Back in 2016, Nutanix decided to take the big step of going public. Part of that process was creating a pitch deck and presenting it during its roadshow, a coming-out party when a company goes on tour prior to its IPO and pitches itself to investors of all stripes.

It’s a huge moment in the life of any company, and after talking to CEO Dheeraj Pandey and CFO Duston Williams, one we better understood. They spoke about how every detail helped define their company and demonstrate its long-term investment value to investors who might not have been entirely familiar with the startup or its technology.

Pandey and Williams reported going through more than 100 versions of the deck before they finished the one they took on the road. Pandey said they had a data room checking every fact, every number — which they then checked yet again.

In a separate Extra Crunch post, we looked at the process of building that deck. Today, we’re looking more closely at the content of the deck itself, especially the numbers Nutanix presented to the world. We want to see what investors did more than three years ago and what’s happened since — did the company live up to its promises?

Plan of attack

The Nutanix roadshow deck is a fascinating document. If you aren’t familiar with “hyperconverged infrastructure,” however, you might feel a bit lost while reading it. Happily, even the least enterprise-focused among us can parse the financial information that the document contains. We can skip the product-y stuff and settle into the numbers.

In that vein, we’ll examine the roadshow presentation from two perspectives. First, what did the company promise? And, second, what has it delivered since?

To fully understand what the company presented to investors in terms of future performance, we’ll start with what the roadshow deck detailed in terms of past performance, and then parse its promised long-term model. From there, we’ll stack up the company’s recent performance against both its past results and goals.

From that point it won’t be hard to grade Nutanix — pull out a pencil, and let’s go.

Results and promises

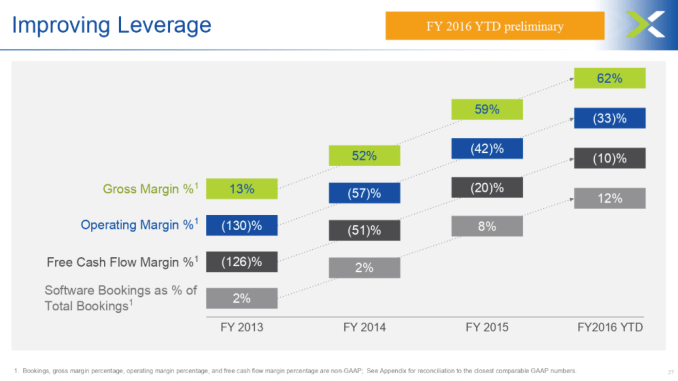

Nutanix highlights growth and improving economics in its roadshow presentation. The company notes, for example, that its gross margins expanded from 13% in its fiscal 2013 to 62% in the then-current portion of its fiscal 2016. Similarly, Nutanix’s operating margin improved from -130% to -33% over the same time period.

The company’s revenue grew from $6.6 million in the 12-month period ending July 3, 2012 to $241.4 million in the same period of 2015. The company also reported $190.5 million in revenue during the six-month period ending January 31, 2016, up from $102.9 million a year prior.

Summarizing, in case that was all a bit much: Nutanix was rapidly adding revenue while improving its revenue quality and operating results as it looked to go public. The data points formed a positive set of directional trends for the enterprise infrastructure provider.

But despite its demonstrated progress toward both profits and larger scale, Nutanix had even higher hopes for itself.

Roadshow decks often include a set of projections called a “long-term model,” representing where the company in question sees its various vital signs settling in the future. The goal is to show investors that contemporaneously weak figures will get better, and that improving metrics have a long period of betterment ahead of them.

