The domestic stock market is advancing today on the back of some better-than-anticipated economic recovery data in the United States. While retail spending is still lower compared to the year-ago period, gains in May from April were better than anticipated.

The American stock market, ready to trade higher on any scrap of good news — even news predicated on economic weakness and the need for continued intervention — shot north, with the tech-heavy Nasdaq Composite index rising 2.3% to 9,947.5 and the SaaS-focused BVP Nasdaq Emerging Cloud Index (EMCLOUD) rising 1.6% to 1,719.2.

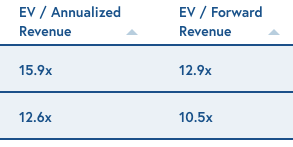

From Bessemer, a venture capital firm that invests in cloud startups, here’s some data on today’s SaaS market:

- Median enterprise value/annualized revenue multiple for public SaaS/cloud companies: 12.6x

- Median forward enterprise value/annualized revenue multiple for public SaaS/cloud companies: 10.5x

- Median “efficiency” (revenue growth plus FCF Margin): 37.8%

- Median revenue growth: 31%

- Media gross margin: 73.6%

We’re marking this moment in time, just days after the Nasdaq Composite index crossed the 10,000 point mark, as it’s a useful yardstick for us to use in the future. Today, the above median results were enough to push EMCLOUD back to within a fraction of a point of its all-time highs.

What surprised me in this data is that the resulting revenue multiples haven’t gone completely bonkers; I expected more extreme figures going into preparing this post.

In fairness, by looking at median results instead of average results, we’re skewing the multiples a bit. Here’s the same data, with average results on top and the previously mentioned medians down below:

Image Credits: BVP

So if we observe a present-day annualized, average metric we can see 50% higher multiples at the max than what we see on the other extreme, a 10.5x EV multiple using forward revenue figures. (Forward multiples are lower as they take into account coming growth; annualized metrics provide a clearer look at how companies are valued against recent results, not future expectations.)

These are historically elevated numbers, mind, when compared to prior norms, but not as stretched as I anticipated. Indeed, going back through my notes on EMCLOUD data over the past few years (here, here and here, to pick three examples) it’s notable how often multiples of 10x or little higher come up.

The gap between average and median results, though, did feel large. What’s driving the average results? Some huge outliers, including:

- Three companies with forward enterprise value revenue multiples over 30x (Shopify, Zoom, Datadog)

- And six more that are over 20x, but under 30x (Coupa, Okta, Zscaler, CrowdStrike, Atlassian and Veeva)

So while SaaS multiples on a median basis don’t seem odd, on an average basis the biggest category winners are distorting the picture. All this means is that a good number of SaaS and cloud companies have captivated investors. For now, at least.

The giants’ pace

There’s one more thing to mention: If we parse the same BVP cloud index data by market cap cohort, something curious comes out of it. The larger a constituent company is by market cap, the faster it is growing, it turns out, and the higher a revenue multiple it enjoys on both a median and average basis.

Bessemer bounds the index into three buckets for sorting: Companies worth $1 billion and up, $5 billion and up, and $10 billion and up. Here’s the data for the three groups (excising the firm’s worth less than $1 billion), looking just at growth for each:

- $1 billion market cap and up median growth rate: 31.1%

- $5 billion market cap and up median growth rate: 33.1%

- $10 billion market cap and up median growth rate: 38.8%

Naturally there is a correlation between corporate value and growth rates; growth is valuable, after all. But to see such a delta between lower-cap SaaS stock and companies worth so much more was a surprise. Usually as companies get bigger, and thus more valuable, growth in percentage terms slows. Not in this case, which likely goes to show that the growth premium for SaaS is still sharply in play for public market investors.

This could impact late-stage SaaS valuations for cloud companies looking to go public in the next quarter or two. Perhaps that’s why some VCs are expecting to see a wave of SaaS IPOs this summer: