While we await a fresh IPO filing from heavily backed insurtech startup Lemonade, let’s talk a little more about its public offering.

Since our first dig into its S-1 filing, TechCrunch has spoken to a number of investors and operators in Lemonade’s space to find out if our initial read was off — were we being too generous or too kind to Lemonade after reading its somewhat complex financial results?

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

The short answer is not really, though there are some positive notes and themes worth highlighting. This morning, let’s ask three questions about Lemonade’s IPO filing that will help us understand what’s ahead for the SoftBank-backed unicorn.

Three questions

Three questions

1. How quickly can Lemonade accelerate its rental insurance graduation rate?

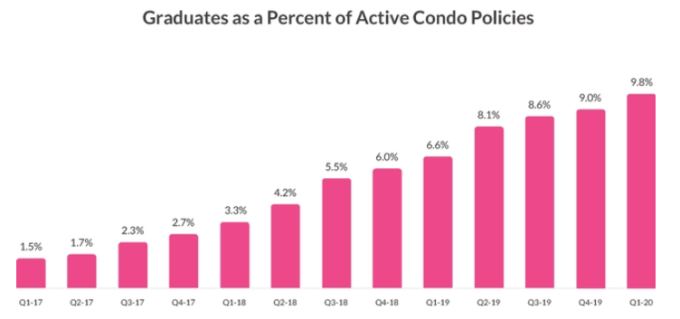

On the theme of things that bode well for Lemonade is its ability to “graduate” customers from low-cost rental insurance to more lucrative products.

In its S-1 filing, Lemonade noted this fact early on. After stating that a “an entry-level $60 a year [rental] policy [corresponds] to $10,000 of possessions,” the company said that as its customers age, they tend to buy more insurance and sometimes swap rental plans for homeowner policies. Moving from the former to the latter is graduating in the company’s parlance.

If many customers moved from rental insurance to homeowner insurance while keeping Lemonade as their provider, the company could do very well, as illustrated by this section of its SEC filing:

We believe graduation improves unit economics dramatically, as premiums jump several fold with virtually no incremental cost to acquire the additional premiums. The average renter pays us nearly $150 per year, and that jumps to around $900 for owners of homes and condos.

The value of a customer paying $900 instead of $150 — provided that margins stay put — is hugely different. This is why Lemonade made noise about the number of its policies that have already graduated:

Further demonstration of this progression is found in a phenomenon we call “graduation,” which is when a customer upgrades their policy from a Lemonade renters policy to a Lemonade condo or homeowner policy. As of March 31, 2020, we had 12,445 customers of condo insurance policies, 10% of whom had graduated with us from a renters policy, a percentage that has grown steadily over the life of the company.

That paragraph was right next to the this chart:

Image Credits: Lemonade via S-1 filing

At that graduation rate, surely Lemonade’s revenue is set to skyrocket, right? Perhaps not.

Note that the company said that premiums for owners of “homes and condos” are around $900. But that chart is just for condo owners, so we’re not seeing the company’s full rental to homeowner graduation rate. Instead, this is the subset of condo plans the company has sold that are graduations from rental insurance. Given the exclusion of noncondo homes from that chart, we can presume the full dataset is less attractive.

Let’s return to our question: “How quickly can Lemonade accelerate its rental insurance graduation rate?” If the company can boost this metric broadly, its economics could improve over time. But the way its S-1 is written makes it hard to tell how its full graduation rate is performing.

And, 10% of 12,445 condos is what, 1,245 plans? Lemonade had 729,325 customers at the end of Q1 2020. That means less than 0.2% of its total plans were rental-to-condo graduations in late March. The result feels pretty modest in that context.

2. How much more can Lemonade juice its loss ratios?

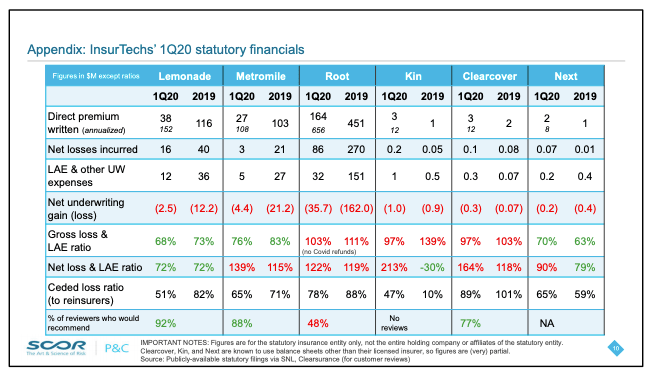

A very plain reading of the Lemonade S-1 filing shows a company with a cost structure firmly out of whack with its ability to generate gross profit. Improved loss ratios and lower loss adjustment expenses as a percent of revenue could dramatically improve the company’s financial health in this context.

But in fairness to the company, things could be worse. Parsing some presentations on Lemonade and its cohort has made it plain that Lemonade is not the worst when it comes to insurance losses. Adrian Jones, deputy CEO of P&C Partners — a self-described “global technical and expertise center” that works with underwriters — posted the following chart to LinkedIn detailing loss ratios at various insurtech players in Q1 2020 (TechCrunch was also sent this deck, but wanted to make sure you could read it as well):

Note: I’m not endorsing every number in this; but what it does show is that Lemonade is hardly in poor shape compared to some rivals and cognates. Image Credits: Adrian Jones

While Lemonade’s numbers are not tremendous, this unicorn is in better shape than most of its detailed brethren.

Still, the company’s loss ratios don’t leave it with much gross margin, making it hard for it to scale revenue without burning huge amounts of cash. How much more it can juice from its current loss ratios depends on your level of optimism regarding the firm’s flywheel, namely this:

Is it an S-1 if it doesn’t feature bullshit iconography? Image Credits: Lemonade via S-1 filing

If Lemonade’s Q2 numbers can show more gross loss ratio and net loss ratio improvements, it may be easier to woo public shareholders. If its Q2 loss numbers are flat or worse when it comes to its loss ratios, the company likely faces a steep path.

3. Is this company really trying to go public?

Finally, I’m not entirely convinced that Lemonade is trying to go public. The company’s model has enough question marks present that Lemonade almost feels too nascent a company to go public. Another year’s operating data, something the firm can afford with its current cash balance, would help illustrate its promise, potential or lack thereof.

By showing off its filing now, Lemonade is more bragging about its ability to acquire new customers at the start of its life-long insurance march (371,571 at the end of Q1 2019 to 729,325 at the end of Q1 2020). That’s something that a big player might find appealing.

Dual-tracking is no sin, mind.

Undergirding this concept is the fact that Lemonade’s valuation could prove hard to defend in 2020 IPO. As a recent post by Thomvest’s Nima Wedlake shows, at various in-market multiples the firm is heading for a lower valuation if it goes public. One way around that is by selling quickly to an interested single-party, perhaps when demand appears hot.

Closing, these are the three questions that have most been stuck in my head lately, concerning Lemonade’s IPO: How fast can it boost its future-favoring graduation rate, how quickly can it bolster its loss ratios (and thus profitability) and is the company utterly committed to going public alone?

More when we get another S-1/A.