Silicon Valley venture firm Social Capital plans to help startups go public without the dreaded IPO process. And it’s something different from what Spotify is doing.

Social Capital is creating a shell company known as a “SPAC” that exists solely to merge with a startup. These types of transactions are not rare outside of the venture world but have little precedent with tech startups.

According to the prospectus, the holding company known as Hedosophia has been formed to make it easier for startups to trade on the stock market. It is raising $500 million by selling shares to investors.

“The traditional technology company IPO process, which has been largely unchanged for decades, has also acted as a driving force to deter private company management teams and their pre-IPO stakeholders from pursuing IPOs,” reads the filing. “We believe management distraction, a sub-optimal price discovery mechanism and the resultant longer-term aftermarket impact have discouraged private technology companies from pursuing IPOs.”

In other words, this will help startups avoid bankers. Known as “underwriters,” the big banks often mess up in recommending the right debut price. They also charge significant fees and find investors, who may or may not be interested in holding the stock for the long-run. Recent venture-backed IPOs like Snap and Blue Apron have faced significant backlash and even lawsuits for falling from the IPO price.

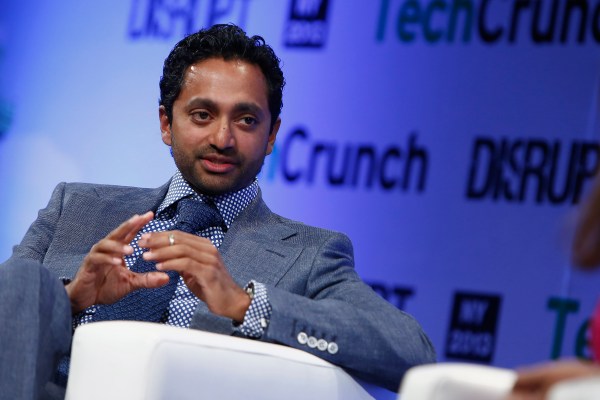

Social Capital founder Chamath Palihapitiya will act as CEO and chairman for the project. He’ll also be joined by former Twitter COO Adam Bain, who is on the board.

Social Capital declined to comment.