While crypto exchanges have demystified some of the largest cryptocurrencies for retail investors, many of the intricacies of decentralized finance are still lost on even more savvy investors as a result of DeFi’s weave of diverse offerings.

Zerion, a startup building a decentralized finance “interface” for crypto investors, has attracted venture capitalist attention on the back of recent growth. Amid a renewed crypto gold rush, the company has processed more than $600 million in transaction volume so far this year, now with over 200,000 monthly active users, CEO Evgeny Yurtaev tells TechCrunch.

The startup has also wrapped an $8.2 million Series A funding round led by Mosaic Ventures, with participation from Placeholder, DCG, Lightspeed and Blockchain.com Ventures, among others. Mosaic’s Toby Coppel and Placeholder’s Brad Burnham have joined Zerion’s Board, the startup also shared.

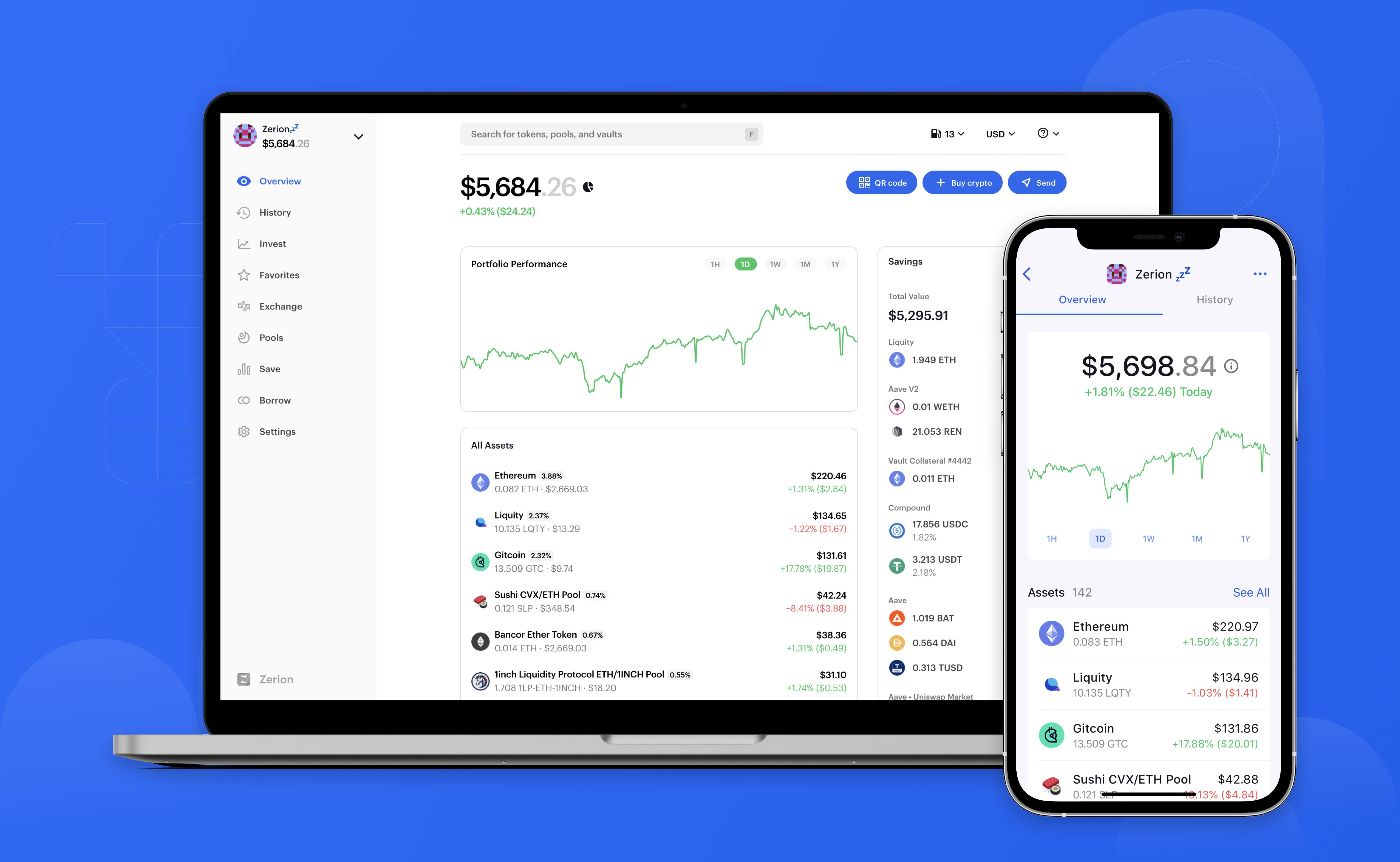

Zerion gives customers access to more than 50,000 digital assets and 60 protocols on the Ethereum blockchain through their app, which streamlines the UI of DeFi. Users can access tokens and invest through the app similar to exchanges like Coinbase or Gemini, but do so using their own personal wallets like MetaMask, meaning user funds and private keys aren’t controlled by or accessible to Zerion, a sticking point for Yurtaev, a lifelong crypto enthusiast and builder.

Image Credits: Zerion

“There are a bunch of different tokens and protocols in the DeFi space,” Yurtaev says. “In theory, it’s supposed to be easy to navigate, but in reality, it’s all a mess … We try to demystify them.”

Alongside major growth in Ethereum and bitcoin prices, DeFi volume has surged in 2021, up from just under $20 billion at the year’s start to nearly $90 billion this May. The DeFi market at large has proven just as volatile as bitcoin, with market volume falling some 35% in the past couple months to just over $57 billion.

The startup’s mobile app on iOS and Android has become a particularly popular way for crypto investors to track the market and the tokens they’re backing. The average user opens the app more than nine times per day, the company says.

Crypto’s 2021 upswing has drawn plenty of investor attention, not only to the assets themselves but to the platforms facilitating those transactions. Last month, venture capital firm Andreessen Horowitz announced that they had raised more than $2.2 billion to invest in startups building products in crypto spaces including decentralized finance.