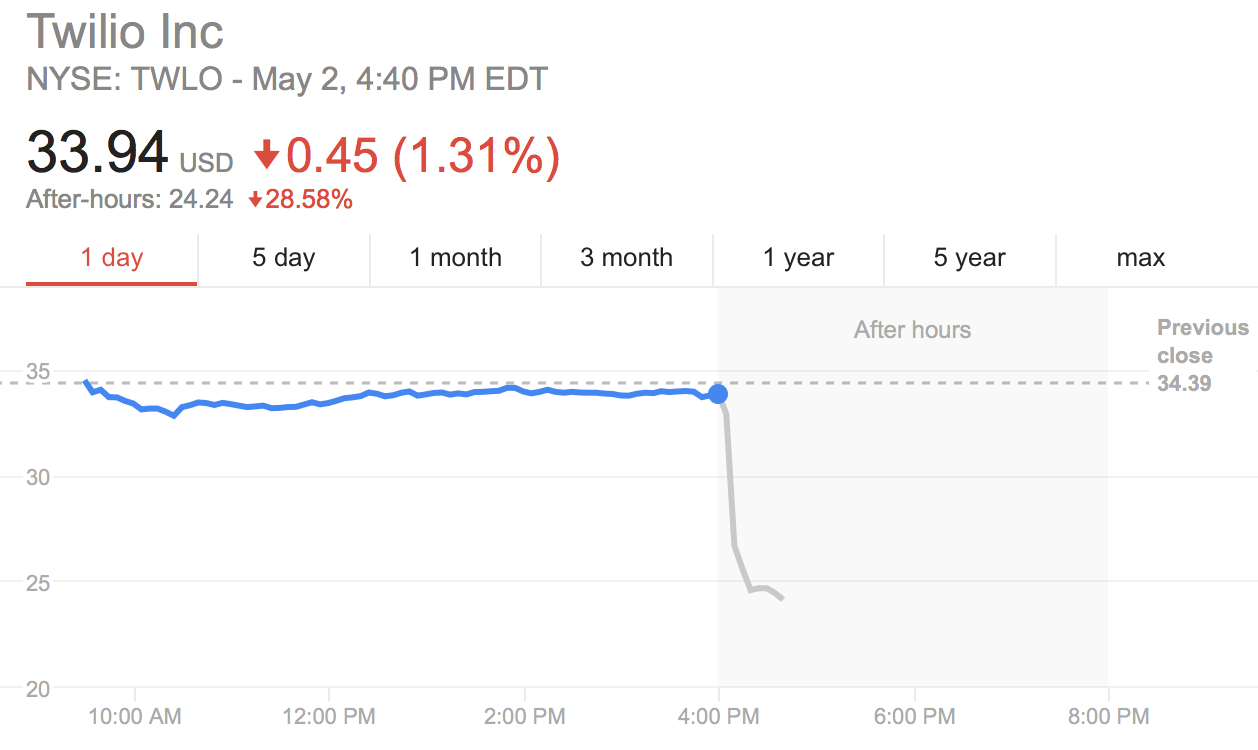

A good report on revenue wasn’t enough to keep Twilio stock from taking a dive in after-hours trading. What at first glance appeared to be a positive story very quickly divulged into a financial nightmare. Shares in the cloud communications company have fallen 30 percent in after-hours trading, attributable to lower than anticipated guidance.

On the earnings call, CEO Jeff Lawson addressed the unexpected guidance by explaining that Uber, one of Twilio’s largest customers, will be reducing its use of Twilio over the next year. This is a major hit for the company because Uber accounted for 12 percent of its revenue in this quarter. Twilio expects this number to fall off over the next year as Uber moves away from Twilio as its principal communications infrastructure provider.

