Amidst the blitz of SoftBank earnings news today comes the financials for all of SoftBank’s subsidiaries, which includes Arm Holdings, the most important chip design and research company in the world that SoftBank bought for $32 billion back in 2016. Arm produces almost all of the key designs for the chips that run today’s smartphones, including Apple’s A13 Bionic chip that powers its flagship iPhone. In all, 22.8 billion chips were shipped globally last year using Arm licenses according to SoftBank’s financials.

It’s a massively important company, and its finances show a complicated picture for itself — and the semiconductor industry at large.

We sat down with Arm Holding’s CEO Simon Segars last year to discuss the company’s growing appetite for ambitious research, fueled by SoftBank dollars and the bullish vision of the conglomerate’s chairman Masayoshi Son:

Rather than being pegged to its stock price or a quick return to a PE shop, Arm is now seemingly evaluated on growth in its intellectual property and strategy for capturing new markets. “I’m in a very fortunate position where, despite the slowing of the smartphone market … I’ve got an owner that says, invest, you know, invest like crazy to make sure you capture these waves of growth in the future, which is what we’re doing,” Segars explained to TechCrunch.

The company could have just doubled down on its existing product lines, but SoftBank’s ownership has opened the floodgates to explore other areas that could use Arm expertise. The company is now focused (if one can focus on many things) on everything from 5G and networking to IoT and autonomous driving. “We look to be in the right place at the right time with the right technology to catch the upswing into the future,“ Segars said.

We headlined that story as “Arm shows SoftBank does tech PE the right way,” so I was curious to see how the company and its owner have held together in the year since we last got a public overview of its financials.

First, the good(ish) news. One of Son’s major goals with the Arm acquisition was to push the company heavier into software and services as a complement to its existing chip design business, which relies on royalties and licenses. That strategy included the acquisition of Treasure Data, which Arm purchased in mid-2018 to bolster this segment.

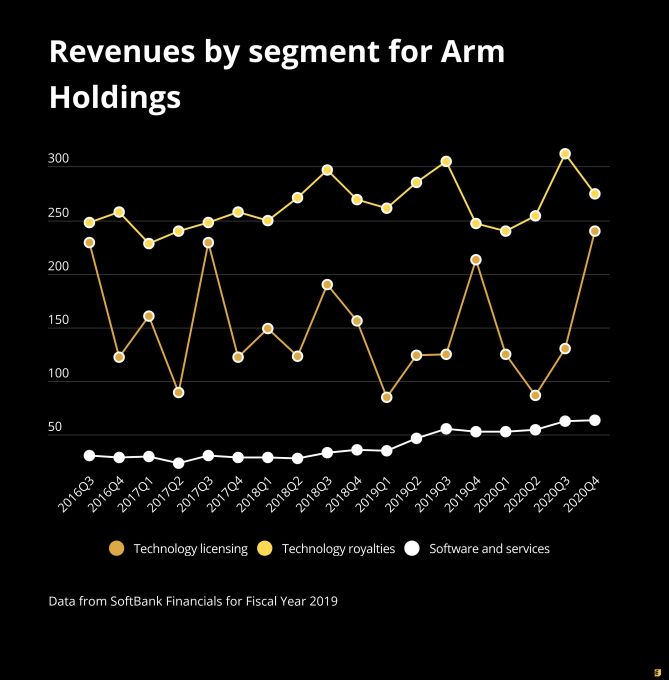

As the graph below shows, Arm has managed to double its software revenue over the past few years, even while the remainder of its business remains mostly flat. That has helped to tilt the company’s revenue mix more toward software and away from licensing, with software now representing about 12-13% of revenues, up from around 6-7% at acquisition in 2016. Even more positively, software revenues hit a new record last quarter of $64 million.

That’s not a great story, but at least it shows some progress against the company’s goals.

The challenges arrive with the main segments of the business though: licenses and royalties.

