Visa has prioritized growth in Africa, and partnering with startups is central to its strategy.

This became obvious in 2019 after the global financial services giant entered a series of collaborations on the continent, but Visa confirmed it in their 2020 Investor Day presentation.

On the company’s annual call, participants mentioned Africa 28 times and featured African startups prominently in the accompanying deck. Visa’s president for Central and Eastern Europe, Middle East and Africa (CEMEA), Andrew Torre, detailed the region’s payments potential and his company’s plans to tap it. “We’re partnering with non-conventional players to realize this potential — fintechs, neobanks and digital wallets — to reach the one billion consumer opportunity,” he said.

Africa strategy and team

TechCrunch has covered a number of Visa’s Africa collaborations and spoke to two execs driving the company’s engagement with startups from Nigeria to South Africa.

Visa’s head of Strategic Partnerships, Fintech and Ventures for Africa, Otto Williams, has been out front, traveling the continent and engaging fintech founders.

Located in Cape Town, Visa’s group general manager for Sub-Saharan Africa, Aida Diarra, oversees the company’s operations in 48 countries. The company has a long track record working with the region’s large banking entities, but that’s shifted to smaller ventures.

Image Credits: Visa

”We’re all meeting startups in the region because we understand they are key players and key partners,” Diarra told TechCrunch on a call.

Fintech’s potential for growth and revenue generation in Africa actually stems from shortcomings of large financial institutions when it comes to reaching the continent’s 1.2 billion people. By several estimates, Africa is home to the largest share of the world’s unbanked population and has a sizable number of underbanked consumers and small businesses.

The last Global Findex report estimated that roughly 20% of the two billion people globally who lack bank accounts reside in Sub-Saharan Africa.

