Mayfield partner Navin Chaddha and Poshmark founder and CEO Manish Chandra met all the way back in 2003, well before Poshmark was even a glimmer in his eye. They stayed connected over the years, through Chandra’s sale of his startup Kaboodle to Hearst and after he left.

At a breakfast one morning, Chandra told Chaddha he was going to try to do everything from his iPhone for the next six months.

Over the course of that time, the idea for Poshmark started to percolate into something more concrete. Chandra, following Kaboodle, knew he wanted to do several things differently. The first was create an engagement and revenue model that was symbiotic, rather than starting with engagement and having to build out a business model later. He also knew he wanted to start with people first, and build a founding team that had deep DNA in the fashion world to pair with his technical background.

He met Tracy Sun, brought her on, and got to work.

This was back in 2011, and Chandra was absolutely adamant that he wanted Poshmark to be an app, not a website. So adamant, in fact, that during beta he actually provided 100 users with video iPods. (He recalled that he only got 20% of them back.)

“Lead with love, and the money comes.” It’s one of the cornerstone values at Poshmark. The company practiced that early on by holding IRL, and then virtual, parties, allowing users to show each other their wares and create an engagement cycle that offered instant gratification. The user base grew from 100 to 150 to 1,000 and so on.

“We still to this day use a similar kind of strategy in a much more compressed timeframe as we go to different countries,” said Chandra. “We focus on building the community first and then scale that community.”

Chaddha and Mayfield led the company’s Series A deal a decade ago. On the latest episode of Extra Crunch Live, Chandra and Chaddha sat down with us and walked us through that original Series A pitch deck (which you can check out below). They also participated in the Pitch Deck Teardown, giving their expert feedback on decks submitted by the audience. If you’d like your deck to be featured on a future episode of Extra Crunch Live, hit up this link.

Poshmark’s Series A Deck

Time stamp — 11:00

Poshmark was built on a couple fundamental premises. The first was that the iPhone would transform the way we do just about everything. The second was more pointed: That fashion, at the time underserved by technology, was a discovery process over a direct search process. A decade ago, Chandra envisioned a fashion marketplace that mimicked shopping in the real world — walk into a shop and let natural attraction do its thing — without holding any inventory.

Indeed, the first slide of the deck lays out exactly what Poshmark would successfully do for a decade: “A simple discovery-based marketplace where anyone can buy and sell fashion merchandise using their mobile phones.”

Chandra reminded us throughout the chat that much of what Poshmark did in the early days feels very obvious now, but was revolutionary at the time.

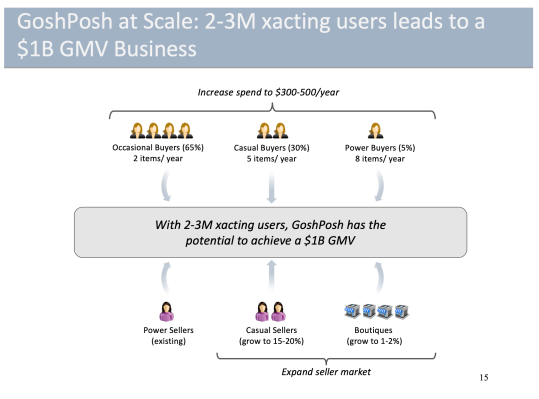

The problem was straightforward. The listing process for sellers was complicated and difficult on platforms like eBay, and the buying process was based on direct search, rather than discovery. Poshmark was equally straightforward about this problem in the deck.

Image Credits: Poshmark

“If you go to the next slide, you’ll see how we are thinking about the pain-solving, where selling is super simple and engaging,” said Chandra. “The discovery process is simple and engaging and the buying and selling process is simple. And that last part has sort of become very commonplace, but really controlling that transaction without touching inventory was very endemic to our belief in the early days.”

Chandra could then go into the sheer size of the online fashion market in the deck, which at the time he estimated to be worth $27 billion. Chaddha explained that one of the big strengths of the deck and Poshmark as a whole was not just the TAM, but the fundamental understanding of how to get to the KPIs the startup had put forth.

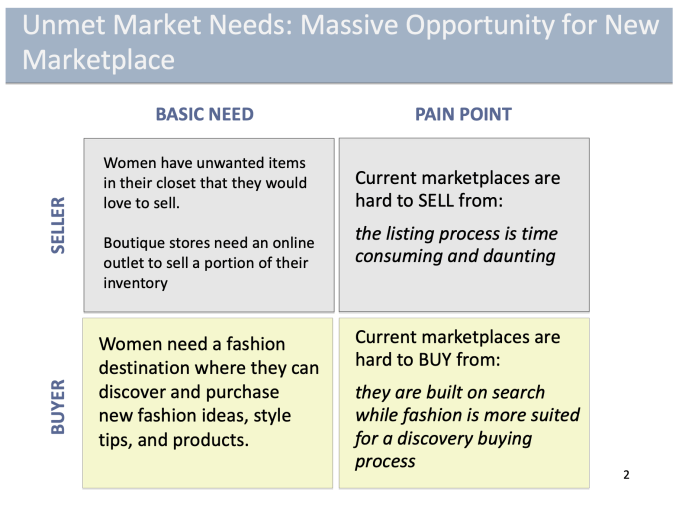

Back then, it was $1 billion in GMV. The first step toward that goal was creating a virtuous cycle of marketplace growth, outlined in the slide below.

Seed new users on the platform, suggest people for them to follow, watch them eventually list their own merchandise, share it on social and bring on new users. Again, it seems obvious now but this type of marketplace strategy was relatively nascent back in 2011.

