Startups hit the brakes in March as COVID-19 took a toll on the global economy. As certain industries ground to a halt, cohorts of startups made staffing cuts, including those focused on serving restaurants and travel.

The waves of startup layoffs in the COVID-19 era hit companies large and small, impacting even the richest, most recently funded companies. It was a swift correction to staffing in an industry that had enjoyed a decade-long bull market and record private financing totals. Looking back, the pivot to fear appears brisk.

The market for startup talent has since improved, to a degree.

This morning, we’ll look at the pace and scale of startup layoffs, leaning on data provided to TechCrunch by Layoffs.fyi. We’ll also rope in information from a global startup survey executed by Paris’s Station F to better parse where the impacts have been starkest.

An improving picture

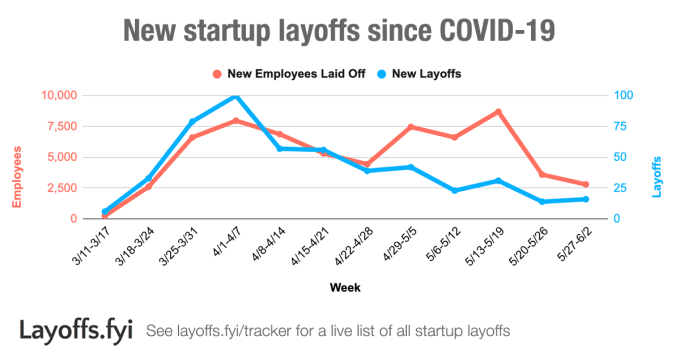

According to data from Layoffs.fyi, which tracks job cuts in the startup industry, the number of people laid off stayed aloft from March to April and into the first weeks of May. In contrast, the total number of companies cutting staff declined from early April through the end of May; fewer companies cut staff as time went along, then, but it appears that they made larger cuts.

Here’s the chart:

This chart includes global, confirmed layoffs via the Layoffs.fyi dataset; there are numerous other unconfirmed layoffs that, if counted, would add to chart’s magnitude. Shared with permission.

Bringing that data slightly more up to date, it appears that layoffs tracked by the company are slow into the first week of June. Of course, the news has had a slightly different focus of late — too late a refocusing, clearly — but that fact is likely slowing the release and leaking of new layoff information.

Regardless, let’s tackle the good news: As May turned to June, both the number of companies laying off staff and the number of workers cut fell to new lows since the start of the pandemic. This means startups are shedding the least staff since tracking started by this dataset.

This does not mean that the talent wars are back … yet, at least. But it likely indicates that startups are not seeing revenue declines so substantial that more cuts were needed.

Where the cuts landed

Station F, a Paris-area incubator, workspace and office for related entities like investors, surveyed 956 startups in mid-May with the help of a reported 120 venture capital funds. The data is a useful prism through which we can peer into where startup layoffs landed the hardest.

Parsing the survey, what stood out the most this morning was its data on which startup stage was most likely to cut staff. Here’s the data:

- Global: 17% of startups cut staff, per the survey

- Pre-Seed: 8%

- Seed: 15%

- Series A: 24%

- Seres B: 34%

- Series C: 17%

Thinking out loud, I’d have expected more layoffs at seed-stage startups, but having sat with these numbers a minute they make some sense. Pre-seed companies have no revenue, so market declines can’t be that upsetting to their financial modeling. Seed-stage startups have very little revenue, so it’s a similar situation.

Moving up the stack, seeing a bump in cuts at Series A makes sense, given how startups staff up at that stage. Series B is when many startups often move to a heavier go-to-market focus (some notes here, and here for more), so if revenue opportunities were drying up, perhaps startups at this stage would be the most heavily impacted as they were likely scaling up their revenue-hunting muscles?

There’s some evidence for our read later in the data, as Station F notes that sales staff and marketing staff were the hardest hit in the layoffs. Finance, senior management and HR were on the other end of the spectrum.

Circling back to the time-series layoff data, it appears that the worst is behind the startup market, at least for now. The United States is seeing rising COVID-19 cases in parts of the country that could sustain the pandemic for months or quarters. And trade tensions, geopolitical issues, debt concerns and still more uncertainties lurk. Some major economies, like the domestic market here, are in recession.

Still, with layoffs falling to pandemic lows, perhaps a smidgen of optimism is acceptable.