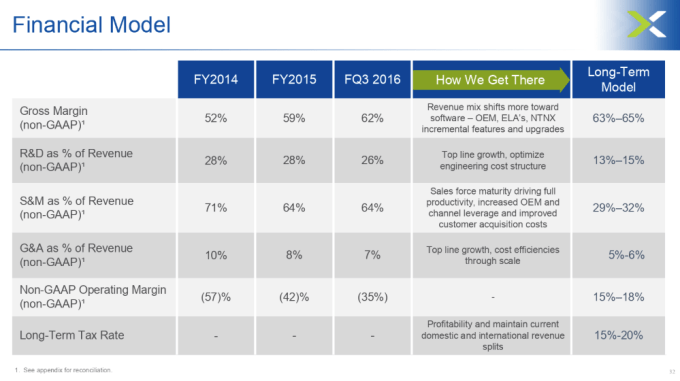

In its long-term model, Nutanix said it expected adjusted gross margins to land between 63% and 65%, adjusted R&D costs to settle between 13% and 15% of revenue, adjusted sales and marketing costs to decline to 29% to 32% of revenue and its adjusted operating margin to reach 15% to 18% of top line.

According to the document, in Nutanix’s last complete quarter before the IPO, the company was close to its adjusted gross margin target (at 62%), but miles away from its adjusted R&D target (then 26% of revenue) and adjusted sales and marketing spend goal (64% of revenue at the time). All that summed to an operating margin at the time of -35%, far from its targeted 15% to 18% of revenue.

In simpler terms, Nutanix was far from where it eventually expected to be. How close has it gotten since?

Recent progress

What constitutes long-term for Nutanix is up to interpretation. It has been 3.33 years since its IPO, however, which means the company has had more than a dozen quarters to make progress. So let’s assess its performance.

Turning to its most recent earnings report (Q1 fiscal 2020, shared in late November 2019), we’ll do our compare and contrast in list format, with the long-term projections in bold, after recent results:

- Adjusted gross margin: 80.1% (63% to 65% target)

- Adjusted R&D spend as percent of revenue: 32.0% (13% to 15% target)

- Adjusted S&M spend as percent of revenue: 83.7% (29% to 32% target)

- Adjusted operating margin: -42.6% (15% to 18% target)

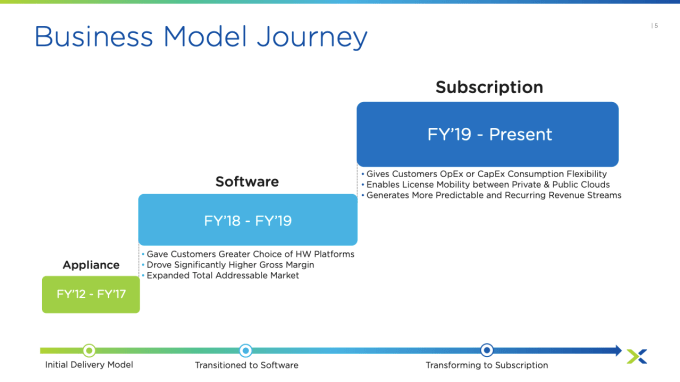

You’ll note that there is one very good number in the mix and then three very bad numbers that follow. There’s a reason for that: Nutanix is in the process of a changeover to selling subscription software, a mutation that takes quite a while. Here’s how the company describes its changeover:

You can see the seeds of the company’s shift from its “initial delivery model” to the software business in its roadshow deck. The company stated at the time that its “Software Bookings as % of Total Bookings” had grown from 2% in its fiscal 2013 to 12% in the midst of its fiscal 2016. It just turned out that the company had one more business model shakeup to get through, namely a switch from software to SaaS.

And that’s why everything is funky in its results when we compare its recent figures to its stated long-term model. The firm noted in its Q1 fiscal 2020 that its revenue growth was modest due to “compression from the company’s ongoing transition to subscription and the significant reduction of hardware revenue from the prior year.”

Given that, it’s hard to truly vet Nutanix today against its old goals. What we can say is that its transition from hardware to software to SaaS has led to dramatically improved gross margins, a good crux from which to lever future profits.

We’ll know a bit more in time how well Nutanix makes the jump from software to services, but what we can learn from all our hard work today is that what you see in a roadshow deck is a company’s best guess. Reality doesn’t always line up with expectations. But that’s no sin, really, in this case. Nutanix is doing something incredibly hard so that it can thrive down the road. You only have to go SaaS once.

More when we have new numbers.