Arm breaks its processor families into five buckets now. There is Classic, which is its older designs. It has three contemporary designs, which it cleverly labels as Cortex-A (for Applications), Cortex-R (for Real-time and safety devices), Cortex-M (for Microcontrollers) and then there is Mali, its GPU technology.

In a notable first, SoftBank did not disclose the breakdown of royalty sales by processor family, which it has disclosed every year in its financials since its takeover of Arm back in 2016. Instead, the company has opted to only release high-level numbers of royalty units, which grew 11.1% in the last fiscal year.

In its last set of statements, 61% of royalty units were for microcontrollers, 9% for real-time, 20% for applications, and 10% for classic. Over the past four years, the big change has been that its classic family of processors has dropped by half in terms of royalty units, while microcontrollers have mostly made up the difference.

That’s a big deal, since different chip architectures have vastly different revenue values, and therefore the underlying mix of processors and their trendlines are important for understanding Arm’s strategy and its financial future. The fact that SoftBank no longer wishes to disclose those figures is in itself a strong signal.

Beyond that detail though, Arm’s next moves here are hard to scry from its financial figures, as the numbers have been almost entirely flat for years (technology licensing is more cyclical though, which is typical in semiconductor sales due to seasonality).

Now, this is where things get dicey. As I described earlier, SoftBank has wanted to give Arm some breathing room and has invested heavily into its new product lines, particularly in areas like automotive, AI, IoT, and other frontier areas where Arm could get market dominance in fast-growing segments. Arm has pushed up expenses and killed EBITDA the past four years all while hiring hundreds of people per year (this past fiscal year, the company added 751 people — a 12% increase).

That ambitious mission is increasingly tenuous, given the state of SoftBank’s financials, which have been slammed from losses at the Vision Fund driven by WeWork and a general malaise across a number of the company’s other segments. SoftBank once had more financial flexibility to offer longer ropes to its companies; that flexibility today is increasingly hard to find.

In summarizing Arm’s performance, SoftBank writes that it’s the “Start of season to harvest returns from increasing R&D capacity.” Or in more direct language: all that investment needs to come back to the bottom line here soon.

There has been some good news for Arm in recent months. One important story is that there are rumors that Apple is looking to use Arm’s chip designs for its desktops going forward, which, if true, would be a boon for Arm and a loss for Intel. In the company’s growth markets like automotive and servers though, its success remains nebulous.

Nothing in any of the financials or the investor presentation indicate that Arm is poised for immediate growth. Licensing deals remain relatively stagnant, its revenues remain flat to negative, and there is ferocious competition in its new markets, which Arm hasn’t experienced for years in the smartphone segment it currently dominates.

Flat isn’t half bad, considering that semiconductors as a whole have had to weather a number of macro shocks, including waning interest in smartphone upgrades, the trade war between the United States and China and COVID-19. Yet, flat isn’t the path to return capital to investors.

SoftBank is carrying Arm at $25 billion in value today for the 75% stake it directly owns (it sold 25% of its stake to the Vision Fund itself in 2017), compared to its purchase price of $32 billion back four years ago. There is still time to drive the value up and turn a steady profit — but the window of opportunity seems to be tightening, even as SoftBank pushes the company to ramp up revenues and get it back to the profitability the chip company was once renowned for.

The question on our minds is simple: if SoftBank is trying to extract some value out of its assets by selling its stakes, how long can Arm last at the conglomerate before it is spun out or sold? Is there a buyer for Arm at a reasonable price? Might SoftBank consider a marriage with a rival or a complementary chip company to build a stake in a different growth target? As semiconductor companies head into tougher times ahead, that looming cloud above Arm is going to radiate to all sides of the industry.

Update May 19, 2020: Changed the language around SoftBank’s stake in Arm in the penultimate paragraph. SoftBank owns 100% of Arm, with 75% of it held directly by SoftBank Group, and 25% of the stake owned by the SoftBank Vision Fund. That changed the meaning of the $25 billion valuation SoftBank holds the company in its financials (it values the company at a bit more than $33B overall). The text has been updated to reflect this information.