Image Credits: Poshmark

Because it was new, and because a mobile-only fashion marketplace based on discovery was not a thing, some investors still needed some convincing.

“I can’t tell you how many investors told me I had to build a website,” said Chandra, relating that he wanted a mobile app instead. He also didn’t want to have a search bar, but rather have social discovery as the main function for finding products. “So you’re building a shopping site, which has no search bar. You never touch inventory. And it’s 100% on the phone. It was challenging almost everything that e-commerce investors were used to at that point in time. So I needed someone who believed in my craziness a little bit and sort of trusted that.”

Chaddha believed wholeheartedly in that craziness. After having known Chandra for years, he had talked through much of this strategy with him before. In fact, Chaddha was the one who prodded Chandra to think practically about how to get to the goal of $1 billion in GMV.

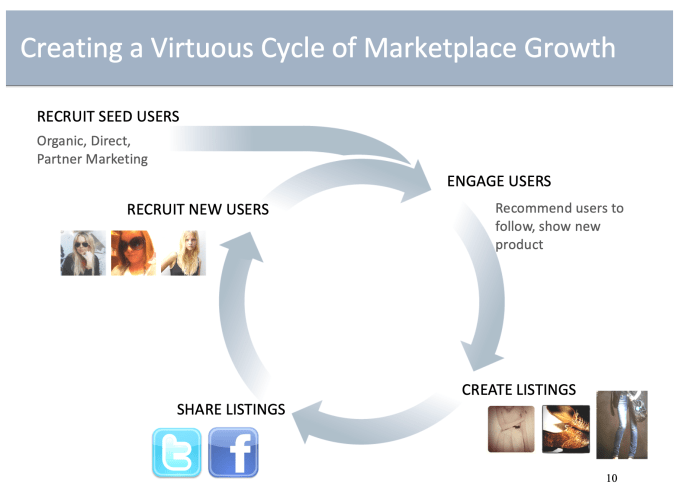

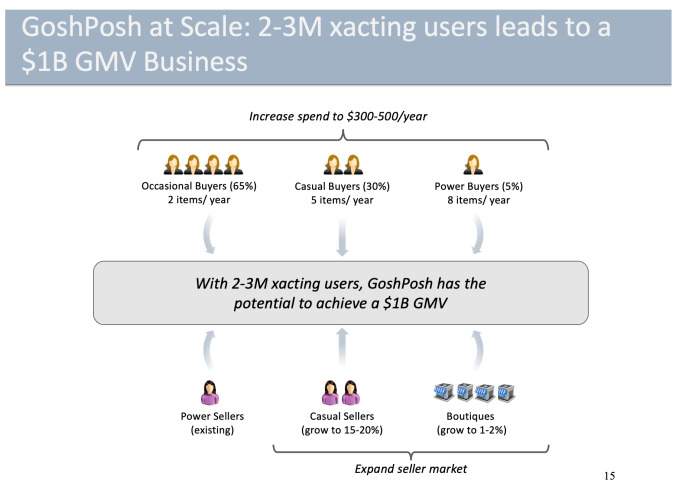

Which brings us to one of the most potent slides of the deck.

Image Credits: Poshmark

It follows the press release model made popular by Amazon, where you start with the end result and build your way backward.

If the mix of power buyers, casual buyers and occasional buyers stayed the same, the company would need 2 million to 3 million users to achieve $1 billion in GMV.

“I think this is something a lot of entrepreneurs could benefit from, and it’s very useful for the investors to see that you’re building a big company [and] have a big vision,” said Chandra. “At scale, how does that vision come together? What is needed? And if you look at it, it’s kind of mathematical, what we did here. I highly, highly encourage entrepreneurs to think about how you paint a vivid picture on how this becomes whatever the big number is.”

Both Chandra and Chaddha attribute much of Poshmark’s success to a culture that is obsessed with the user.

“I remember Manish getting up at 6:00 a.m. and staying up until midnight during those first years, really trying to understand the questions the community was asking and answer them,” said Chaddha. “When the CEO sets that culture of customer obsession and customer delight, it sets the foundation for the future. In reality, that’s what entrepreneurs have to do. They have to give white glove service to the first 100 or 1,000 or 10,000 users because to build a tall building, 100 floors up, it will topple without a strong foundation.”

He added that customer obsession doesn’t end after the 10,000 user mark. It must be rinse and repeat.

Poshmark Series A Deck by Jordan Crook on Scribd

Pitch Deck Teardown

Time stamp — 42:00

- Bookend your deck with a strong mission statement and a plan of action, respectively.

What I like to see early on, if you go back to the beginning of the deck, is a very strong mission statement after the title slide. What is the company all about? To attract a VC in the first 30 seconds, I need to know that this is going to become the DuPont for planetary health or something like that. I highly recommend entrepreneurs have a summary at the end on why we should invest. Whether it’s massive market, proven technology, defensible IP or traction.

- Don’t get caught up in five-year projections. Focus on what you’ve accomplished with what you have, and use that credibility to back up what you plan to achieve with the funding.

I never look at the five-year plan. I just want to know with the money you’re raising, what will you accomplish? If you had a seed round, what did you do with that money? And also, please tell me, what did you tell the board? And, of that what did you actually do and what were your learnings? At a Series A company, you don’t know what you’re going to do in five years. You don’t even know what you’re going to do in six months. A lot of VCs can’t focus on five-year financials. I try not to look at financials, but rather the milestones. What product would you do? What hiring would you do? What customer adoption would you get? What would be your customer success metrics?

You can check out the full episode below and any other episode, for that matter, right here.