Last week, we discussed the possibility that Dell could be exploring a sale of VMware as a way to deal with its hefty debt load, a weight that continues to linger since its $67 billion acquisition of EMC in 2016. VMware was the most valuable asset in the EMC family of companies, and it remains central to Dell’s hybrid cloud strategy today.

As CNBC pointed out last week, VMware is a far more valuable company than Dell itself, with a market cap of almost $62 billion. Dell, on the other hand, has a market cap of around $39 billion.

How is Dell, which owns 81% of VMware, worth less than the company it controls? We believe it’s related to that debt, and if we’re right, Dell could unlock lots of its own value by reducing its indebtedness. In that light, the sale, partial or otherwise, of VMware starts to look like a no-brainer from a financial perspective.

At the end of its most recent quarter, Dell had $8.4 billion in short-term debt and long-term debts totaling $48.4 billion. That’s a lot, but Dell has the ability to pay down a significant portion of that by leveraging the value locked inside its stake in VMware.

Yes, but …

Nothing is ever as simple as it seems. As Holger Mueller from Constellation Research pointed out in our article last week, VMware is the one piece of the Dell family that is really continuing to innovate. Meanwhile, Dell and EMC are stuck in hardware hell at a time when companies are moving faster than ever expected to the cloud due to the pandemic.

Dell is essentially being handicapped by a core business that involves selling computers, storage and the like to in-house data centers. While it’s also looking to modernize that approach by trying to be the hybrid link between on-premise and the cloud, the economy is also working against it. The pandemic has made the difficult prospect of large enterprise selling even more challenging without large conferences, golf outings and business lunches to grease the skids of commerce.

While the economy will always rise and fall, Dell’s debt load likely weighs more heavily on it in difficult financial times, limiting its ability to achieve the levels of profitability it might otherwise find within its grasp.

But keep in mind that whatever Dell decides, we probably won’t see any action on this front until at least September 2021 because the company will enjoy favorable tax implications by waiting until then.

For now, we can speculate. Under that banner, our take is that selling at least a chunk of VMware to unburden Dell would make a lot of sense for the parent company financially and solve a lot of its financial problems.

The EMC federation

This many years after the acquisition, it might be helpful to explain how EMC once worked. While at its core EMC was always a storage business, it bought a variety of tangential businesses over the years, like enterprise content management vendor Documentum in 2003 for $1.7 billion. It also bought VMware in the same year for what now feels like a bargain price of $635 million.

The EMC family ran like a federation of companies, some of which, like VMware, operated entirely distinctly from the main company, with separate shares of stock and independent operations. While all of the companies in the federation had common goals, some could make decisions — such as acquisitions — independently of the mother ship.

Since Dell bought EMC, the structure of that federation has pretty much remained intact. In the case of VMware, Michael Dell recognized he had snagged a gem and that letting it operate independently was the way to go. Customers are satisfied: The company has continued to grow and innovate over the years becoming even more valuable in market cap terms than Dell itself.

The point of walking through all of that is to explain that a VMware free of Dell is just fine, and that Dell won’t dry up and blow away without VMware (although it won’t be nearly as valuable). With that in mind, let’s talk about a value exchange.

Another day older, another day deeper in debt

Dell is a complex company to parse, given its history of going public, going private, buying EMC and later going public again. We’ll try to keep things simple. What we want to know is how much debt does Dell have, how fast is it paying it down, and what might an acceleration of that payback look like and accomplish?