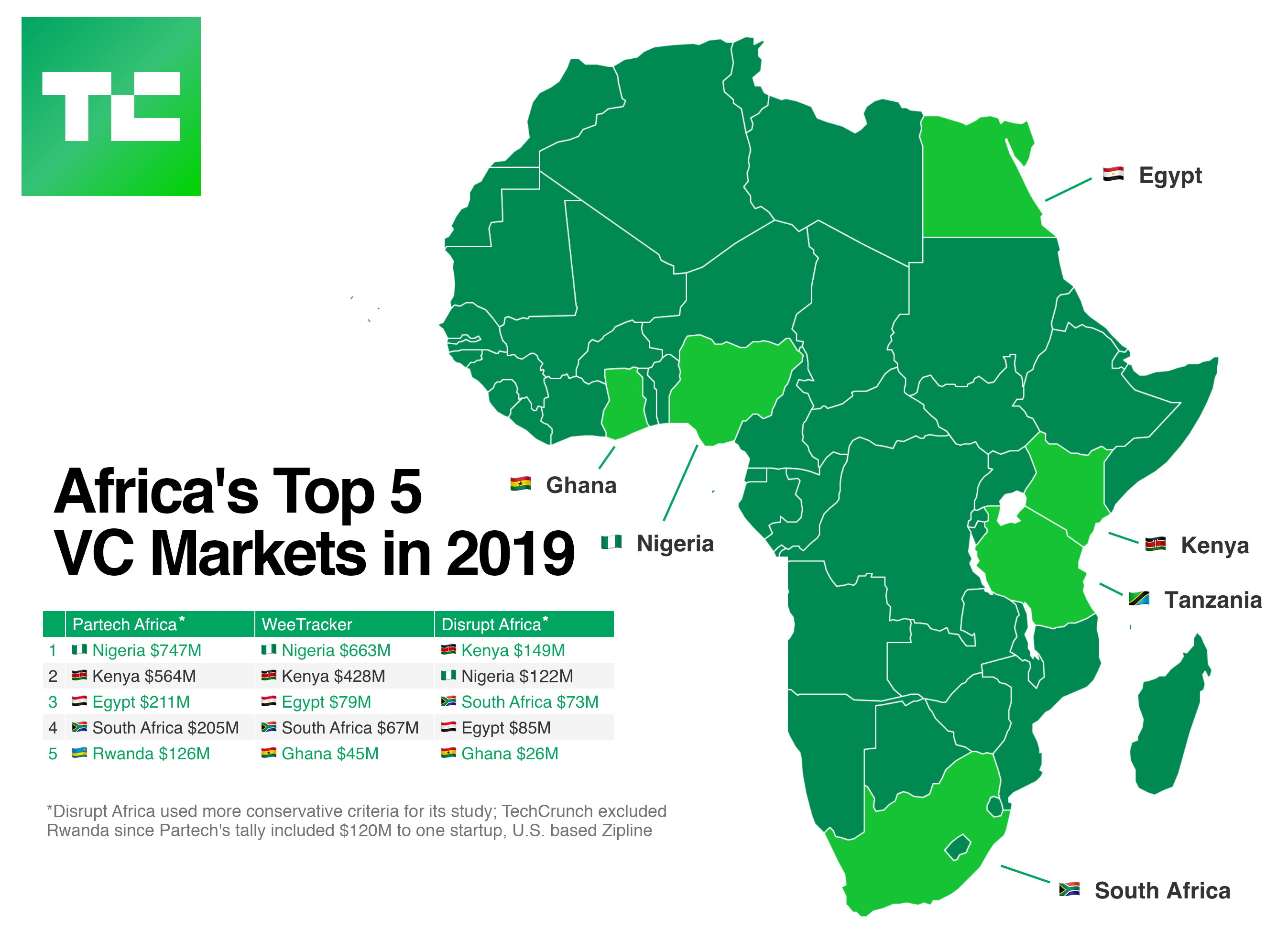

But because of that, fintech — and startups focused on financial inclusion — now receive the majority of VC funding annually in Africa, in major population and tech hubs such as Nigeria, South Africa and Kenya.

Fintech products around mobile-money in particular have become an effective means to leapfrog brick-and-mortar banking and connect consumers directly with financial services. In Kenya, Safaricom’s M-Pesa payments product has 32 million subscribers, or roughly 60% of the country’s population, using the phone-based-app to pay bills or transfer money to friends and family.

Fintech startups are a fast-track to scaling payment volume, fees and revenue in Africa, and Visa’s Williams and Diarra summarized the company’s objectives.

“We want to digitize cash, that’s a strategic priority for us. We want to expand merchant access to payment acceptance and we want to drive financial inclusion,” Williams told TechCrunch recently.

“We’ll continue to work with traditional banks and financial institutions, but we need to recognize that fintechs have played a significant role in driving financial inclusion [in Africa],” Diarra said. “They have the ability to reach more consumers and clients and that’s something we definitely see and embrace,” she added.

Partnership startups

To drive acceptance, Visa has partnered with Yoco, a venture that develops and sells digital payment hardware and services for small businesses. The Series B startup raised $16 million in 2018 that it has used to grow a network of 80,000 clients and process roughly $500 million annually.

Image Credits: Jake Bright

Yoco’s point-of-sales devices process a portion of that volume over Visa’s network, according to the startup’s founder, Katlego Maphai.

Another key startup partner for Visa is Flutterwave. The San Francisco and Lagos-based fintech company has built its business providing B2B payments services for companies operating in Africa to pay other companies on the continent and abroad.

Launched in 2016, Flutterwave allows clients to tap its APIs and work with developers to customize payments applications. Existing customers include Uber, Booking.com and e-commerce company Jumia.