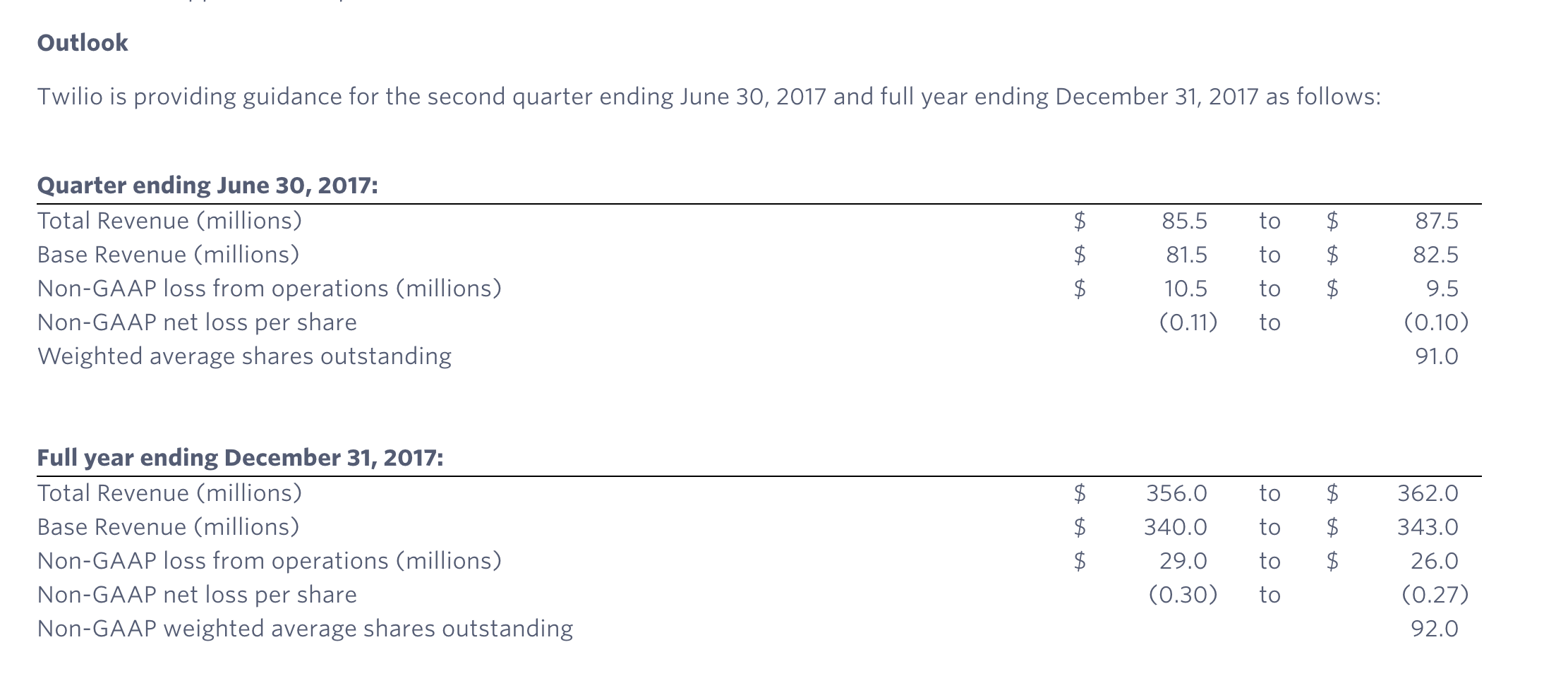

The company issued guidance indicating that revenue would fall between $356 and $362 million for the year. This is short of expectations of $370 million. For Q2 2017 earnings, Twilio also issued guidance noting that it expected between $85.5 and $87.5 million in revenue. Analysts had anticipated $87 million would be a baseline expectation, not a high-end target.

Outside of guidance, Twilio reported revenue of $87.4 million with a loss of 4 cents in non-GAAP earnings per share for its Q1 2017 earnings report. This overshot analyst expectations of $83.6 million in revenue by $3.8 million and nicely beat expected non-GAAP losses of six cents per share.

Twilio has long struggled with its customer concentration and it just came back to bite them. Large clients like WhatsApp and Uber have historically made up large portions of the company’s revenue, causing some on Wall Street anxiety. But while Twilio has been moving to diversify its sources of revenue, a single customer, in this case Uber, was still able to extract almost a billion dollars in market value from the public company.

“Uber really is an outlier,” Lawson said on Twilio’s earnings call. “You’d need to spend a lot of money to justify the substantial undertaking that Uber is undertaking.”

Lawson went on to explain that Uber and WhatsApp are the two largest clients of Twilio by a significant margin. Twilio added 4,000 new customers over the last quarter. The company has traditionally added an average of 2,800 customers per quarter.

Most of the book on Twilio has yet to be written. CEO Jeff Lawson has done an impressive job building up a developer community. The pressure from Silicon Valley for Twilio to perform well to induce more exits has largely faded as a new pipeline of tech IPOs has stolen the industry’s attention.

But even still, Twilio clearly has a lot of work ahead of it to diversify its customer concentration. Twilio negotiated a contract with Amazon Web Services earlier this year. The deal integrated Twilio’s APIs with Amazon Connect, its contact center service offering. Continuing to build new channels should help the company reach new audiences.