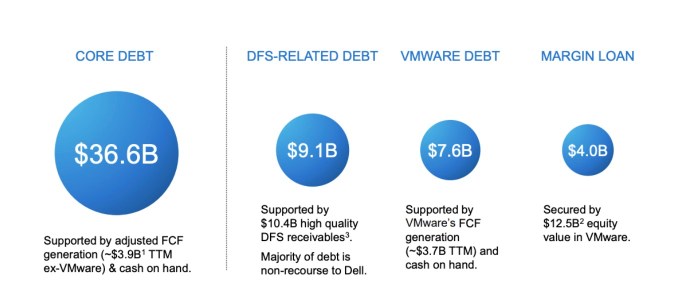

To get started, let’s understand Dell’s current debt. We looked at the slide deck from its most recent earnings. Here’s a key chart outlining the company’s debt:

Image Credits: Dell

Let’s start with “core debt,” which Dell defines as ”the total amount of our debt, less: (a) unrestricted subsidiary debt, (b) DFS related debt and (c) other debt.” That’s a lot. To translate, core debt is Dell’s total debt load minus debts that are attached to its subsidiaries, its financial arm (DFS — Dell Financial Services) and other, special debts.

Next to core debt we see debt related to Dell Financial Services, which as the chart notes is not really a Dell problem (nonrecourse means no problem!). To the right there’s VMware’s debts and a margin loan of $4 billion, which matures in 2022 (page 31).

Dell’s so-called “core debt” has a short-term reduction plan. Dell said in its most recent earnings materials that its “intent is to reduce core debt by approximately $5.5 billion in FY21 dependent on macro and related business performance.” That works out to 15% of its current debt load, for reference, though only if its business performance holds up.

Cool. Dell is set to reduce its core debt, assuming conditions are right, and we know that its margin loan matures in a few years. So there’s some good momentum to Dell’s debt reduction given its current plans and some known maturity periods. This downward glide of paying off its current debts likely pleases the company’s investors, as they likely don’t want the company to have more debt than market cap forever. (Help, we’re upside down!)

But Dell is still out there borrowing, so the reduction picture isn’t entirely clear from our vantage point. The company continues to add new debts to its accounts, including $2.25 billion in early April of this year, to pick one example.

Dell’s debts are complex and the company has plans to reduce its main bucket of arrears, and has plans to pay down parts of its liabilities, but it has also been borrowing more at the same time and that could be problematic.

Debt is expensive

Dell’s debts are not uniform, meaning that they don’t just have a single date at which they mature, or a single cost profile. For example (page 28), Dell has one $2 billion debt due in 2046 that currently pays out 8.35%. Oof. That’s a high cost of capital at a time in which money is historically inexpensive thanks to current central banking interest rate setting policy.

Dell is also paying 8.10% on $1.5 billion in debt that won’t come due until 2036, and a hair over 6% on $4.5 billion that is due in 2026. The list goes on and on. It’s not a great sight.

We all know that corporations are not people and that they don’t operate like households. This is not like a family with a maxed out credit card. But Dell’s continued borrowing, its huge list of short- and long-term debts, and its high debt servicing costs point to a company that could dig itself out if it wanted given its unique asset base.

What impact might that have?

Less debt, more profit

Dell spent $672 million in the quarter ending May 1, 2020 on interest expenses (page 73). That was down from $699 million in the preceding three months. Those figures were worth around 96% and 127% of its operating income in the two periods respectively. In short, the company’s interest costs are eating the hell out of its ability to generate GAAP profit. That sucks!

How might selling some VMware stock help with that situation?

Imagine a world in which Dell sells $20 billion of its VMware stake, or about 40% of it at today’s prices. Dell would still own 41% of VMware, but with that $20 billion it could wipe out its short-term debts and a number of its most expensive long-term notes.

If the company was able to pay off its higher cost debts first, it might be able lower its interest costs sharply, freeing up its operating profit. That strategy could unlock lots of GAAP (an accounting term meaning inclusive of all costs) profitability, making its shares appear cheap on an earnings-multiple basis. That could cause them to rise in value, making Dell itself worth more.

Lower leverage, greater profits? Sure, Dell would own less VMware, but it could become a healthier operating company in the process, instead of a debt-laden operating company with value tied to some of its holdings — and it would still have the advantage of having VMware in the fold, even if it owned much less of the company stock.

If we were betting folk, we’d reckon that Dell carves off a piece of its VMware shares to cover some of its debts next year. The question then becomes: How much and can VMware appreciate in value before then?