TechCrunch has spilled much digital ink tracking the fate of VMware since it was brought to Dell’s orbit thanks to the latter company’s epic purchase of EMC in 2016 for $58 billion. That transaction saddled the well-known Texas tech company with heavy debts. Because the deal left VMware a public company, albeit one controlled by Dell, how it might be used to pay down some of its parent company’s arrears was a constant question.

Dell made its move earlier this week, agreeing to spin out VMware in exchange for a huge one-time dividend, a five-year commercial partnership agreement, lots of stock for existing Dell shareholders and Michael Dell retaining his role as chairman of its board.

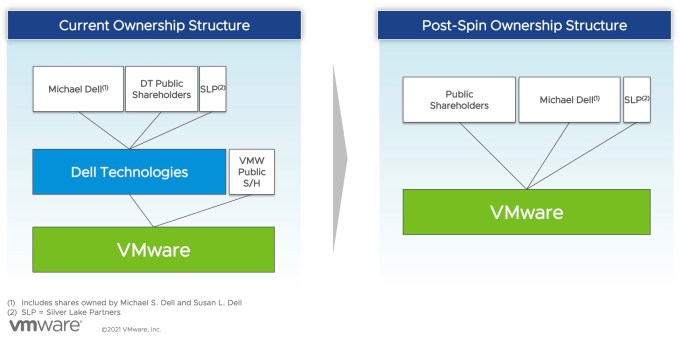

So, where does the deal leave VMware in terms of independence, and in terms of Dell influence? Dell no longer will hold formal control over VMware as part of the deal, though its shareholders will retain a large stake in the virtualization giant. And with Michael Dell staying on VMware’s board, it will retain influence.

Here’s how VMware described it to shareholders in a presentation this week. The graphic shows that under the new agreement, VMware is no longer a subsidiary of Dell and will now be an independent company.

Image Credits: VMware

But with VMware tipped to become independent once again, it could become something of a takeover target. When Dell controlled VMware thanks to majority ownership, a hostile takeover felt out of the question. Now, VMware is a more possible target to the right company with the right offer — provided that the Dell spinout works as planned.

Buying VMware would be an expensive effort, however. It’s worth around $67 billion today. Presuming a large premium would be needed to take this particular technology chess piece off the competitive board, it could cost $100 billion or more to snag VMware from the public markets.

So VMware will soon be more free to pursue a transaction that might be favorable to its shareholders — which will still include every Dell shareholder, because they are receiving stock in VMware as part of its spinout — without worrying about its parent company simply saying no.

Who could afford to buy VMware?

If you accept that this move puts VMware in play, the price tag means that the number of firms that could afford such a deal are few and far between.

Yesterday, Todd R. Weiss from Enterprise AI wrote a post in which some analysts speculated that Intel might be interested in buying VMware. The move would unite Intel CEO Pat Gelsinger’s old company with his new one and give Intel a big play on the software side of the cloud to go with its silicon.

Intel clearly doesn’t have enough cash, but it has the value with a market cap over $264 billion, and it could borrow enough to make a transaction possible. Whether that’s something Gelsinger is considering is unknown, but it certainly would make for an interesting acquisition.

Let’s look at some other companies that might be interested in VMware and could possibly afford the likely hefty price.

Microsoft

Last week, Microsoft bought Nuance Communications for $20 billion, so we know it has a taste for big deals, and it has over $136 billion in cash to play with (at least it did prior to the Nuance deal). Furthermore, Redmond has been chasing Amazon in the cloud market for years, making it the only viable competitor for AWS today. Microsoft could afford a deal of this scope and might be willing to pull the trigger if the transaction would push it closer to its primary rival in the cloud infrastructure market.

Oracle

Larry Ellison was in love with the Dell-EMC deal, but the company was building up its cloud infrastructure at the time and didn’t have the cash to pull off a deal. Today, Oracle has over $40 billion in cash and a market cap of over $226 billion. It would be like Ellison to make a big splash like this and having access to the VMware market would be a good way to push his company’s cloud business in a major way.

IBM

Big Blue bought Red Hat in 2018 for $34 billion to force its way into the hybrid cloud market. IBM is in the midst of a spinout of its own, letting go of its managed services business, a move announced last year. And the company has struggled financially for a number of years as it tries to make the transition to selling a hybrid cloud solution. If it could afford to buy the virtualization giant, the deal would definitely put it back on the map with Red Hat and VMware in the fold, but the affordability question looms large.

Google/Alphabet

As with IBM, Google’s cloud computing business has been growing more slowly than its primary rivals at the top of the market, Amazon and Microsoft. Google is sitting at around 10% market share today, and while it has been growing under the leadership of Thomas Kurian, it has been costly to gain share. Bringing VMware into the fold could make a huge difference in terms of its position in the enterprise market. It’s also worth noting that prior Google Cloud CEO Diane Greene was one of the founders at VMware.

Amazon

Amazon’s cloud arm, AWS, is a $50 billion company on its own. It has a substantial market share lead over its closest competitor, Microsoft. And it has a broad partnership with VMware already. While it could probably afford to bring VMware into the fold, it’s not clear it would make sense to pay that price to do it given that Amazon already enjoys market dominance thanks to AWS sans buying VMware.

Other players include the usual highly acquisitive enterprise suspects such as SAP or Cisco, if they could swallow the cost. This is all clear speculation, and the deal to spin out VMware won’t even close until the end of this year at the earliest. But the spinout does have the potential to put VMware in play at some point and it’s a useful exercise to look at the possible buyers.

Drop a comment if there’s a company you think we didn’t consider.