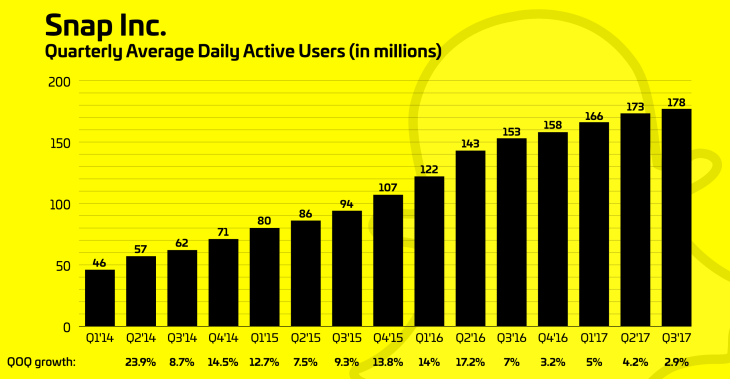

Snap’s losing streak continued with today’s Q3 2017 earnings report that saw it miss financial expectations and add just 4.5 million users. Snap earned $207.9 million in revenue with a loss of $0.14 per share, compared to expectations of a $237 million in revenue and a loss of $0.15 EPS. The 178 million total daily users equates to a 2.9 percent quarter-over-quarter user growth rate, its lowest ever, and much slower than the 4.2 percent in Q2 and 5 percent in Q1. Analysts had expected 180 million users.

Snap’s share price closed at $15.12 today before earnings were announced. The share price fell more than 16 percent when the awful earnings were announced, bringing the share price down to hover around $12.65. Snap will have to hope its plan for a sweeping redesign and a shift from reverse-chronological Stories list to an algorithmically personalized list will save it.

Snap lost a staggering $443 million this quarter as it struggles to improve its efficiency while growing its advertising base. The company took a $40 million charge on unsold Spectacles hardware, confirming reports of them selling worse than the company expected.

Snap blamed its revenue miss on shifting from direct sales to an auction-based bidding system for selling advertisers. It hopes this will make it easier to cheaply scale its ad business in the future, but that caused a massive 60 percent drop in the cost per ad impression year-over-year.

Snap’s average revenue per user grew 11 percent from $1.05 to $1.17, but stayed almost flat in the Rest of World region, budging from $0.29 to just $0.30. In its core North American market, ARPU grew 10 percent. That might be the closest thing to a bright point Snap gets in this earnings report.

A few other points of progress and plans for the future that CEO Evan Spiegel announced today:

- Snap has been working to improve the engineering of its Android app, and since April, it’s reduced the average time to open its camera on Android by 20 percent. That has helped boost Android user sign-up rates above that of iOS, where Snapchat was already popular.

- Seventy percent of the 13 to 34-year-old population in the U.S., France, the U.K. and Australia now use Snapchat, but the app needs to improve adoption with Android users, users over age 34, and people in the developing world.

- Snap has recognized that loading Stories takes too long, so it’s rearchitecting its Stories streaming system to play files before they’re fully downloaded.

- Snap plans to work with wireless carriers to reduce the cost of using the app, which might mean it will strike “zero-rating” deals that let users on certain carriers pay less or nothing for Snapchat data usage.

- Spiegel said “we have historically neglected the creator community . . . In 2018, we are going to build more distribution and monetization opportunities for these creators.” This is a stern shift from shunning social media influencers.

Snap needs saving

Snap has had a tough few months. It experienced layoffs in its Spectacles hardware team and cut 18 from its recruiting division, Business Insider reported. The company apparently has hundreds of thousands of pairs of its camera glasses sitting unsold in warehouses says The Information, and the majority of owners didn’t keep using them after a month. A bungled launch led details of Snapchat’s new augmented reality art platform to leak before its big reveal.

Meanwhile, competition from Facebook has only increased. It’s pouring more resources into building out the Facebook Camera platform that copies Snap’s camera. And both Instagram Stories and WhatsApp Status now have 300 million daily users — far more than Snap’s whole app that pioneered Stories.

Snap will have to hope its upcoming redesigns, plus more differentiated products like Snap Map location sharing and its premium mobile video Shows, can draw in more users — or at least more time per user — as the rest of its app gets cloned to death.