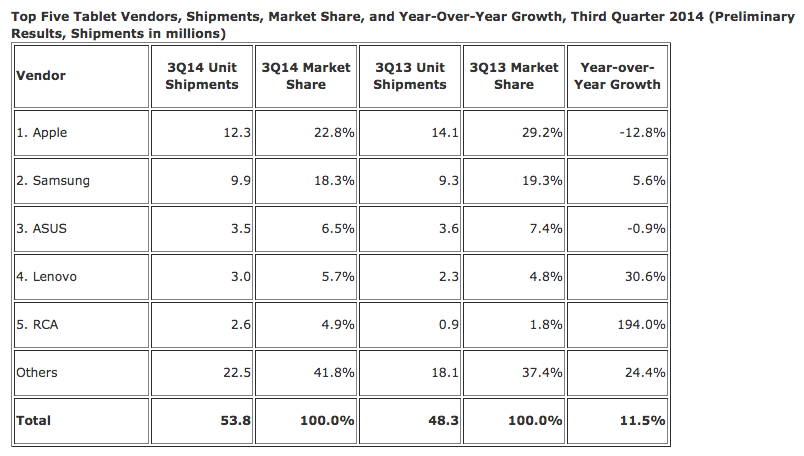

Tablets — once thought of as the great disruptor to PC sales with their lighter form factor and cheaper price — continue to grow in sales, but at a far slower pace than in quarters past. IDC today published its Q3 numbers for tablet sales, and its analysts estimate that globally there were just under 54 million tablets shipped — 53.8 million to be exact — working out to a rise of 11.5% over last year. Apple, whose iPad models remain the most popular of all, continues to see its leadership margin erode at the expense of Samsung and others competing on price.

The figures support estimates published earlier this month by Gartner, which noted tablet sales growth of just 11%, and are in line with figures from IDC published in May revising down its forecasts in light of longer sales cycles. People are simply holding on to tablets for longer, and new models are just not compelling enough to get consumers to buy them instead of the big-screened phones hitting the market.

While those are still persistent issues, Q3 saw a bump, IDC says, because of back-to-school promotions and growth in one market in particular, the U.S.

“Not only is the U.S. market one of the largest for tablets, but third quarter results also indicate that this is where the growth is,” writes Jean Philippe Bouchard, IDC Research Director for Tablets. “We saw Verizon continuing to sell connected tablets at a fast pace, a strategy that we believe other carriers will replicate in following quarters. We also saw RCA enter the top 5, impacting the entire US market and worldwide ranking with one large deal linked to back-to-school and channel fill ahead of Black Friday. Those two elements resulted in the US tablet market growing at 18.5% year-over-year compared to the worldwide market growing at 11.5% annually.”

While Apple in quarters past had all but dominated the tablet market, taking over 50% of sales, this is no longer the case. This quarter the company took just under 23% of shipments, 12.3 million units, to Samsung’s 18.3% — a margin of just over 4 percentage points compared to a 10 percentage point margin in Q3 last year. In the top five, Apple saw by far the biggest sales decline, down almost 13%, with Asus the only other seeing a decline, in its case of about 1 percent.

IDC, however, points out that a longstanding fact about Apple: it’s typically not concerned with market share erosion because a lot of it is based on cheaply priced tablets, which inevitably impact the margins for its competitors.

“Although the low-cost vendors are moving a lot of volume, the top vendors, like Apple, continue to rake in the dollars,” writes IDC senior research analyst Jitesh Ubrani. “A sub-$100 tablet simply isn’t sustainable—Apple knows this—and it’s likely the reason they aren’t concerned with market share erosion.”

Samsung, of course, takes a very different view: thinner margins, perhaps, but improving the bottom line by way of volumes. In the past quarter IDC notes that it’s taken this strategy specifically to North America and Middle East and Africa (MEA), “where low-cost Asian vendors haven’t been able to gain a foothold just yet.”

Although Microsoft’s hasn’t seen a significant gain in the smartphone landscape, it’s seeing a little bump in the tablet space by way of ASUS, which passed Lenovo for the number-three ranking, with “Much of this gain… fueled by Windows-based 2-in-1 devices as ASUS continues to offer some prominent models at highly competitive prices.”

Lenovo, which today completed its purchase of Motorola from Google, has seen growth of 30% in sales, increasing its share by 1%.