Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today we’re exploring the 2019 IPO cohort from a capital-in perspective. How much did tech companies going public in 2019 raise before they went public, and what impact that did that have on their valuation when they debuted?

Looking ahead, the tech startups and other venture-backed companies expected to go public in 2020 will include a similar mix of mid-sized offerings, unicorn debuts and perhaps a huge direct listing. What we’ve seen in 2019 should be a good prelude to the 2020 IPO market.

With that in mind, let’s examine how much money tech companies that went public this year raised before their IPO. Spoiler: It’s a lot more than was normal just a few years ago. Afterwards, I have a question regarding what to call companies in the $100 million ARR club (more here) that we’ve been exploring lately. Let’s go!

Privately rich

According to CBInsights’ recent IPO 2020 IPO report, there’s a sharp, upward swing in the amount of capital that tech companies raise before they go public. It’s so steep that the data draw a nearly linear breakout from a preceding, comfortable normal.

Here’s the chart:

There are two distinct periods; from 2012 to 2015, raising up to $100 million was the norm (median) for tech companies going public. That’s still a lot of cash, mind.

The second period is more exciting. From 2016 on we can see a private capital arms race in which tech companies going public stacked ever-greater sums under their mattresses before debuting. This is generally consistent with a different trend that you are also aware of, namely the rise of $100 million financings.

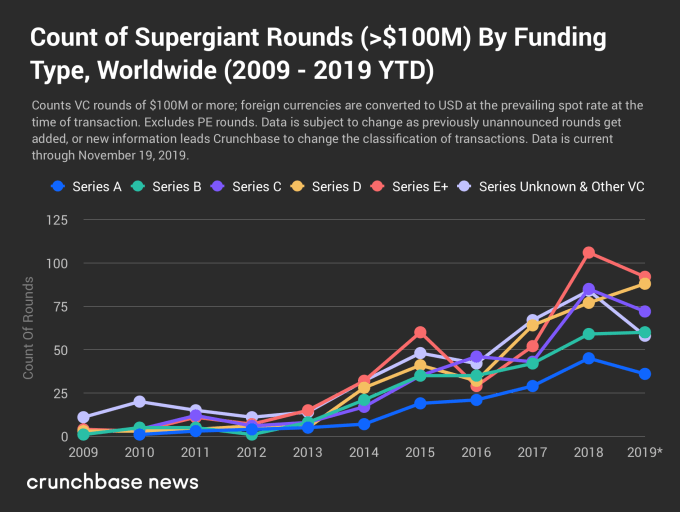

Before we turn back to the CBInsights data, let’s observe a chart from Crunchbase News that underscores the simply astounding rise of $100 million financings that was published just a few weeks ago. As you look at this chart, remember that prior to 2016, more than half of venture-backed technology companies going public had raised less than $100 million total:

Now, compare the two data sets.

You’ll note that super-giant rounds — private investments of least $100 million — began to rise in 2014. There is a slight dip in 2016, and then quick acceleration as the chart moves through into 2019.

There’s some temporal lag between the two charts, but you can generally see a rise in the number of super-giant rounds that coincided with the rise in the amount of capital raised by tech companies before their IPOs. (Disclosure: I used to work on the Crunchbase News team, competing to some degree with CBInsights; please consider my use of a chart from each as a form of truce.)

It’s worth noting that we can’t put the onus for the rise in super-giant rounds, and the rise in capital raised by technology companies pre-IPO only on SoftBank and its monster Vision Fund. SoftBank announced the formation of the Vision Fund in late 2016 (it started to close in 2017). So while the Vision Fund is certainly part of the reason why 2017, 2018, and 2019 saw huge numbers of very large investments, the trend was already rising before SoftBank got busy.

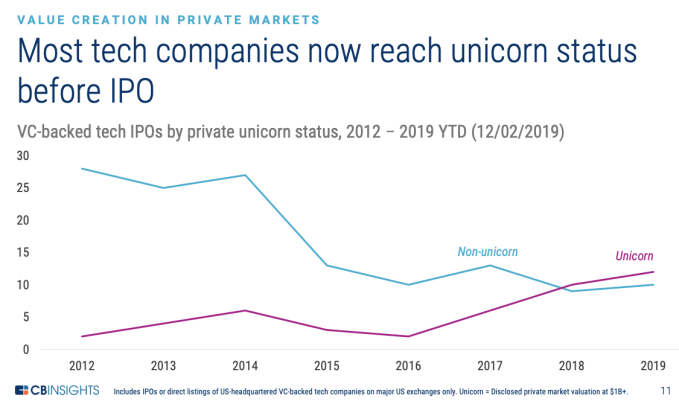

The result, as CBInsights points out in a following chart, is that the value of debuting venture-backed tech companies rose. Indeed, the portion that were over the $1 billion mark eventually beat out the group that weren’t. Here’s the chart:

So what?

There’s a fun divergence in the chart tracking the rise in capital raised by tech companies going public and the chart showing historical growth in huge funding events. If you observe, the 2019 totals for super-giant rounds that Crunchbase News charted are mostly trending down in 2019. Flat or down, really. That is happening while the pre-IPO totals of companies going public continues to rise.

I suspect that we’re seeing a deceleration of $100 million IPO rounds (a downward trend that is already deeply underway in China) that will, in time, limit the median and average amount of capital raised by venture-backed technology companies. It will take a few years for the 2018 peak of $100 million rounds to work their way through the IPO process.

Bringing this back to the start, what can we glean for the 2020 IPO cohort? A few things, I reckon:

- Companies going public next year will be fantastically capitalized

- Expect 2018, 2019, and perhaps 2020 to be high points for pre-IPO capital totals for venture-backed tech startups

- Don’t expect much downward pressure on the numbers, however, inside of 2020

What we’ve seen this year, then, should be much of what we see next year. The year after, however, could bring more frugal companies to the public markets.

A concluding note and a question. I have noticed lately on phone calls with founders who have recently money that there are more voices than before discussing growth, profit and margins. These are welcome noises and could indicate that founders are more focused now on business mechanics than the sugar rush of raising and announcing new capital than they were before.

And our question: What should we call companies in the $100 million ARR club? I’m working towards a name, and we’ve had a goodly number of suggestions sent in. But, I’d love to hear from you all the same. Send in notes to alex.wilhelm@techcruch.com and be a cool kid!