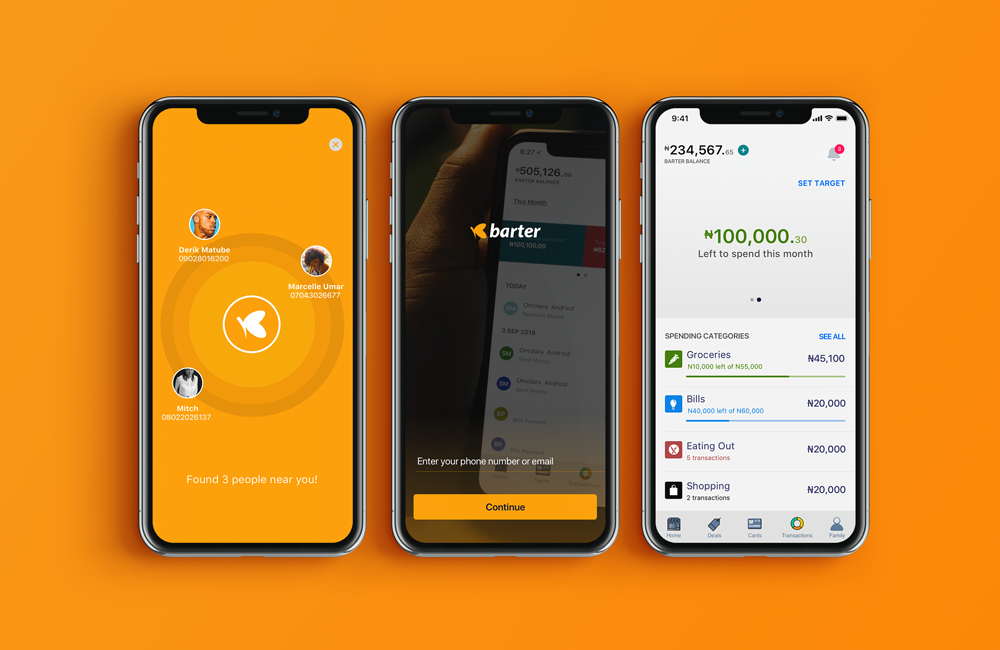

Image Credits: Flutterwave

In 2019, Flutterwave processed 107 million transactions worth $5.4 billion, according to company data. Last year, Flutterwave partnered with Visa to pivot toward more P2P and small business transactions, announcing a new consumer payment product for Africa, called GetBarter.

The app-based offering is aimed at personal and small merchant payments within and across African countries. Existing Visa cardholders can send and receive funds at home or internationally on GetBarter.

In addition to Flutterwave, Nigeria-based fintech ventures lead Visa’s startup collaborations — largely because of the West African country’s emerging status as the continent’s unofficial tech capital.

“Nigeria is the largest economy and most populous country in Africa. Its fintech industry is one of the most advanced in Africa, up there with Kenya and South Africa,” Chipper Cash CEO Ham Serunjogi told TechCrunch in 2019, regarding his payment venture’s expansion there.

“I think for any company doing fintech across borders that is looking to be successful in Africa, it’s imperative that you have a presence in Nigeria,” Serunjogi added.

Visa partnered with Chipper Cash in 2020 to offer virtual Visa cards across its network, including Nigeria. It also works with PalmPay, a Lagos-based mobile-payment startup backed by $40 million in Chinese VC, and Paga, one of Nigeria’s largest payments ventures.

In early March, Visa and Paga announced a collaboration on payments and tech. Founded by Cisco and Stanford Business School alum Tayo Oviosu, Paga has created a multi-channel network more than 14 million customers in Nigeria use to transfer money, pay bills and buy things digitally.

Visa and Paga look to drive larger payment volumes together and plan to team up to launch QR codes and NFC [payments] in Nigeria, Oviosu told TechCrunch.

Diarra said Visa is also looking to expand startup partnerships in rising African tech markets beyond the big three of South Africa, Nigeria and Kenya, naming Tanzania, Ghana, Cameroon and Ivory Coast in particular. “The objective is to expand the reach [of Visa] to more markets and more people,” she said.

Venture funding in Africa

Visa has also jumped into the venture-funding space in African fintech. In 2019, Nigerian financial services company Interswitch reached a $1 billion valuation and unicorn status after Visa acquired a minority equity stake.

Visa has made additional venture investments in Paystack, Flutterwave and Branch, according to Williams.

Visa’s Otto Williams. Photo Credits: Visa

“We believe these assets help us expand the outcomes we described — merchant access, including more consumers in digital financial services — faster,” he said.

Williams, who has taken a lead on the company’s Africa strategy, noted non-equity collaborations will remain the primary focus — though those could lead to VC down the road. “The commercial and partnership goals are what leads these investments… but we don’t lead with ventures, we lead with partnerships.”

Visa’s focus on partnering with fintech ventures to scale in Africa is an affirmation of how far the continent’s entrepreneur-driven startups have come over the last decade. And Visa isn’t the only major financial services provider investing in or collaborating with these African companies.

A growing list of the masters of the payment universe — Alipay, Worldpay, Mastercard — have shown they need Africa’s startups to reach the masses with financial services on the continent.