DirecTV Now, AT&T’s live TV service aimed at cord cutters, has now reached nearly 500,000 subscribers only 7 months after launch, the company announced today as part of its Q2 2017 earnings release. That uptick comes from the addition of 152,000 subscribers this past quarter, and is up from the 200,000 DTV Now subscribers the company had reported in January, following its first month of operations.

According to AT&T’s earnings statement, DirecTV Now’s growth is “helping offset traditional TV subscriber decline.” It’s helping, sure, but it’s not solving the problem.

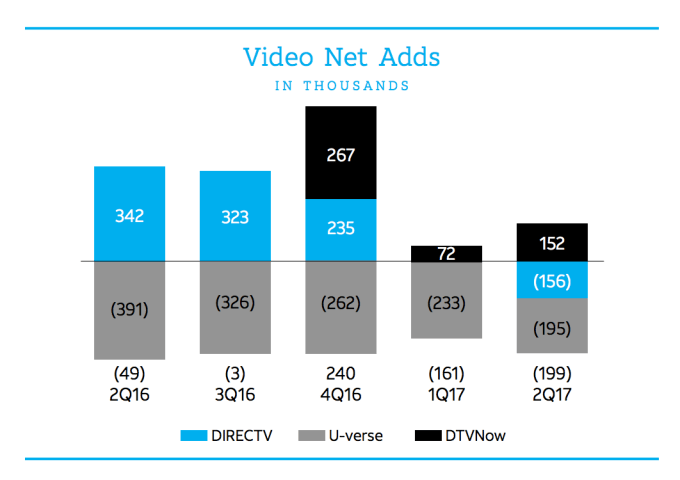

With total video losses combined with DirecTV Now’s gains – 491,000 this quarter, up from 72,000 in the quarter prior – the total video subscriber numbers were essentially flat year-over-year, AT&T claims. As of June 30, 2017, AT&T had 38.8 million video subscribers (which includes DirecTV Now’s 491K), compared with 37.8 million this time last year.

But the cord cutting trend is coming fast for AT&T, the earnings also revealed. Perhaps too fast. The company lost 351,000 traditional video subscribers in Q2, it said, while DirecTV Now gained 152,000. (see below chart)

AT&T’s live TV service launched in November of last year, with the goal of offering a variety of over-the-top live TV packages for those who want to cancel their pay TV service – or who just never signed up in the first place.

The service is competitively priced, compared with competitors like Sling TV, YouTube TV, Sony’s Vue, and Hulu Live TV, as its entry-level package begins at $35 per month for over 60 channels, including, in some markets, major broadcasters like NBC, ABC, and Fox.

However, one of the service’s bigger selling points is its perks for AT&T subscribers, who can stream to mobile devices without tapping into their wireless data plans.

Earlier this month, AT&T announced that DirecTV Now was rolling out a series of new features, including a cloud DVR – something that its rivals all offer. This was a key component it had lacked, and something that may attract more users when it exits beta. It also said it would soon be introducing other features, too, including live TV pausing and parental controls. Meanwhile, user profiles, a “download and go” feature, and 4K HDR support are planned for a 2018 release.

The service wasn’t well-received by all its early adopters at launch, many of whom complained about freezing and crashes; others had trouble requesting refunds.

Despite the glitches, DirecTV Now has benefited from being a product created under the AT&T umbrella, as this allows the company cross-promotion capabilities others don’t have.

Case in point: this June, AT&T announced it would make DirecTV Now a $10 add-on to its Unlimited Choice plan.

However, even with its quick growth, DirecTV Now will be challenged by market leaders in streaming like Amazon, Netflix and Hulu, which all have growing subscribers numbers and a lot of the same programming, thanks to their on-demand content deals.

Hulu, though, is the only one of the big three offering live TV in addition to on-demand; it said in May it had 47 million unique viewers across its services, but no longer reports subscribers.

But one thing AT&T does seem to be doing well is to make the case to the so-called “cord nevers” that its live TV service is worth paying for. The company says that around 50 percent of the DirecTV Now’s adds previously had no pay TV service at all.