A startup called Flow wants to make it easier for companies to sell their products in different geographies. To extend its platform to even more e-commerce sellers, the company has raised some funding from Forerunner Ventures and Fung Capital.

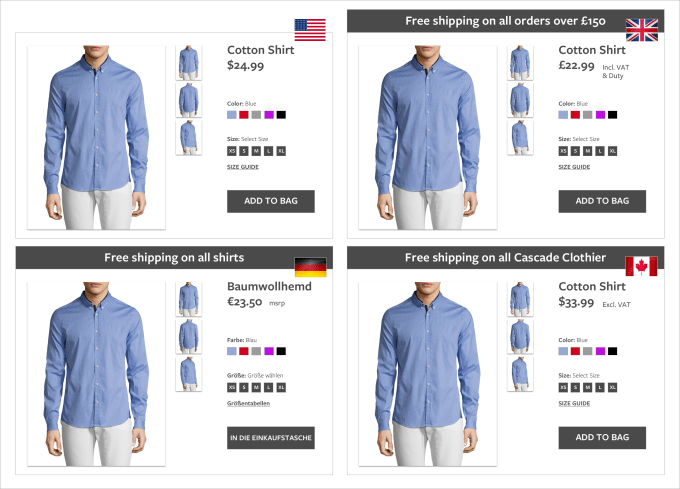

Flow provides a platform to help brands and retailers make their goods available for sale across multiple regions and geographies, handling everything from currency and pricing localization to taking payments to working with multiple shipping providers to find the most cost-effective way to get goods to a merchant’s international customers.

According to founder and CEO Rob Keve, Flow has five different modules online retailers can take advantage of. The first is multi-currency pricing, allowing e-commerce sellers to automatically price their goods in the currency of their customers. Along those same lines, the company has also built out a number of international payment options that cater to different individual markets.

Logistics is the next thing Flow set out to solve, and it’s built out a network of cost-efficient and rapid shipping options for each region it ships to. In addition, the company has an engine to customs, duties and taxes associated with cross-border sales. Finally, Flow has created a simple way for end customers to return goods, which is mostly unheard of for goods purchased internationally.

Each of those modules could be its own business — and indeed, there are startups offering point solutions for all of those problems. The power of Flow is that it brought all the different pieces together into one platform running in the cloud.

By adding Forerunner and Fung Capital, the company hopes to capitalize on those firm’s e-commerce connections. Forerunner, of course, has invested in a number of online retailers and CPG brands, including Dollar Shave Club, Jet.com, Birchbox, Bonobos, and Warby Parker. Meanwhile, Fung Capital is the investment arm of Hong Kong’s Fung family, which controls a number of e-commerce and omnichannel retail brands.

The latest funding comes as part of a $16 million Series A round led by Bain Capital Ventures. Other investors include The Honest Company’s Brian Lee, Gilt’s Alexandra Wilkis Wilson and Alexis Maybank, Zola’s Shan-Lyn Ma and David Tisch.